Middle Eastern Penny Stocks To Watch In January 2026

As most Gulf bourses gain on rising bets for a U.S. Federal Reserve rate cut, the Middle Eastern markets are experiencing a wave of optimism despite some pressure from fluctuating oil prices. Penny stocks, though often seen as an outdated term, continue to represent intriguing opportunities for investors interested in smaller or newer companies that may offer growth potential at lower price points. With the right financial health and fundamentals, these stocks can stand out as hidden gems amidst the broader market landscape.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Al-Modawat Specialized Medical (SASE:9594) | SAR4.73 | SAR336.65M | ✅ 1 ⚠️ 4 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.36 | SAR1.34B | ✅ 2 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.04 | AED2.12B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.52 | AED228M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.50 | AED724.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Arabian Pipes (SASE:2200) | SAR4.66 | SAR928M | ✅ 3 ⚠️ 0 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.25 | AED384.62M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.57 | AED15.18B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.862 | AED524.31M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.574 | ₪202.05M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 76 stocks from our Middle Eastern Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

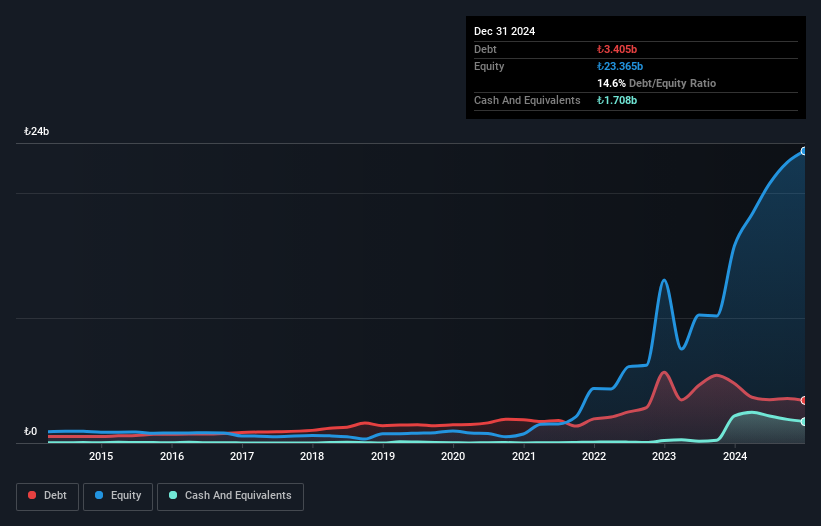

Akfen Gayrimenkul Yatirim Ortakligi (IBSE:AKFGY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Akfen Gayrimenkul Yatirim Ortakligi, known as Akfen GYO, is a real estate investment trust that emerged from the rebranding and restructuring of Aksel Tourism Investments and Management Inc., with a market capitalization of TRY10.33 billion.

Operations: Akfen GYO generates revenue primarily from its real estate investments, amounting to TRY1.21 billion.

Market Cap: TRY10.33B

Akfen Gayrimenkul Yatirim Ortakligi (Akfen GYO) has shown significant financial progress, becoming profitable over the past year. Despite a low return on equity at 3.5%, its interest payments are well-covered by EBIT, and debt is satisfactorily managed with a net debt to equity ratio of 9%. The company's short-term assets exceed its short-term liabilities but fall short of covering long-term liabilities. Recent earnings reports indicate stable sales and improved net income, though impacted by large one-off gains. With an experienced board but a relatively new management team, Akfen GYO presents both opportunities and challenges for investors in penny stocks.

- Dive into the specifics of Akfen Gayrimenkul Yatirim Ortakligi here with our thorough balance sheet health report.

- Understand Akfen Gayrimenkul Yatirim Ortakligi's track record by examining our performance history report.

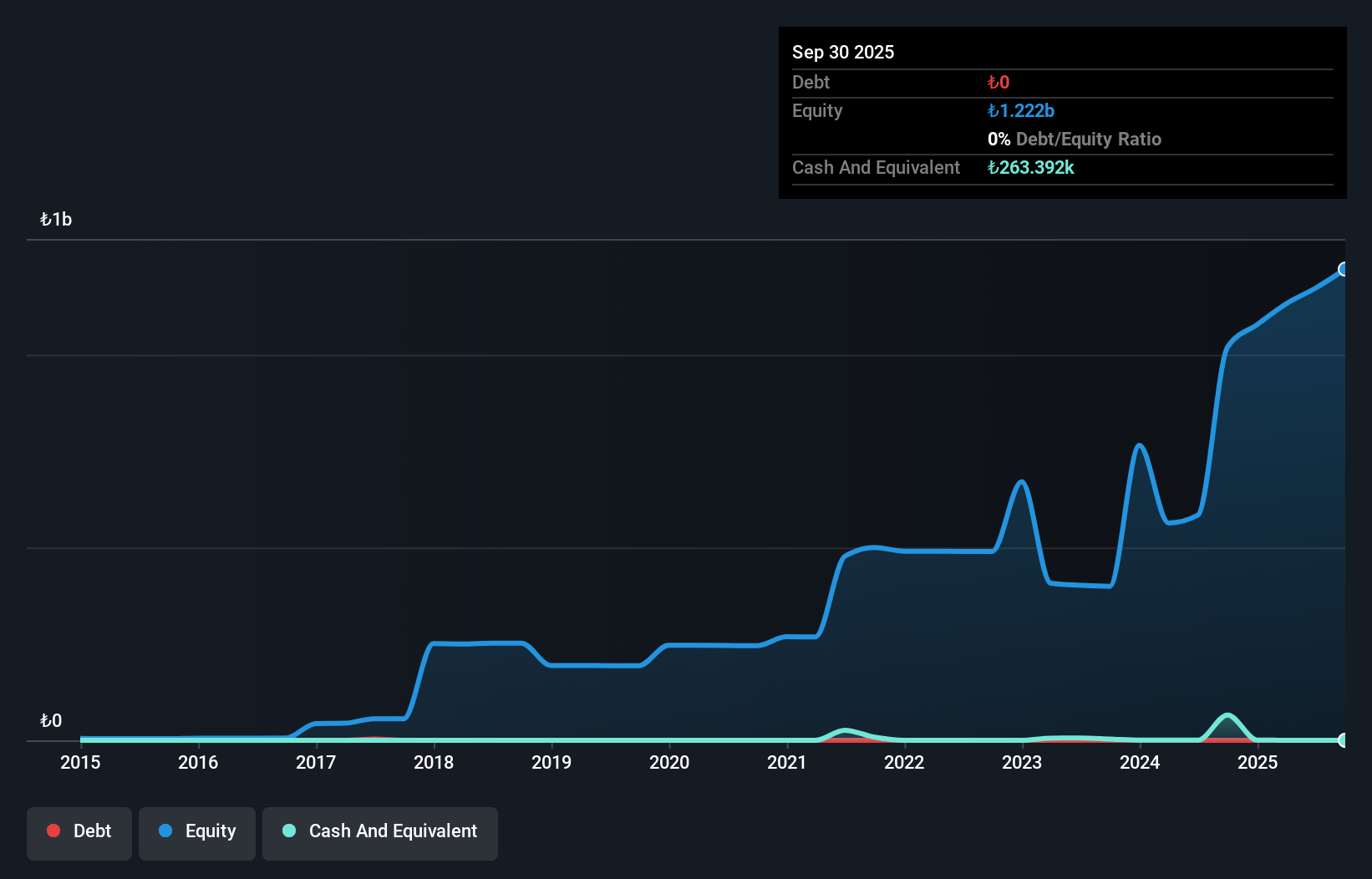

Yesil Yatirim Holding Anonim Sirketi (IBSE:YESIL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Yesil Yatirim Holding Anonim Sirketi specializes in technical planning, programming, budgeting, project planning, and financial organization with a market cap of TRY1.26 billion.

Operations: No specific revenue segments are reported for Yesil Yatirim Holding Anonim Sirketi.

Market Cap: TRY1.26B

Yesil Yatirim Holding Anonim Sirketi, with a market cap of TRY1.26 billion, is currently pre-revenue and unprofitable, reporting a net loss of TRY 38.91 million for Q3 2025. Despite stable weekly volatility over the past year, its share price remains highly volatile in the short term. The company is debt-free and has sufficient short-term assets to cover liabilities but faces challenges with a cash runway under one year if free cash flow continues to decline at historical rates. While lacking meaningful revenue streams, Yesil's financial position presents both risks and potential for turnaround in penny stock investments.

- Click here and access our complete financial health analysis report to understand the dynamics of Yesil Yatirim Holding Anonim Sirketi.

- Examine Yesil Yatirim Holding Anonim Sirketi's past performance report to understand how it has performed in prior years.

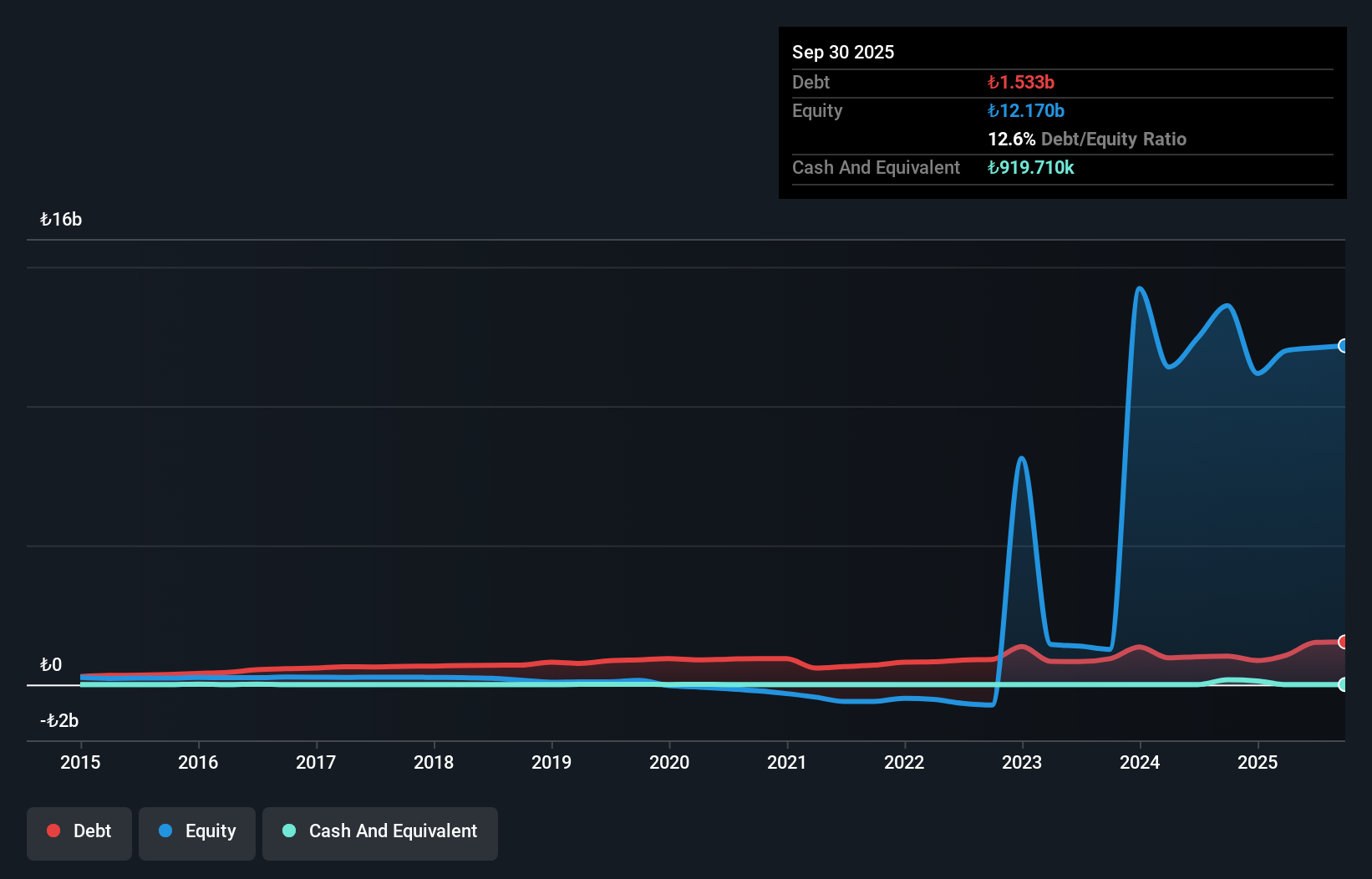

Yesil Gayrimenkul Yatirim Ortakligi (IBSE:YGYO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yesil Gayrimenkul Yatirim Ortakligi, a publicly owned real estate investment firm, has a market capitalization of TRY1.70 billion.

Operations: The company's revenue segment is entirely derived from Turkey, amounting to TRY3.75 billion.

Market Cap: TRY1.7B

Yesil Gayrimenkul Yatirim Ortakligi, with a market cap of TRY1.70 billion, remains unprofitable and pre-revenue, reporting significant net losses for Q3 2025 and the nine-month period ending September 30, 2025. Despite its financial challenges, the company benefits from a seasoned management team and board of directors with over ten years of average tenure. Its short-term assets significantly exceed both short-term and long-term liabilities, suggesting a solid liquidity position. However, its high share price volatility presents risks typical in penny stock investments while offering potential for future recovery if profitability improves.

- Navigate through the intricacies of Yesil Gayrimenkul Yatirim Ortakligi with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Yesil Gayrimenkul Yatirim Ortakligi's track record.

Key Takeaways

- Gain an insight into the universe of 76 Middle Eastern Penny Stocks by clicking here.

- Interested In Other Possibilities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal