Assessing CoreWeave (CRWV) Valuation After Recent Share Price Weakness And GenAI Growth Expectations

CoreWeave (CRWV) has been catching investor attention after recent trading swings, with the share price closing at US$76.86. You may be considering what this means for a business focused on GenAI cloud infrastructure and related compute services.

See our latest analysis for CoreWeave.

The recent pullback, with a 1 day share price return of 3.1% decline and a 30 day share price return of 13% decline, sits against a much steeper 90 day share price return of 45.1% decline. This suggests momentum has been fading even as CoreWeave positions itself in GenAI cloud infrastructure.

If CoreWeave has you looking more closely at AI infrastructure, it could be a good moment to widen your search and scan high growth tech and AI stocks for other potential ideas.

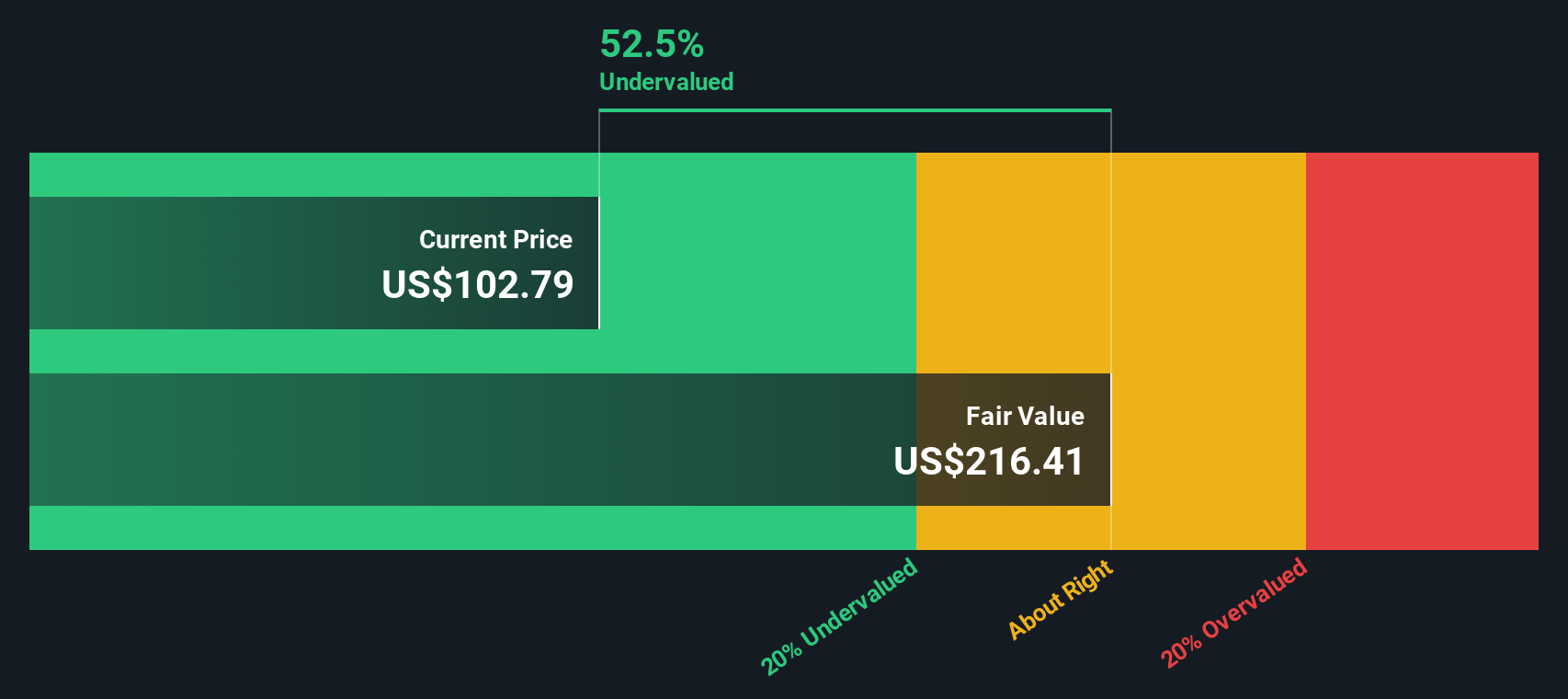

So with CoreWeave’s shares well below analyst price targets and recent returns under pressure, should you see today’s valuation as a chance to buy into GenAI infrastructure at a discount, or has the market already priced in future growth?

Price-to-Sales of 8.9x: Is it justified?

On a P/S of 8.9x at a last close of US$76.86, CoreWeave screens as cheaper than peers on sales, even though it remains loss making today.

The P/S multiple compares the company’s market value to its revenue, which can be useful when earnings are negative and traditional P/E is not available. For a GenAI focused cloud infrastructure provider like CoreWeave, revenue is a central reference point because the business is still in a scale up phase, reporting US$4,306.53m of revenue and a loss of US$824.73m.

Against that backdrop, CoreWeave’s 8.9x P/S is described as good value versus both a peer average of 17.7x and an estimated fair P/S ratio of 25.6x. That is a wide gap, and it suggests the market is assigning a meaningfully lower sales multiple than the level that regression based modelling indicates could be reasonable if expectations around growth and future profitability play out.

By contrast, when you compare the same 8.9x P/S to the broader US IT industry average of 2.2x, CoreWeave screens as expensive, with its shares trading on a multiple that is several times higher than the sector’s typical level.

Explore the SWS fair ratio for CoreWeave

Result: Price-to-sales of 8.9x (ABOUT RIGHT)

However, this story can change quickly if demand for GenAI compute services softens, or if CoreWeave’s losses of US$824.73m widen and funding conditions tighten.

Find out about the key risks to this CoreWeave narrative.

Another view: DCF sends a different signal

While the 8.9x P/S ratio presents CoreWeave as relatively cheap compared to peers on sales, our DCF model presents a very different picture, with an estimated fair value of US$30.30 versus the current US$76.86. That comparison suggests shares are trading significantly above this fair value estimate, raising the question of which signal is more reliable.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CoreWeave for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CoreWeave Narrative

If some of these signals do not quite line up with your view, or you would rather test the numbers yourself, you can build a tailored narrative in just a few minutes. To get started, use Do it your way.

A great starting point for your CoreWeave research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready to hunt for more investment ideas?

If CoreWeave has sharpened your interest in GenAI and related themes, do not stop here. The next move that fits your portfolio could be sitting in another corner of the market.

- Spot potential growth stories early by scanning these 3556 penny stocks with strong financials that pair smaller share prices with solid underlying financials.

- Target GenAI and automation tailwinds by reviewing these 25 AI penny stocks that focus on artificial intelligence and related technologies.

- Zero in on pricing opportunities using these 881 undervalued stocks based on cash flows that flag companies trading below estimates based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal