Assessing Boeing’s Valuation After Apache Contract Win And 737 Production Ramp Plans

The latest catalyst for Boeing (BA) is a US$2.7b U.S. Army contract for Apache helicopter support, paired with FAA-backed plans to increase 737 production, drawing fresh attention to the stock.

See our latest analysis for Boeing.

That contract and the FAA approved 737 production ramp come against a backdrop where the 1 year total shareholder return of 33.23% and 1 month share price return of 13.84% suggest momentum has recently picked up from a relatively flat year to date share price return of 0.91%.

If Boeing’s mix of defense contracts and commercial recovery has your attention, it could be a good moment to scan other aerospace and defense stocks that fit your thesis.

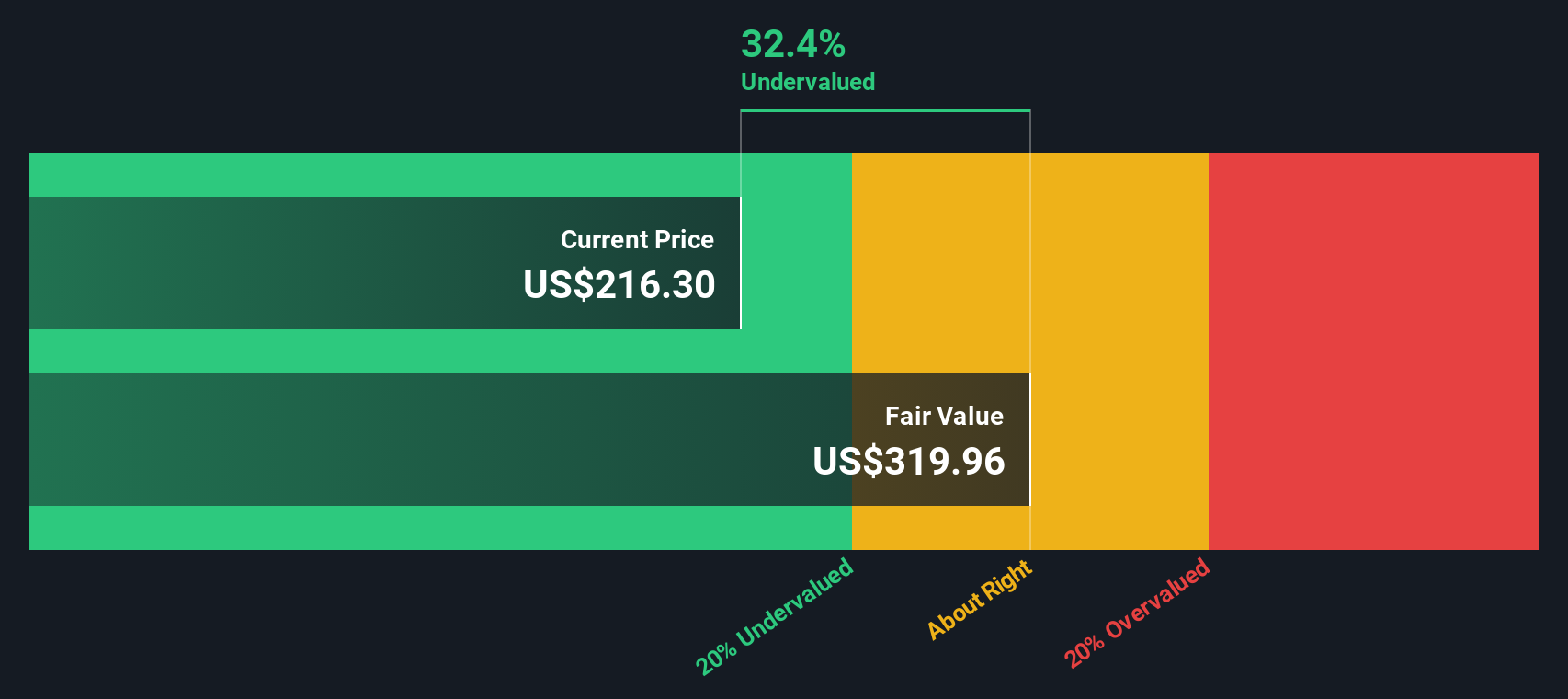

With Boeing trading at US$229.84, sitting about 8% below the average analyst target and at an estimated 35% discount to one intrinsic value model, you have to ask: is there still a genuine entry point here, or is the market already pricing in the recovery story?

Most Popular Narrative: 7% Undervalued

With Boeing last closing at US$229.84 against a narrative fair value of about US$247, the current setup hinges on how you view future growth and margins.

In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $114.4 billion, earnings will come to $7.1 billion, and it would be trading on a PE ratio of 40.9x, assuming you use a discount rate of 8.3%.

Curious what kind of revenue climb, margin shift, and profit multiple need to line up to support that view? The full narrative lays out those levers in detail.

Result: Fair Value of $247.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still pressure points here, including the commercial division's operating loss and Boeing's US$53.3b debt load, that could limit the extent of this recovery narrative.

Find out about the key risks to this Boeing narrative.

Another View: What Do The Ratios Say?

Our DCF work suggests Boeing trades at roughly a 35% discount to an estimated fair value of US$355.56. This contrasts with the 7% narrative undervaluation around US$247.04. If both models are looking at the same business, which one do you think is closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Boeing Narrative

If parts of this story do not sit right with you, or you would rather test the assumptions yourself, you can build your own narrative in minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Boeing.

Looking for more investment ideas?

If Boeing has sharpened your focus, do not stop here. The same tools can help you uncover other opportunities that fit the way you like to invest.

- Spot potential value plays early by checking out these 877 undervalued stocks based on cash flows, backed by detailed cash flow work, before they hit everyone else's radar.

- Ride the wave of rapid tech progress by scanning these 25 AI penny stocks for companies tied to the growth of artificial intelligence across multiple industries.

- Target higher income potential by reviewing these 11 dividend stocks with yields > 3% that aim to deliver yields above 3% from established dividend payers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal