Assessing Bristol Myers Squibb (BMY) Valuation After New Eliquis Pact Trial Update And Opdivo Approval

Bristol-Myers Squibb (BMY) is back in focus after several drug related updates, including a Medicaid agreement for Eliquis, new Phase 3 trial plans in pediatric neuropsychiatry, and fresh approval for subcutaneous Opdivo.

See our latest analysis for Bristol-Myers Squibb.

These updates arrive as Bristol-Myers Squibb’s share price has climbed to US$54.42, with a 90-day share price return of 22.18% and a 1-year total shareholder return close to flat at 0.05%. This suggests momentum has picked up recently while longer term performance remains muted.

If you are comparing Bristol-Myers Squibb with peers in the same space, it could be worth scanning other healthcare stocks that might fit your portfolio. It is a quick way to spot more ideas in this sector.

With Bristol-Myers Squibb trading at US$54.42 and sitting close to the average analyst price target, yet showing a large intrinsic discount estimate, you have to ask yourself: is this a value opportunity, or is the market already pricing in future growth?

Most Popular Narrative: 1.6% Overvalued

Compared with the last close at US$54.42, the most followed narrative sees fair value only slightly lower, implying a modestly rich valuation today.

Analysts have nudged their price target for Bristol-Myers Squibb slightly higher to approximately $54 per share. This reflects a modestly richer future earnings multiple despite expectations for somewhat weaker revenue growth and profit margins, along with a more cautious Sector Perform stance from recent Street research.

Curious how softer revenue expectations still line up with a higher future earnings multiple? The key lies in margin assumptions and what happens to earnings a few years out. Want to see which forecast combination keeps that fair value only slightly below today’s price? Read the narrative that spells it out step by step.

Result: Fair Value of $53.55 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, keep in mind that upcoming patent cliffs on key drugs, along with ongoing drug pricing and tariff debates, could quickly shift how realistic this fair value narrative looks.

Find out about the key risks to this Bristol-Myers Squibb narrative.

Another View: Earnings Multiple Sends a Different Signal

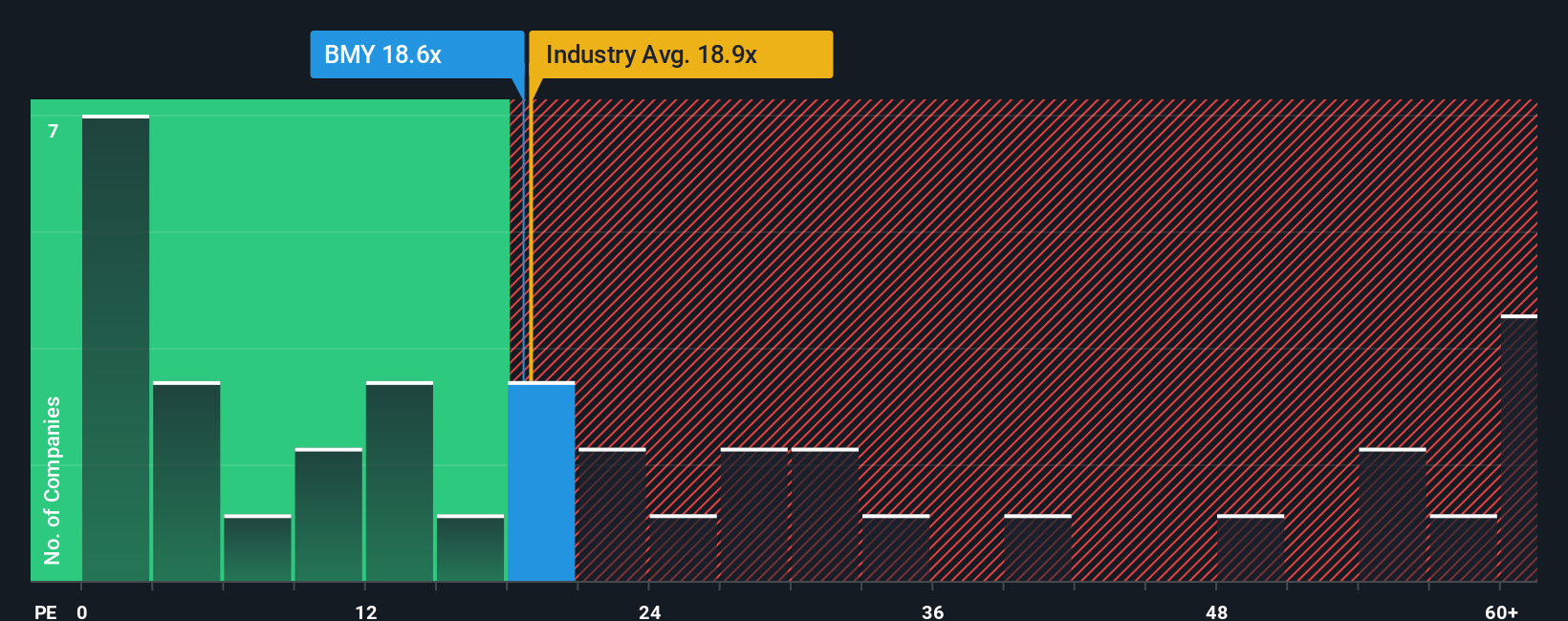

While the most popular narrative pins fair value near US$53.55 and flags Bristol-Myers Squibb as 1.6% overvalued, the earnings multiple tells a different story. The current P/E of 18.3x sits below the US Pharmaceuticals industry at 19.6x, the peer average at 25.5x, and the fair ratio at 23.9x, which points to a meaningful valuation gap that the market could close over time. The question is whether you see that gap as a cushion against disappointment or a sign that expectations are simply lower for BMY than for its rivals.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bristol-Myers Squibb Narrative

If you look at these numbers and come to a different conclusion, or simply prefer to test your own assumptions, you can build a custom story in just a few minutes with Do it your way.

A great starting point for your Bristol-Myers Squibb research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Bristol-Myers Squibb is on your radar, do not stop here. A wider watchlist can help you spot opportunities you might otherwise miss.

- Target potential mispricings by scanning these 877 undervalued stocks based on cash flows that might sit below their estimated cash flow value.

- Tap into fast moving themes by reviewing these 25 AI penny stocks that are tied to artificial intelligence trends.

- Strengthen your income focus by checking out these 11 dividend stocks with yields > 3% that could complement a long term portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal