Should GoDaddy’s AI Push and US$900 Million Buyback Require Action From GoDaddy (GDDY) Investors?

- In 2025, GoDaddy stepped up its AI push with products like Airo.ai and enhanced WordPress tools, while also approving a US$900 million share repurchase program following solid but slightly below-expectation earnings and cautious guidance.

- This combination of heavy AI investment and large buybacks highlights management’s confidence in the business model even as some investors question the earnings outlook.

- Next, we’ll examine how GoDaddy’s sizable new share repurchase plan reshapes the company’s investment narrative built around AI-driven expansion.

We've found 11 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

GoDaddy Investment Narrative Recap

To own GoDaddy, you need to believe that its AI tools and commerce platform can keep small businesses choosing its ecosystem despite intense competition and customer churn risk. The recent earnings disappointment and share price drop have sharpened the focus on execution in AI as the key short term catalyst, while the main near term risk remains that these new AI products fail to lift engagement and spending meaningfully. So far, the latest news does not materially change that balance.

The most relevant recent move is GoDaddy’s US$3,000 million share repurchase authorization through 2027, on top of the fresh US$900 million program. That level of buyback activity can significantly reshape per share metrics and supports a narrative that pairs AI led product expansion with aggressive capital returns, even as the stock’s roughly 40% fall in 2025 keeps attention firmly on whether Airo.ai and related tools can translate into durable customer value.

Yet while buybacks may look appealing, the risk that AI agents and bundled services fail to curb churn is something investors should be aware of...

Read the full narrative on GoDaddy (it's free!)

GoDaddy's narrative projects $5.9 billion revenue and $1.3 billion earnings by 2028. This requires 7.7% yearly revenue growth and an earnings increase of about $0.5 billion from $808.5 million today.

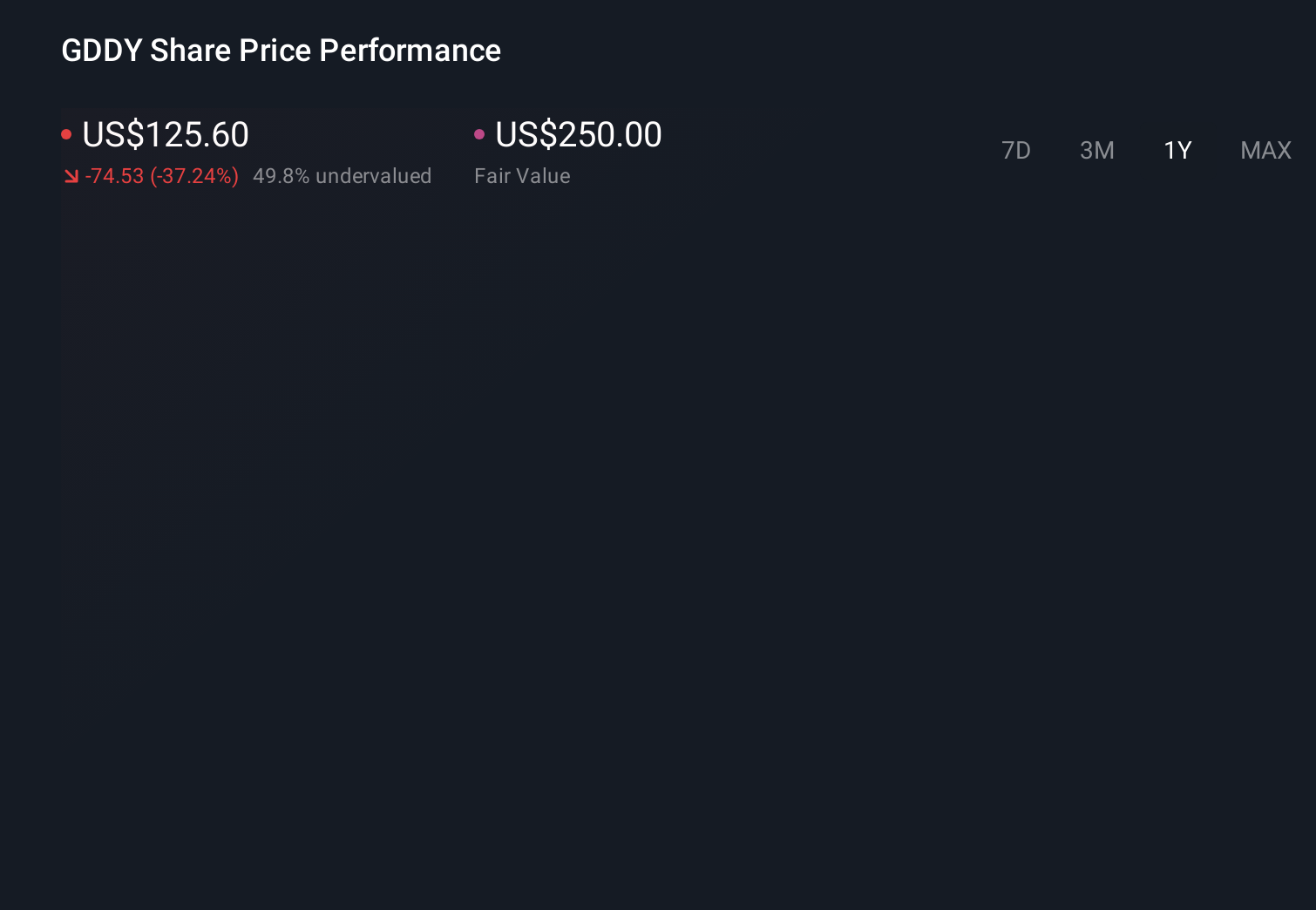

Uncover how GoDaddy's forecasts yield a $175.06 fair value, a 46% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span about US$175 to US$244 per share, underlining how far apart individual views can be. When you set those against the execution risk in GoDaddy’s AI initiatives discussed earlier, it becomes even more important to compare multiple perspectives before forming an opinion on the company’s longer term performance.

Explore 2 other fair value estimates on GoDaddy - why the stock might be worth over 2x more than the current price!

Build Your Own GoDaddy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GoDaddy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free GoDaddy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GoDaddy's overall financial health at a glance.

No Opportunity In GoDaddy?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal