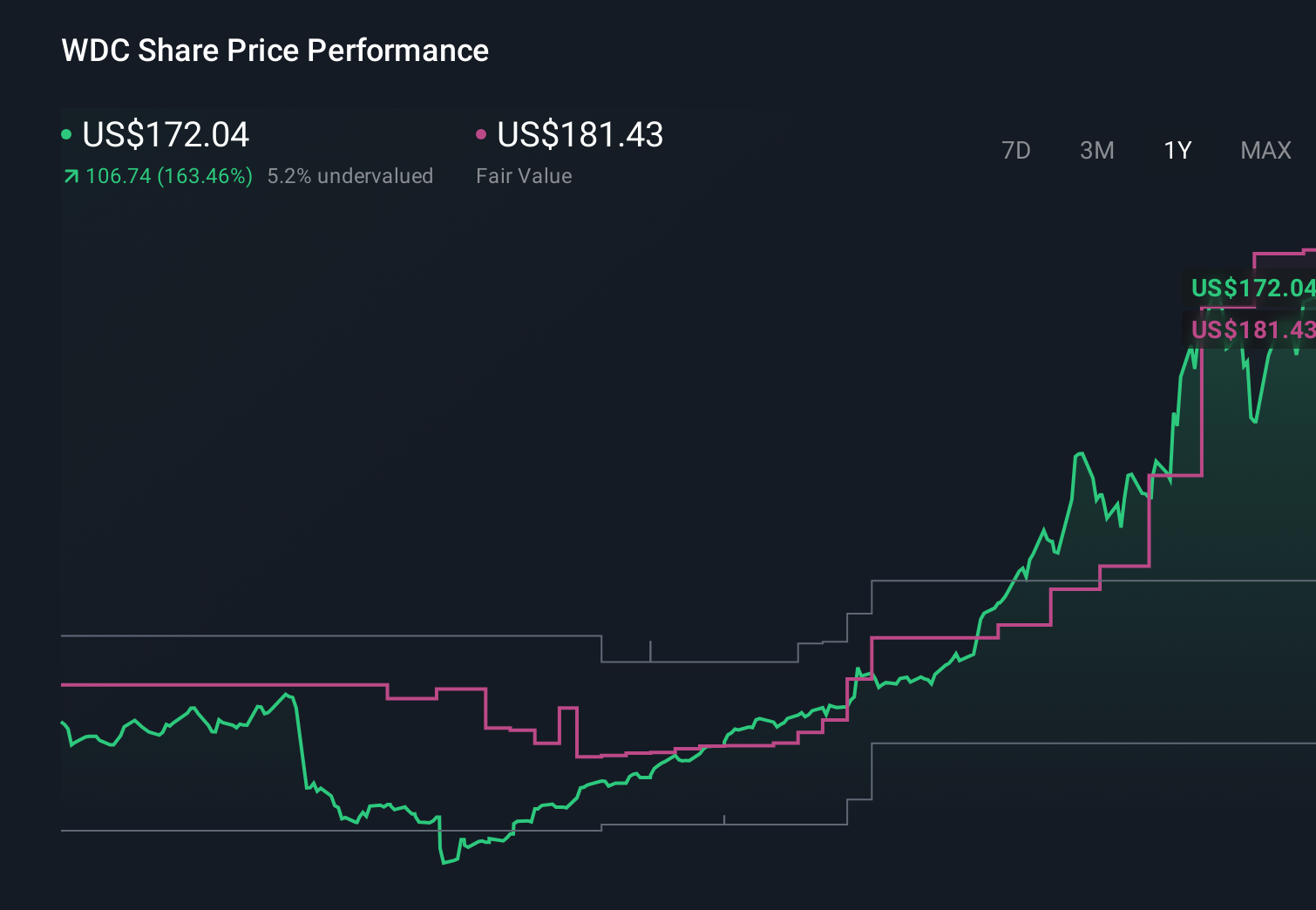

Why Western Digital (WDC) Is Up 24.6% After Doubling Down On AI-Centric Cloud Storage

- In early January 2026, Western Digital reported surging demand for its high-capacity hard drives used in AI and cloud data centers, following its split from the flash business and sharpened focus on enterprise and hyperscale customers.

- This shift, reinforced by its addition to the Nasdaq-100 and constrained supply for AI-optimized storage, is increasingly positioning Western Digital as a crucial infrastructure provider for the generative AI buildout.

- We’ll now examine how Western Digital’s pivot toward AI-driven cloud storage demand may reshape its investment narrative and key assumptions.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Western Digital Investment Narrative Recap

To own Western Digital today, you need to believe that AI and cloud data centers will keep requiring vast, cost-efficient hard drive storage, and that Western Digital can stay a preferred supplier to hyperscale customers. The recent AI-fueled share price jump and tighter supply backdrop reinforce that the key near term catalyst remains cloud capex and storage pricing, while the biggest current risk is the company’s heavy revenue concentration in a small number of large cloud buyers.

Among recent developments, Western Digital’s addition to the Nasdaq-100 is particularly relevant, as it reinforces the market’s view of the company as a core enabler of AI infrastructure. This index inclusion may magnify short term moves around upcoming earnings and macro data, since passive flows and sentiment around AI spending can both amplify how investors react to any change in cloud storage demand or pricing.

Yet while optimism is high, investors should be aware that customer concentration risk means...

Read the full narrative on Western Digital (it's free!)

Western Digital's narrative projects $11.9 billion revenue and $2.2 billion earnings by 2028. This requires 7.6% yearly revenue growth and around a $0.6 billion earnings increase from $1.6 billion today.

Uncover how Western Digital's forecasts yield a $186.96 fair value, a 15% downside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community value Western Digital between US$186.96 and US$242.69 per share, reflecting a wide spread of individual views. You may want to weigh those against the current AI driven reliance on a small number of hyperscale customers and what that could mean for Western Digital’s future earnings resilience.

Explore 5 other fair value estimates on Western Digital - why the stock might be worth 15% less than the current price!

Build Your Own Western Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Western Digital research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Western Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Western Digital's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal