Asian Value Stocks Estimated Below Intrinsic Worth In January 2026

As we step into 2026, Asian markets are showing mixed signals with Japan's stock indices experiencing slight declines and China's manufacturing sector seeing modest improvements. In this environment of fluctuating economic indicators, identifying undervalued stocks becomes crucial for investors seeking opportunities to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Visional (TSE:4194) | ¥10100.00 | ¥19763.34 | 48.9% |

| Takara Bio (TSE:4974) | ¥801.00 | ¥1561.87 | 48.7% |

| PharmaResearch (KOSDAQ:A214450) | ₩433000.00 | ₩865547.12 | 50% |

| Nan Juen International (TPEX:6584) | NT$340.50 | NT$680.86 | 50% |

| Mobvista (SEHK:1860) | HK$15.60 | HK$30.61 | 49% |

| Kuraray (TSE:3405) | ¥1622.00 | ¥3167.52 | 48.8% |

| Great Giant Fibre Garment (TWSE:4441) | NT$233.50 | NT$458.94 | 49.1% |

| CURVES HOLDINGS (TSE:7085) | ¥807.00 | ¥1589.05 | 49.2% |

| ASE Technology Holding (TWSE:3711) | NT$271.50 | NT$537.10 | 49.5% |

| Andes Technology (TWSE:6533) | NT$245.00 | NT$478.97 | 48.8% |

Let's dive into some prime choices out of the screener.

Ningbo Sanxing Medical ElectricLtd (SHSE:601567)

Overview: Ningbo Sanxing Medical Electric Co., Ltd. manufactures and sells power distribution products in China and internationally, with a market cap of CN¥34.68 billion.

Operations: The company's revenue is derived from the manufacturing and sale of power distribution products both domestically and internationally.

Estimated Discount To Fair Value: 21.8%

Ningbo Sanxing Medical Electric Ltd. is trading at 21.8% below its estimated fair value of CN¥31.55, indicating it may be undervalued based on cash flows. Despite a recent decline in net income to CN¥1,527.83 million for the nine months ending September 2025, earnings are forecast to grow significantly at 28.15% annually over the next three years, outpacing market expectations and supporting its potential as an undervalued investment opportunity in Asia's medical sector.

- Our expertly prepared growth report on Ningbo Sanxing Medical ElectricLtd implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Ningbo Sanxing Medical ElectricLtd here with our thorough financial health report.

Beijing Roborock Technology (SHSE:688169)

Overview: Beijing Roborock Technology Co., Ltd. specializes in the design, research and development, production, and sales of intelligent sweeping robots in China with a market cap of CN¥41.79 billion.

Operations: The company generates revenue primarily from intelligent cleaning products, amounting to CN¥17.00 billion.

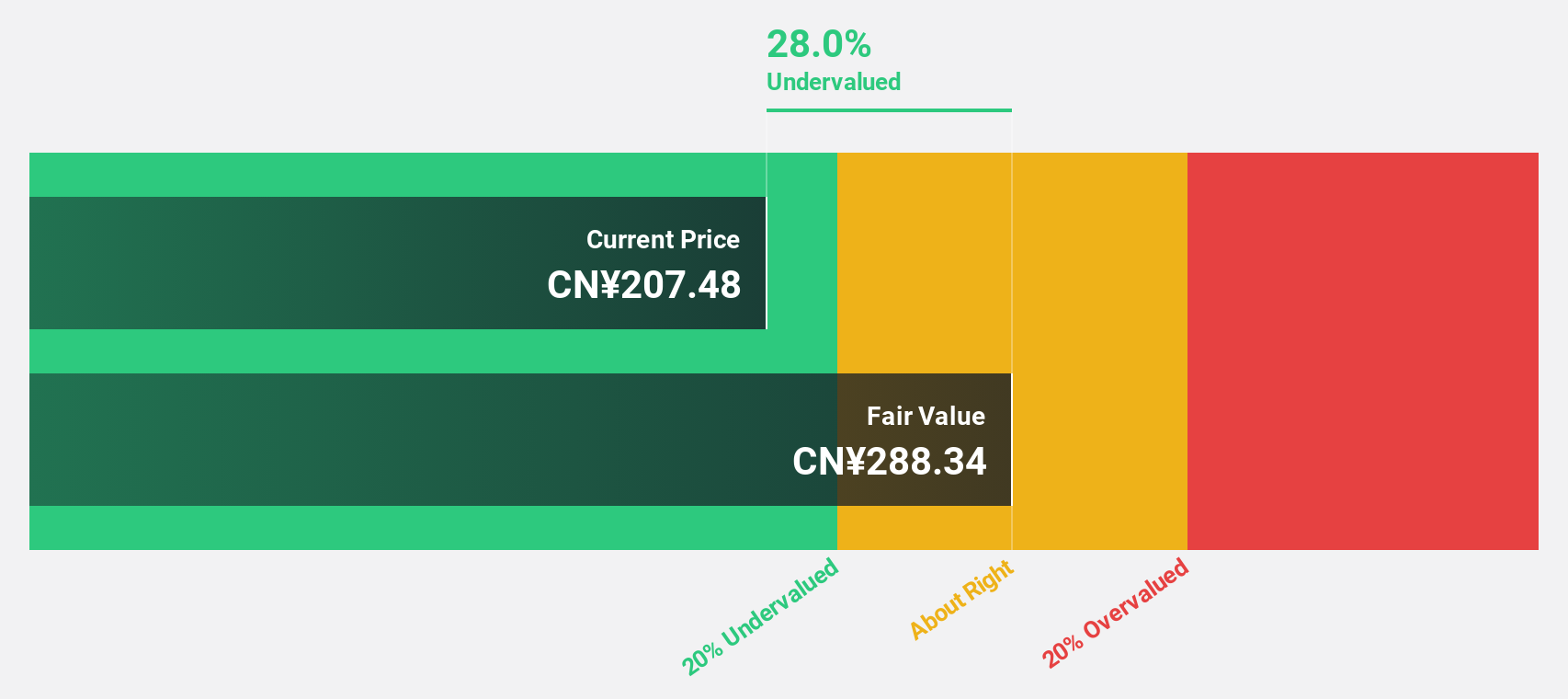

Estimated Discount To Fair Value: 25.4%

Beijing Roborock Technology is trading at CN¥161.29, significantly below its fair value estimate of CN¥216.3, highlighting potential undervaluation based on cash flows. Despite a drop in net income to CNY 1.04 billion for the first nine months of 2025, earnings are expected to grow substantially at 31.22% annually over the next three years, surpassing market growth rates and suggesting robust future performance amidst current challenges like reduced profit margins and recent index exclusion.

- According our earnings growth report, there's an indication that Beijing Roborock Technology might be ready to expand.

- Unlock comprehensive insights into our analysis of Beijing Roborock Technology stock in this financial health report.

Xi'an International Medical Investment (SZSE:000516)

Overview: Xi'an International Medical Investment Company Limited provides healthcare services and has a market cap of CN¥11.62 billion.

Operations: Revenue Segments (in millions of CN¥):

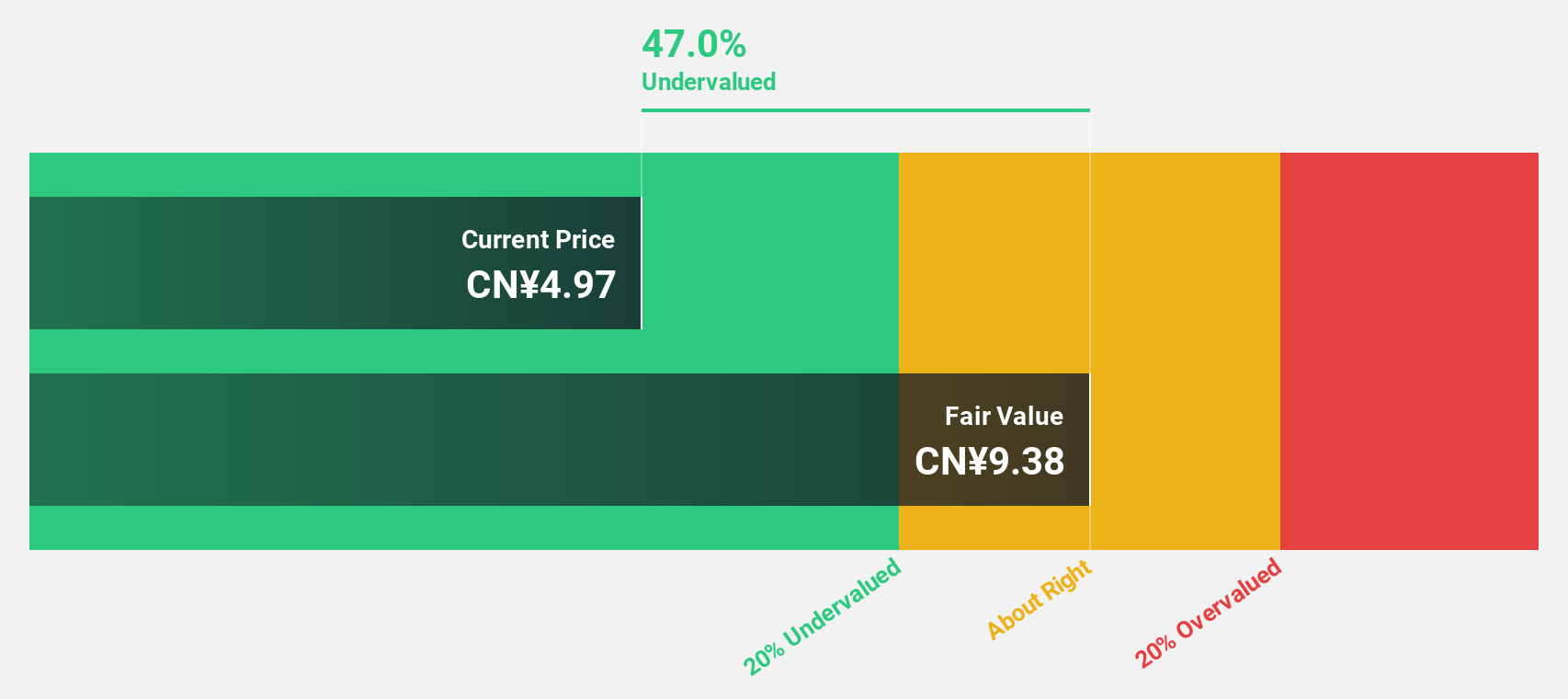

Estimated Discount To Fair Value: 44.7%

Xi'an International Medical Investment, trading at CN¥5.19, is significantly undervalued compared to its estimated fair value of CN¥9.38. Despite a net loss of CNY 293.66 million for the first nine months of 2025 and declining revenue, the company anticipates becoming profitable within three years with earnings growth projected at 88.34% annually. A recent private placement aims to raise CNY 1 billion, potentially strengthening its financial position amidst ongoing challenges.

- The growth report we've compiled suggests that Xi'an International Medical Investment's future prospects could be on the up.

- Take a closer look at Xi'an International Medical Investment's balance sheet health here in our report.

Where To Now?

- Click through to start exploring the rest of the 258 Undervalued Asian Stocks Based On Cash Flows now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal