Assessing Beam Therapeutics (BEAM) Valuation After ARK Invest Expands Its Position

ARK Invest recently expanded its position in Beam Therapeutics (BEAM), adding more than 195,000 shares as it leans further into precision genetic medicines and base-editing approaches to address serious inherited diseases.

See our latest analysis for Beam Therapeutics.

The ARK purchase comes as Beam Therapeutics trades at US$28.34, with a 1 day share price return of 5.59% and a year to date share price return of 4.42%. The 1 year total shareholder return of 4.65% sits against a 5 year total shareholder return that reflects a 70.80% decline, suggesting recent momentum is improving after a much tougher longer term experience for holders.

If ARK's renewed interest in genetic medicines has caught your attention, it could be a good moment to scan other specialised healthcare names using our healthcare stocks as a starting point.

So with Beam trading at US$28.34, annual revenue of US$55.7m and a recent net loss of US$414.6m, plus a large gap to analyst targets, are you looking at a mispriced opportunity, or is the market already banking on future growth?

Most Popular Narrative: 81.1% Undervalued

According to davidlsander, the narrative anchors Beam Therapeutics at a fair value of US$65 per share, well above the last close of US$28.34, and builds that view around a detailed rNPV framework for its lead programs.

Beam achieved a landmark milestone with BEAM-302, providing the first-ever clinical proof-of-concept for in vivo base editing in humans. This "one-and-done" therapy for AATD directly corrects the disease-causing PiZ mutation. Early data is exceptionally strong, showing it achieves the dual therapeutic goal: it halts the production of the toxic liver protein (Z-AAT) while simultaneously restoring the functional, protective lung protein (M-AAT). This establishes a clear best-in-class profile and significantly de-risks the entire liver-directed LNP platform.

It may not be obvious how a clinical stage company with ongoing losses arrives at that higher fair value. The key is how future revenue, margins and probability of success are incorporated into the rNPV calculations. The way those assumptions stack across just two programs, plus cash, drives a substantial portion of this valuation narrative.

Result: Fair Value of $65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this bullish view still depends on successful clinical outcomes and regulatory progress, and any safety issues or delays could quickly challenge the rNPV-based fair value.

Find out about the key risks to this Beam Therapeutics narrative.

Another View: Price Versus Sales Sends A Different Signal

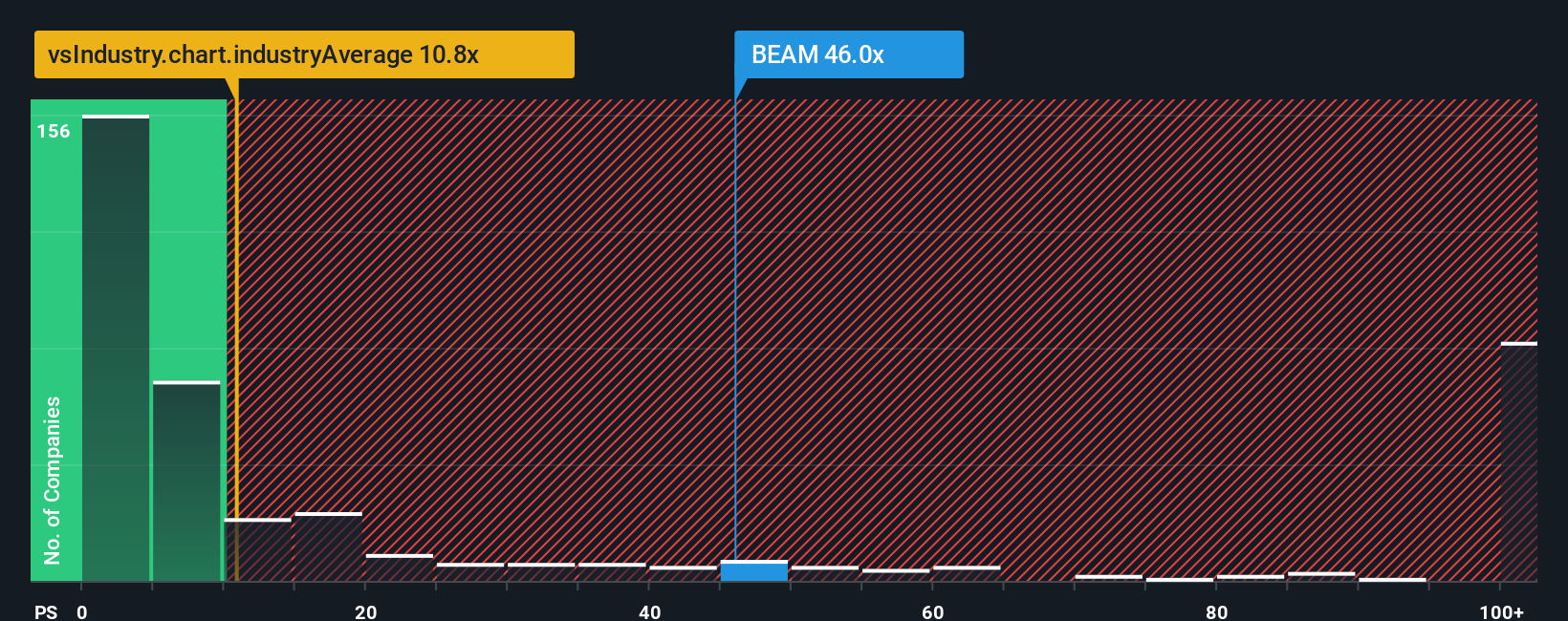

That rNPV driven fair value of US$65 sits very differently to what the current price implies when you look at Beam on a simple P/S basis. At 47.6x sales versus around 11.5x for the US biotech industry and 18.4x for peers, the stock carries a much richer tag than its group.

Our fair ratio for Beam comes out at 0x P/S, which effectively suggests the current revenue base alone does not justify a premium multiple. For you as an investor, that kind of gap can either be a sign the market is already banking on a lot of success or a sign the model inputs deserve a closer look.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Beam Therapeutics Narrative

If you look at the numbers and come to a different conclusion, or simply prefer to test your own assumptions, you can build a complete Beam view yourself in just a few minutes, starting with Do it your way.

A great starting point for your Beam Therapeutics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready For More Investment Ideas?

If Beam feels interesting but you want a wider view, now is the moment to line up a few more names that fit exactly what you care about.

- Spot potential value setups by scanning these 876 undervalued stocks based on cash flows where current prices sit well below what their cash flows might support.

- Zero in on cutting edge opportunities across these 25 AI penny stocks that are applying artificial intelligence across different parts of the economy.

- Collect ideas for regular income by filtering through these 11 dividend stocks with yields > 3% and focusing on companies with yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal