Asian Dividend Stocks To Consider For Your Portfolio

As Asian markets navigate a mixed economic landscape, with China's manufacturing sector showing signs of recovery and South Korea's exports reaching new highs, investors are increasingly looking towards stable income-generating opportunities. In this context, dividend stocks can offer a reliable source of returns by providing consistent payouts, making them an attractive option for those seeking to balance growth with income in their portfolios.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.61% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.31% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.20% | ★★★★★★ |

| NCD (TSE:4783) | 3.54% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.86% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.10% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.56% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.89% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.79% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.12% | ★★★★★★ |

Click here to see the full list of 986 stocks from our Top Asian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

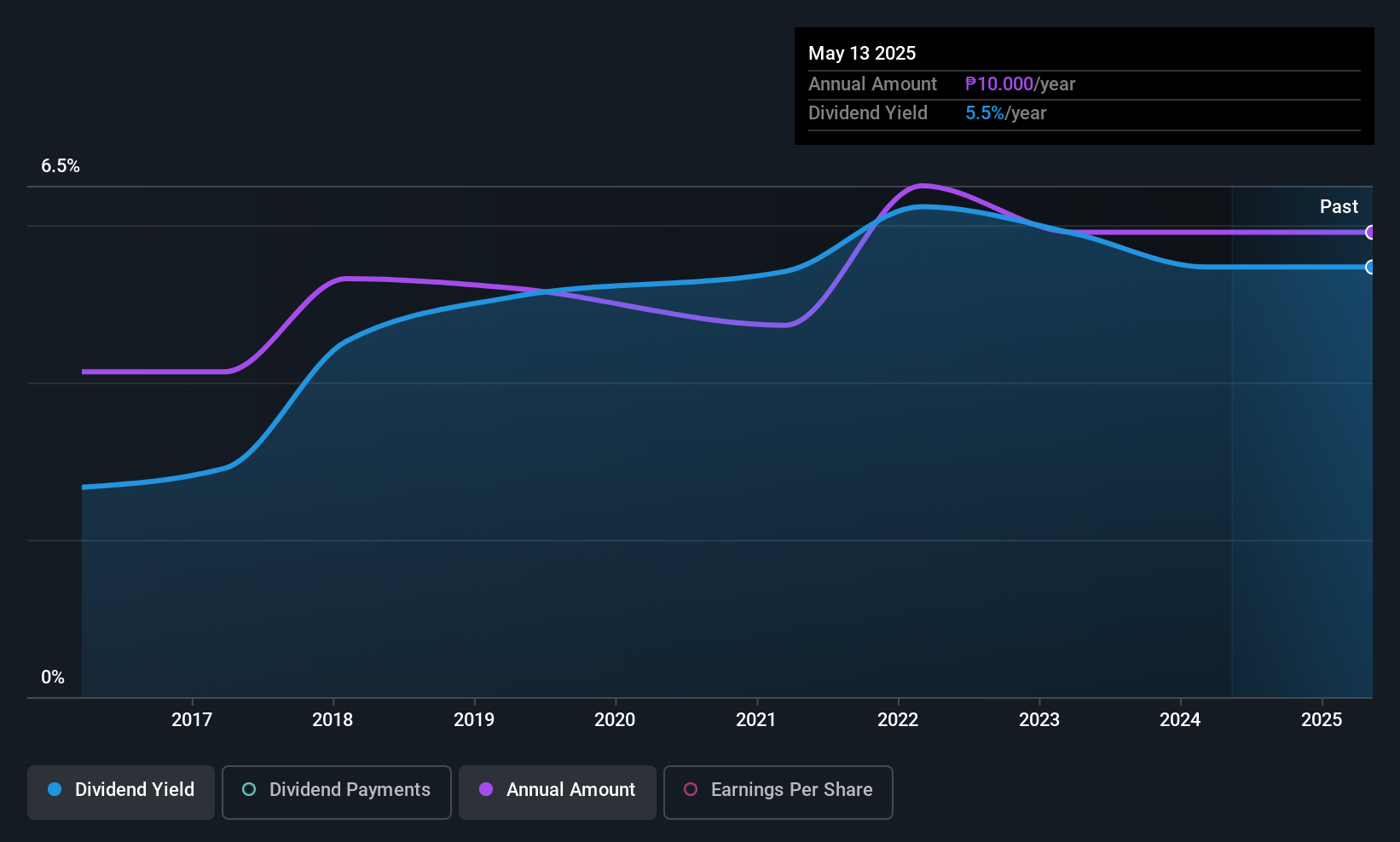

Philippine Stock Exchange (PSE:PSE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Philippine Stock Exchange, Inc., along with its subsidiaries, operates as a stock exchange in the Philippines and has a market capitalization of approximately ₱18.10 billion.

Operations: The Philippine Stock Exchange, Inc. generates revenue through its operations as a stock exchange in the Philippines.

Dividend Yield: 4.5%

The Philippine Stock Exchange (PSE) has shown a strong earnings growth of 49.1% over the past year, with net income reaching PHP 683.13 million for the first nine months of 2025. Despite an increase in dividend payments over the last decade, PSE's dividends have been volatile and fall short compared to top-tier payers in the Philippines. The company's payout ratio is sustainable at 31.5%, but its dividend reliability remains questionable due to past volatility and large one-off items impacting financial results.

- Click here to discover the nuances of Philippine Stock Exchange with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Philippine Stock Exchange is trading beyond its estimated value.

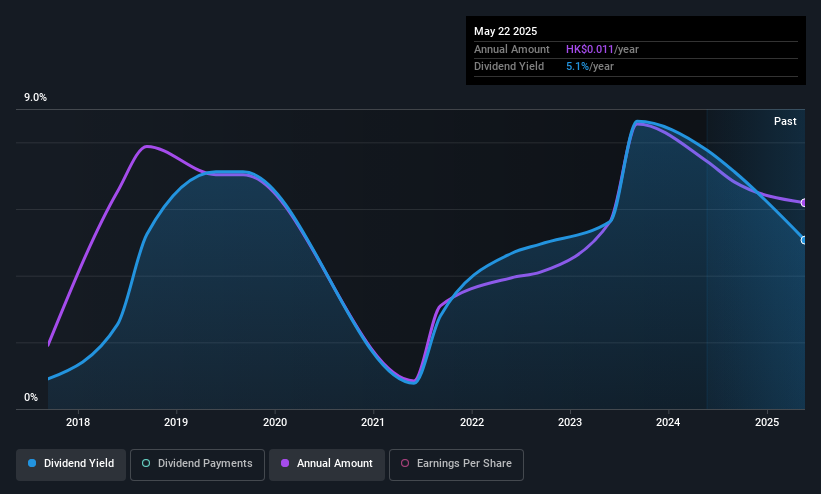

China Resources Medical Holdings (SEHK:1515)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Resources Medical Holdings Company Limited operates as an investment holding company offering general healthcare, hospital management, and related services in China with a market cap of HK$4.43 billion.

Operations: China Resources Medical Holdings Company Limited generates revenue primarily from its Hospital Business, which accounts for CN¥8.84 billion.

Dividend Yield: 4.3%

China Resources Medical Holdings' dividend yield of 4.3% is lower than the top 25% in Hong Kong, yet its payout ratio of 35.4% indicates dividends are well-covered by earnings and cash flows. Despite a history of volatility, recent strategic agreements like the Healthcare Management Services Framework and Supply Chain Management Services could support future stability and growth. Executive changes may also influence operational efficiencies, potentially impacting dividend sustainability positively over time.

- Dive into the specifics of China Resources Medical Holdings here with our thorough dividend report.

- The valuation report we've compiled suggests that China Resources Medical Holdings' current price could be quite moderate.

Emperor Watch & Jewellery (SEHK:887)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Emperor Watch & Jewellery Limited is an investment holding company involved in the sale of watches and jewelry products, with a market cap of HK$1.76 billion.

Operations: Emperor Watch & Jewellery Limited generates revenue of HK$5.43 billion from its watch and jewelry sales.

Dividend Yield: 4.1%

Emperor Watch & Jewellery's dividend yield of 4.12% is modest compared to the top 25% in Hong Kong, yet its payout ratio of 26.1% ensures dividends are well-covered by earnings and cash flows, with a cash payout ratio of just 8.4%. Despite a decade-long history of volatility and unreliability in dividend payments, the company trades significantly below its estimated fair value, suggesting potential for capital appreciation alongside income returns.

- Unlock comprehensive insights into our analysis of Emperor Watch & Jewellery stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Emperor Watch & Jewellery is priced lower than what may be justified by its financials.

Summing It All Up

- Click this link to deep-dive into the 986 companies within our Top Asian Dividend Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal