Investor Optimism Abounds Firstsource Solutions Limited (NSE:FSL) But Growth Is Lacking

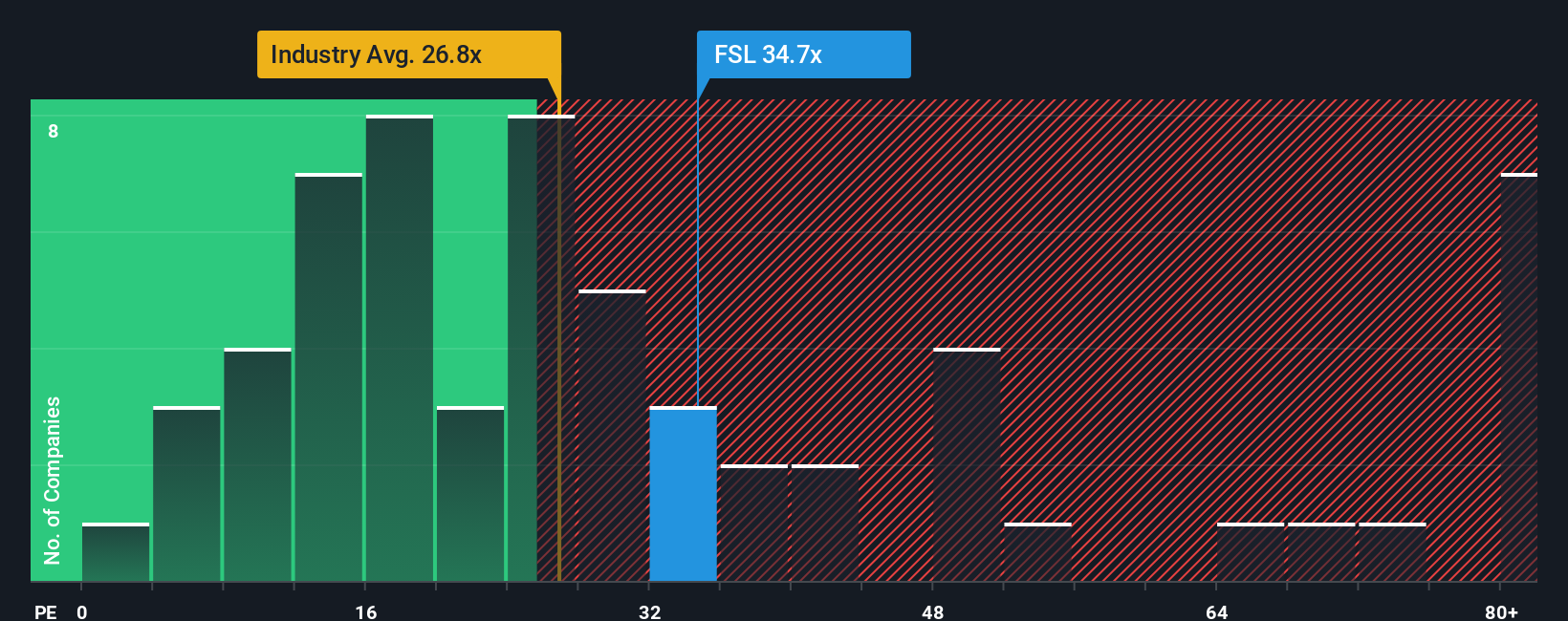

With a price-to-earnings (or "P/E") ratio of 34.7x Firstsource Solutions Limited (NSE:FSL) may be sending bearish signals at the moment, given that almost half of all companies in India have P/E ratios under 25x and even P/E's lower than 14x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times have been advantageous for Firstsource Solutions as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Firstsource Solutions

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Firstsource Solutions' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 25%. The latest three year period has also seen an excellent 37% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the twelve analysts covering the company suggest earnings should grow by 20% each year over the next three years. With the market predicted to deliver 20% growth per year, the company is positioned for a comparable earnings result.

With this information, we find it interesting that Firstsource Solutions is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Firstsource Solutions' P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Firstsource Solutions' analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Firstsource Solutions, and understanding should be part of your investment process.

You might be able to find a better investment than Firstsource Solutions. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal