A Look At Chipotle Mexican Grill’s Valuation As Growth Plans Progress And Sales Soften

Chipotle Mexican Grill (CMG) is back in focus after a recent share move that coincides with shifting earnings expectations, softer comparable sales, and fresh attention on the company’s long-term expansion and menu plans.

See our latest analysis for Chipotle Mexican Grill.

The recent move in Chipotle Mexican Grill’s share price, with a 30 day share price return of 13.79% and a year to date share price return of 3.01%, contrasts with its 1 year total shareholder return of a 33.40% decline. This suggests that near term momentum has picked up while longer term investors are still reflecting on prior weakness.

If this kind of rebound has your attention, it could be a good moment to widen your search and check out fast growing stocks with high insider ownership.

So with Chipotle’s shares rebounding over the past month but still down on a 1 year view, and with earnings expectations under review, is this a chance to pick up the stock at a discount, or is future growth already priced in?

Most Popular Narrative Narrative: 10.6% Undervalued

Chipotle Mexican Grill's most followed narrative points to a fair value of about $43.18 per share, compared with the last close of $38.62. This frames the current debate around upside versus execution risk.

The analysts have a consensus price target of $57.75 for Chipotle Mexican Grill based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $65.0, and the most bearish reporting a price target of just $46.0.

Curious what has to happen between now and the late 2020s for that fair value to hold up? Revenue, earnings, margins and the future P/E all need to line up in a very specific way. The full narrative spells out those assumptions step by step.

Result: Fair Value of $43.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, weaker transaction trends and potential tariffs on key ingredients could squeeze revenue growth and margins, challenging the assumptions behind that undervalued narrative.

Find out about the key risks to this Chipotle Mexican Grill narrative.

Another Angle: Premium Price Tag, Different Story

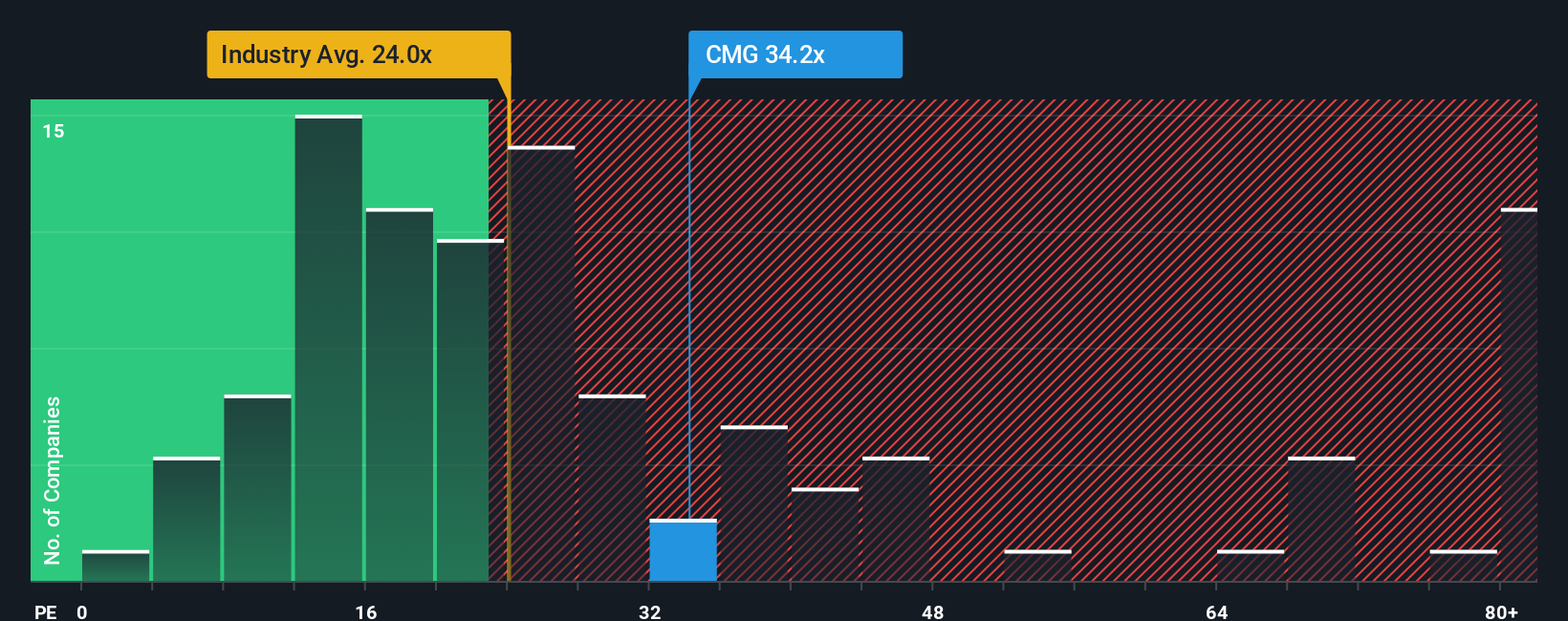

That 10.6% undervalued fair value view sits next to a very different signal from simple pricing. Chipotle trades on a P/E of 33.2x, compared with 21.8x for the US Hospitality industry, 32.1x for peers, and a fair ratio of 26.8x. That gap points to valuation risk rather than a clear bargain. Which story do you think carries more weight right now?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chipotle Mexican Grill Narrative

If you see the numbers differently or want your own angle on Chipotle’s story, you can build a custom, data backed narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Chipotle Mexican Grill.

Looking for more investment ideas?

If Chipotle has sharpened your interest, do not stop here. Use the Simply Wall St Screener to surface other opportunities that could suit your style and goals.

- Spot potential value setups by scanning these 877 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Explore the future of automation by checking out these 25 AI penny stocks that are building tools and platforms powered by artificial intelligence.

- Examine digital asset themes with these 79 cryptocurrency and blockchain stocks that are tied to blockchain infrastructure, payment rails, and related services.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal