BioNTech (NasdaqGS:BNTX) Valuation Check After Positive COVID 19 Vaccine Efficacy Data

BioNTech (NasdaqGS:BNTX) is back in focus after Pfizer and the company reported initial COVID-19 vaccine data suggesting over 90% effectiveness in preventing infection, while scientists highlighted unanswered questions about long term protection.

See our latest analysis for BioNTech.

That vaccine announcement lands against a mixed backdrop, with the share price at $98.09 after a 1 day share price return of 1.28% and a 90 day share price return decline of 7.71%, while the 1 year total shareholder return decline of 22.69% and 3 year total shareholder return decline of 36.17% suggest recent momentum has picked up from a weaker multi year performance.

If you are looking beyond BioNTech, this could be a good moment to compare it with other healthcare stocks that might fit a similar investment thesis or offer a different risk profile.

With BioNTech sharing promising vaccine data but reporting a net loss of €571.6m on €3,152.5m of revenue, the key question now is whether the stock reflects these risks and prospects, or if markets are already pricing in future growth.

Most Popular Narrative: 28.9% Undervalued

With the fair value estimate at about $138 versus the $98.09 last close, the most followed view leans toward a meaningful valuation gap built on future earnings power and margin recovery.

Deep investment and advances in mRNA platform technologies, supported by the planned CureVac acquisition and expanding R&D infrastructure, enhance BioNTech's ability to penetrate the rapidly growing market for personalized medicine. This targets expanding patient populations and supports long-term margin expansion.

Want to see what sits behind that margin story and higher fair value? The narrative leans on shifting revenue mix, stronger profitability assumptions, and a bold future earnings multiple. Curious how those pieces combine into that $138 figure?

Result: Fair Value of $138 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that gap to fair value depends on BioNTech reducing its reliance on COVID-19 vaccines and successfully turning its heavy oncology investment into commercially approved products.

Find out about the key risks to this BioNTech narrative.

Another View: What The Sales Multiple Is Telling You

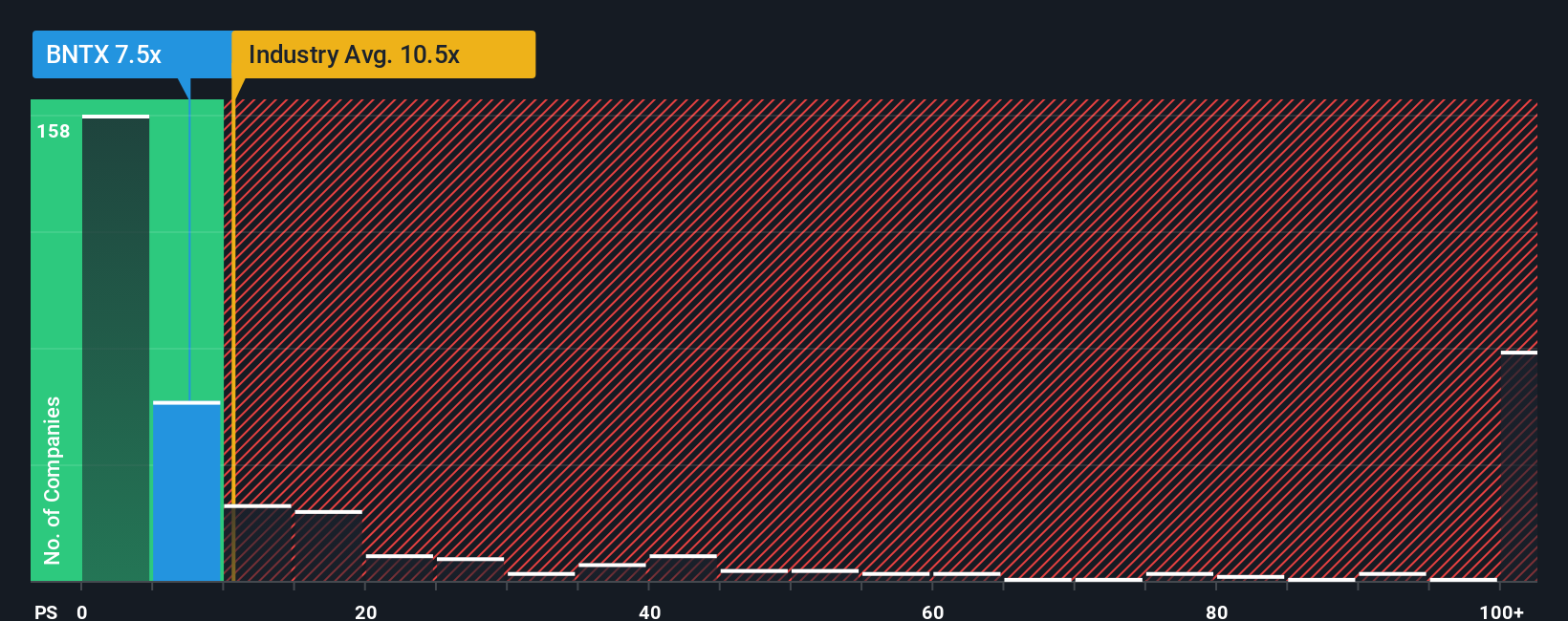

The popular narrative leans on a fair value of about $138, yet the P/S story is more cautious. BioNTech trades on a 6.4x P/S, above its fair ratio of 5.9x and the 4.9x peer average, even though it sits below the 11.5x US Biotechs industry average.

This mix suggests some valuation risk if the market shifts closer to that fair ratio or peer levels. The question for you is whether the oncology pipeline and Covid cash flows justify paying above that 5.9x marker today.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BioNTech Narrative

If you see the story differently or prefer to weigh the numbers yourself, you can shape a custom view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding BioNTech.

Looking for more investment ideas?

If BioNTech is on your radar, do not stop there. Casting a wider net of ideas today can give you more options when markets shift.

- Spot fresh upside potential by scanning these 877 undervalued stocks based on cash flows that trade at prices which may not fully reflect their fundamentals.

- Ride powerful tech trends by checking out these 25 AI penny stocks that tie artificial intelligence to real business models.

- Go off the beaten path with these 79 cryptocurrency and blockchain stocks that connect listed companies to blockchain, digital assets, and payment infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal