A Look At DXC Technology’s (DXC) Valuation After New Alpha Modus Kiosk Partnership

Alpha Modus Holdings has signed an agreement with DXC Technology (DXC) to roll out financial services kiosks for underbanked consumers, starting with about 119 units in a major retailer, drawing fresh attention to the stock.

See our latest analysis for DXC Technology.

The kiosk rollout news lands after a mixed period for DXC Technology, with a 90-day share price return of 9.82% and a 1-year total shareholder return decline of 27.9%, suggesting near term momentum has picked up while longer term performance remains weak.

If this kind of turnaround story interests you, it could be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

So with DXC carrying a long stretch of weak shareholder returns but trading around a 50% discount to one estimate of intrinsic value, is there real upside left here, or is the market already pricing in any future growth?

Most Popular Narrative: 1% Overvalued

The widely followed narrative puts DXC Technology’s fair value at US$14.50, slightly below the last close of US$14.65, which frames the stock as marginally rich.

Continued operational efficiency initiatives including broad-based internal application of AI, standardized delivery processes, and ongoing cost discipline are expected to enhance margins and generate strong free cash flow, providing additional capital for reinvestment or shareholder returns.

It may be surprising that a business with shrinking revenue expectations still lands near that fair value mark. The key is how earnings, margins, and future valuation multiples are incorporated into this narrative. This perspective highlights which assumptions carry the most weight and how they connect to the projected earnings base and higher P/E multiple a few years from now.

Result: Fair Value of $14.50 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear watchpoints, including ongoing revenue declines and pressure in the Global Infrastructure Services segment, that could keep margins and earnings under strain.

Find out about the key risks to this DXC Technology narrative.

Another View: Value Signals From Earnings

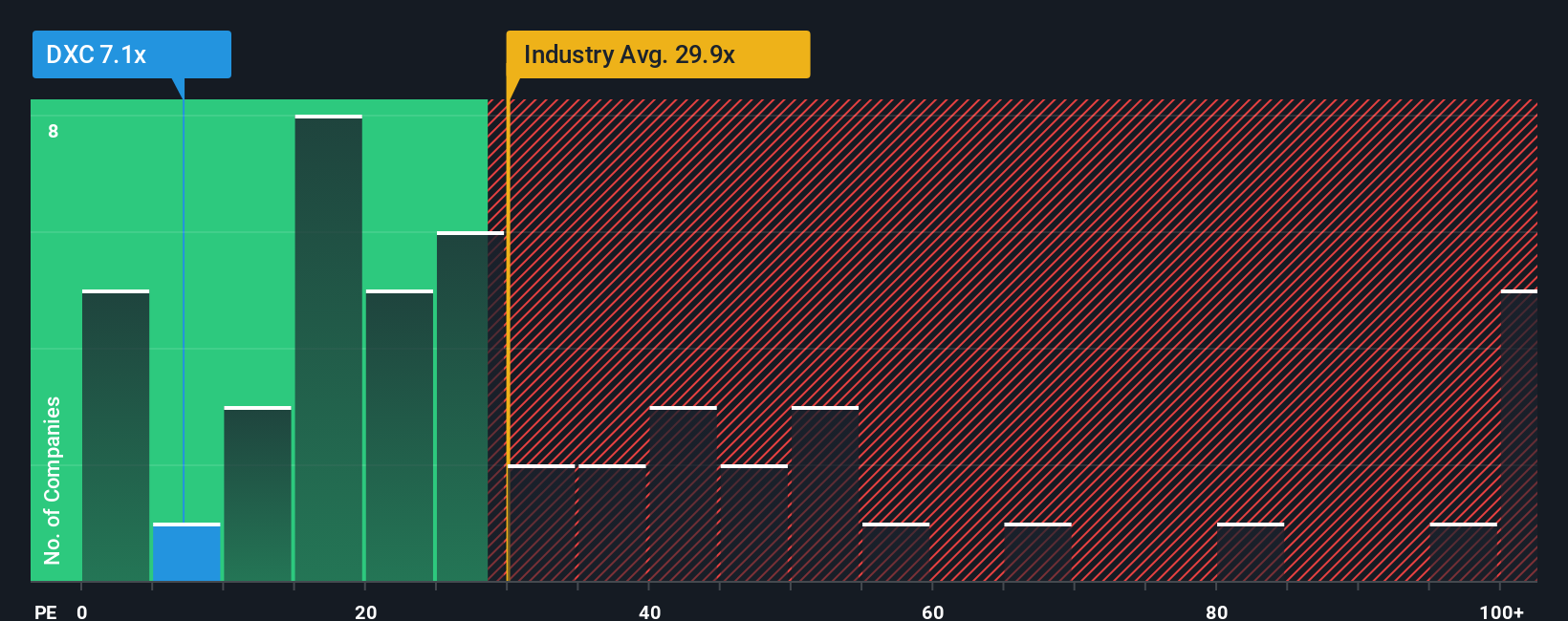

The consensus narrative pegs DXC Technology at roughly fair value around US$14.50, but the earnings based view tells a different story. At a P/E of 6.8x versus 19.3x for peers and 30.1x for the wider US IT group, and a fair ratio of 18.6x, the gap is wide. That discount can reflect risk, opportunity, or a mix of both. Which side do you think dominates here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DXC Technology Narrative

If you look at the numbers and reach a different conclusion, or simply want to stress test the assumptions yourself, you can build a custom DXC view in just a few minutes with Do it your way.

A great starting point for your DXC Technology research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If DXC has caught your attention, do not stop here. Use the broader market to surface other ideas that could better match your goals and risk appetite.

- Target fast moving opportunities by scanning these 3554 penny stocks with strong financials that pair smaller market caps with stronger financial footing.

- Zero in on future facing themes through these 25 AI penny stocks that sit at the intersection of artificial intelligence and high growth potential.

- Hunt for price gaps with these 877 undervalued stocks based on cash flows that screens for companies trading below estimated cash flow based worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal