Evaluating Diodes (DIOD) After Earnings Miss And Chip Slowdown Shifts Valuation Story

Diodes (DIOD) shares recently dropped after earnings fell short of expectations as the broader chip cycle cooled and revenue softened, putting fresh attention on how its fundamentals compare with today’s price.

See our latest analysis for Diodes.

Even with the recent earnings disappointment, Diodes’ share price has shown short term resilience, with a 7 day share price return of 9.92% and a year to date share price return of 6.63%. However, the 1 year total shareholder return of a 15.75% decline points to fading longer term momentum.

If you are reassessing chip names after this earnings move, it could be a good moment to broaden your search and check out high growth tech and AI stocks.

So with Diodes trading around US$54.84 after a weak year and sitting close to analyst targets, is the recent slump giving you a mispriced power chip specialist, or is the market already baking in its future growth?

Most Popular Narrative: 6.5% Undervalued

With Diodes last closing at US$54.84 against a fair value estimate of US$58.67, the most followed narrative sees some upside priced into its long term outlook.

Rising demand for Diodes' solutions in AI-related computing and the broader ecosystem of connected devices (including data centers, servers, industrial automation, and IoT) is boosting revenue momentum and contributing to consistent market share gains, improving longer-term top-line growth visibility.

Rapid electrification in automotive, particularly EVs in China, is leading to growing content per vehicle and an expanding set of design wins for Diodes' automotive-qualified products (such as protection devices, LED controllers, and power management ICs), supporting higher average selling prices and future margin expansion.

Want to see what kind of revenue path and margin rebuild sit behind that price target? The narrative leans on faster earnings growth and a richer future P/E multiple, all run through a 10.1% discount rate. The full story is in how those moving parts fit together over the next few years.

Result: Fair Value of $58.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on consumer demand holding up, and on Diodes managing its high inventory and Asia heavy revenue exposure without margin or earnings pressure creeping in.

Find out about the key risks to this Diodes narrative.

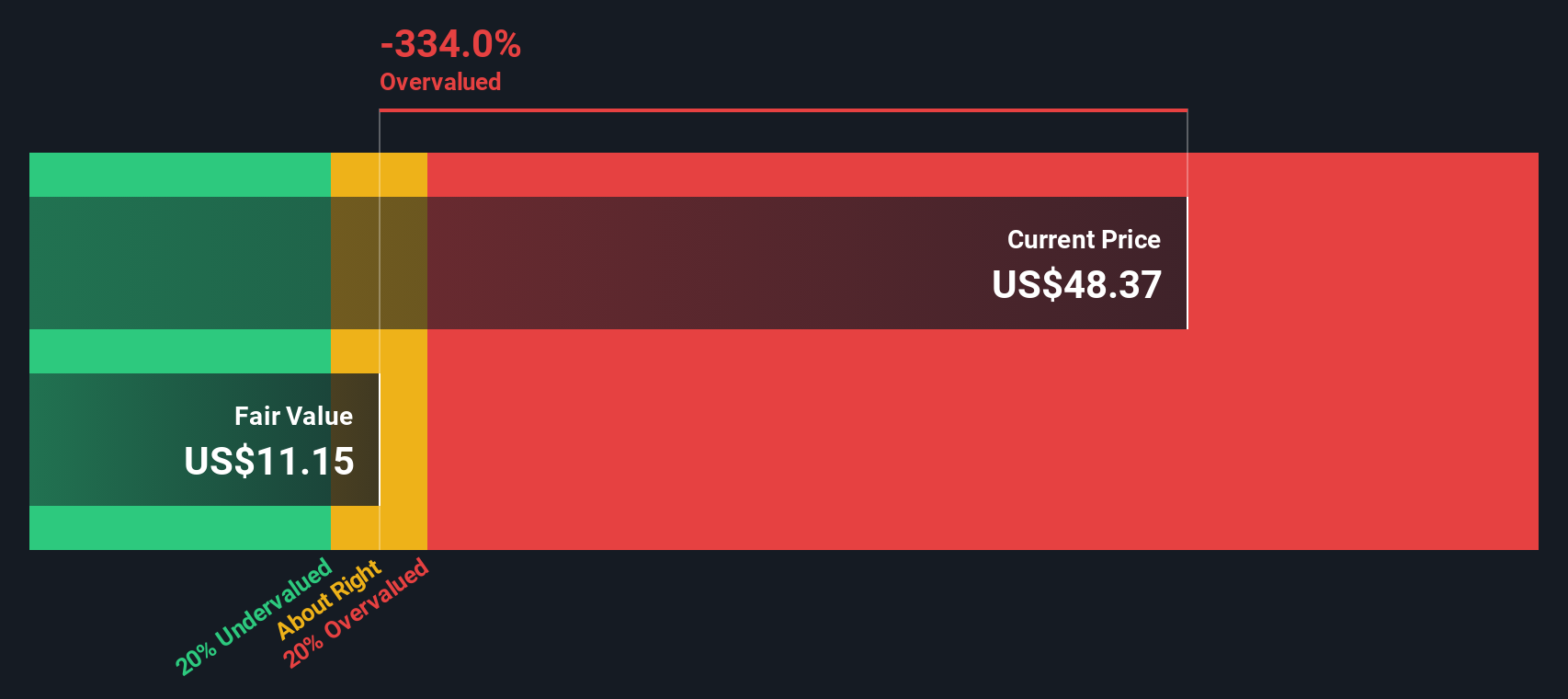

Another View: DCF Says The Stock Is Expensive

While the narrative points to a fair value of US$58.67 and a mild undervaluation, our DCF model paints a very different picture. On that measure, Diodes’ estimated fair value sits at US$27.35, well below the current US$54.84 share price. Which story do you think fits better with the risks and growth assumptions?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Diodes for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Diodes Narrative

If this view does not quite fit how you see Diodes, you can review the numbers yourself, develop your own thesis and Do it your way in just a few minutes.

A great starting point for your Diodes research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Diodes is on your radar, do not stop there. A wider watchlist can give you better context, fresh ideas and more chances to act with confidence.

- Target income focused opportunities by scanning these 11 dividend stocks with yields > 3% that might suit a yield oriented approach.

- Zero in on potential mispricings by checking these 877 undervalued stocks based on cash flows that line up with your own expectations.

- Position yourself early in emerging themes by reviewing these 79 cryptocurrency and blockchain stocks shaping the digital assets space.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal