Home Depot (HD) Valuation Check As Shares Soften And Long Term Returns Remain Resilient

With no single headline event in focus, Home Depot (HD) is drawing attention as investors weigh its recent share performance, including a negative past 3 months return, against its current valuation and earnings profile.

See our latest analysis for Home Depot.

At a share price of $349.29, Home Depot has seen short term momentum soften, with a 30 day share price return of a 1.5% decline and a 90 day share price return of a 9% decline, even as the 5 year total shareholder return of 42.78% points to a much stronger long term record.

If Home Depot has you thinking about where else value or momentum might be building, it could be a good moment to broaden your search with fast growing stocks with high insider ownership.

So, with recent short-term weakness set against a 5-year total return of 42.78% and growth in annual revenue and net income, is Home Depot quietly undervalued at this point, or is the market already pricing in its future growth?

Most Popular Narrative: 12.4% Undervalued

Compared with Home Depot's last close at $349.29, the most widely followed narrative points to a higher fair value anchored in long term earnings power.

The company's targeted acquisitions (SRS, pending GMS) and continued expansion of its Pro customer ecosystem are positioning Home Depot as the supplier of choice for complex, higher-ticket projects, which is set to increase market share, customer lifetime value, and organic revenue growth over time.

Curious what sits behind that confidence in future earnings? The narrative leans on steady top line expansion, firmer margins, and a richer profit multiple. The full story is in the numbers.

Result: Fair Value of $398.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that optimism collides with softer big ticket remodeling demand and higher capital spending, which could pressure margins and stall the earnings trajectory behind this view of 12.4% undervaluation.

Find out about the key risks to this Home Depot narrative.

Another View: Market Multiple Sends A Different Signal

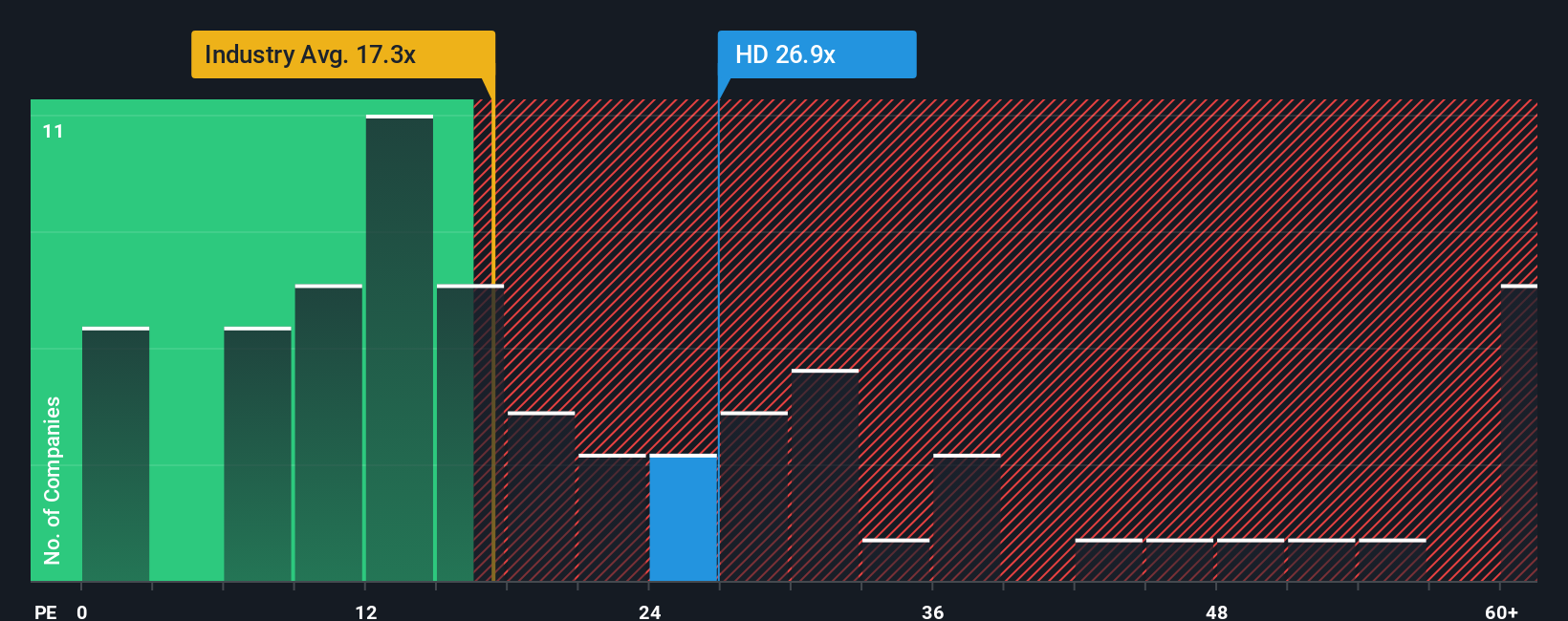

That 12.4% undervalued narrative sits awkwardly next to how the market is pricing Home Depot today. On a P/E of 23.8x, the shares trade above the US Specialty Retail industry at 20.2x and above the fair ratio of 22.8x that the market could move toward over time.

If sentiment cooled and the P/E simply drifted toward that 22.8x fair ratio or closer to peers at 20.2x, today’s price would start to look full rather than cheap. So is this a case of the market paying up for quality, or are expectations already doing a lot of the heavy lifting?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Home Depot Narrative

If you see the numbers differently or just prefer to test your own assumptions, you can build a complete Home Depot view in minutes with Do it your way.

A great starting point for your Home Depot research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you only stop at Home Depot, you could miss opportunities that fit your style even better, so use the Screener to keep your shortlist sharp.

- Spot potential mispricing quickly by filtering for companies that appear cheap on cash flow metrics using these 877 undervalued stocks based on cash flows before others catch on.

- Ride powerful tech trends by checking out these 25 AI penny stocks that are tied to artificial intelligence themes across different parts of the market.

- Strengthen your income focus by zeroing in on these 11 dividend stocks with yields > 3% that could help you build a portfolio with more reliable cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal