Wind: The total amount of equity financing in the US stock market in 2025 was US$2018 billion, an increase of 14.27%

The Zhitong Finance App learned that on January 7, Wind released the 2025 US Stock Underwriting Ranking. In 2025, the US stock equity financing market continued its recovery trend against the backdrop of gradually clear macroeconomic expectations. Activity in the primary market rebounded markedly compared to the previous period, and the amount and scale of equity financing both hit new highs in the past four years. According to Wind statistics, the total amount of equity financing (including IPOs and refinancing) in the US stock market in 2025 was US$201.8 billion, an increase of US$25.2 billion over US$176.6 billion in 2024, an increase of 14.27%.

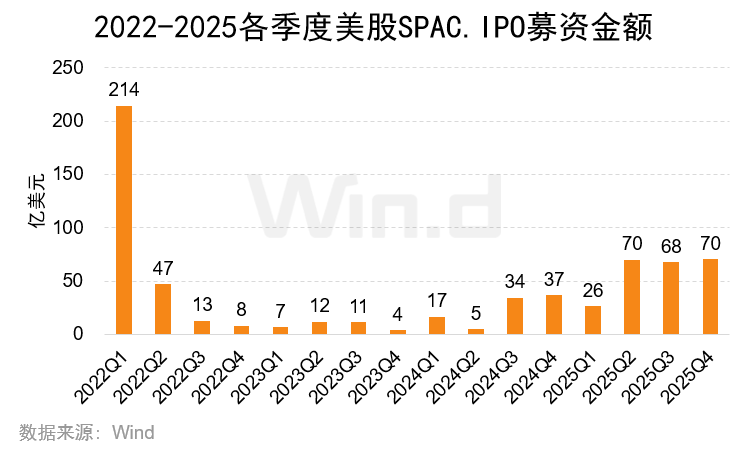

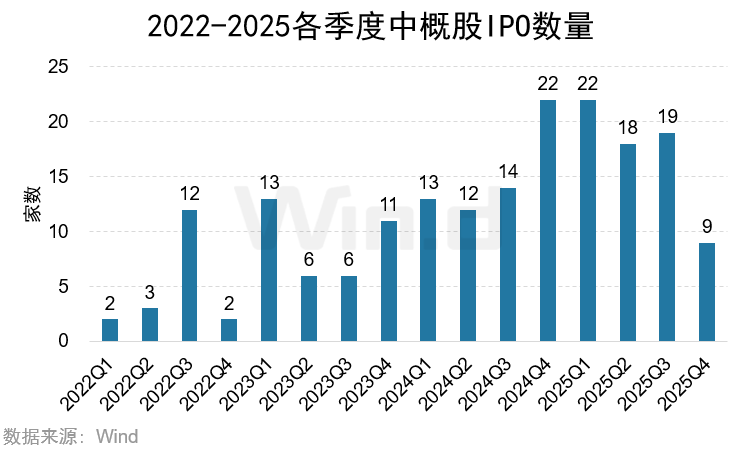

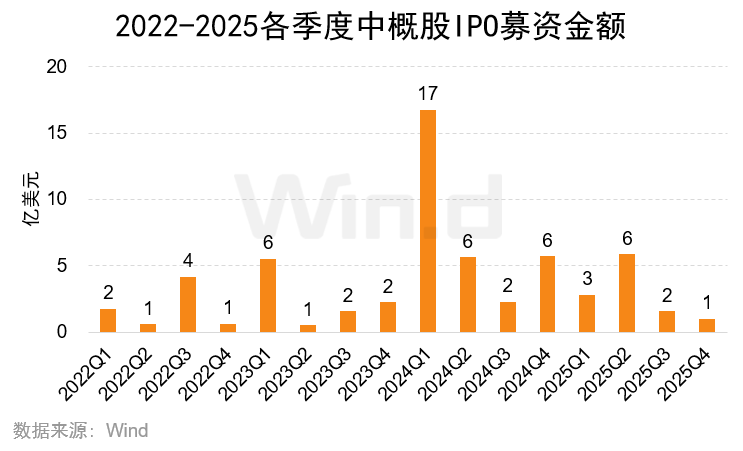

In terms of IPOs, a total of 403 companies were successfully listed in 2025, an increase of 131 over 2024; the total amount of financing was 68.4 billion US dollars, an increase of 67.95% over 2024; among them, Medline raised the largest amount of capital raised, with a total amount of 6.265 billion US dollars. In terms of SPAC, the number of IPO financiers in 2025 was 123, an increase of 72 over 2024; the total amount of financing was US$23.4 billion, a sharp increase of 153.75% over 2024. In terms of Chinese securities, the companies that went to the US for IPOs in 2025 were dominated by small and medium-sized enterprises, with a total of 68 listed companies, an increase of 7 over 2024; the total amount of financing was only 1.1 billion US dollars, a decrease of 62.88% from 2024.

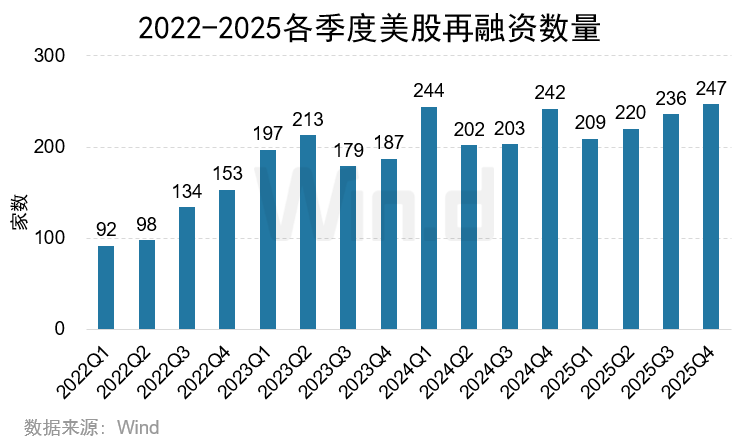

In terms of refinancing, the number of refinancing incidents in 2025 was 912, an increase of 21 over 2024; the total scale of refinancing was US$133.4 billion, a decrease of 1.82% compared to 2024.

In terms of underwriting, in terms of IPOs, Cantor FitzGerald topped the IPO underwriting list with an underwriting amount of US$6.484 billion, with 34 underwriters; Goldman Sachs ranked second with an underwriting amount of US$6.354 billion, with 36 underwriters; and Morgan Stanley ranked third with an underwriting amount of US$5.956 billion, with 35 underwriters. In terms of refinancing, J.P. Morgan ranked first with an underwriting scale of US$21.98 billion, with 91 underwriting cases; Goldman Sachs ranked second with an underwriting scale of US$16.393 billion, with 73 underwriting cases; and Morgan Stanley ranked third with an underwriting amount of US$12.876 billion, with 74 underwriting cases.

(Note: 1. The total amount of capital raised in the list includes overallotment; 2. The IPO statistics include public offerings, SPACs, and introductory listings)

Equity Finance Market Overview

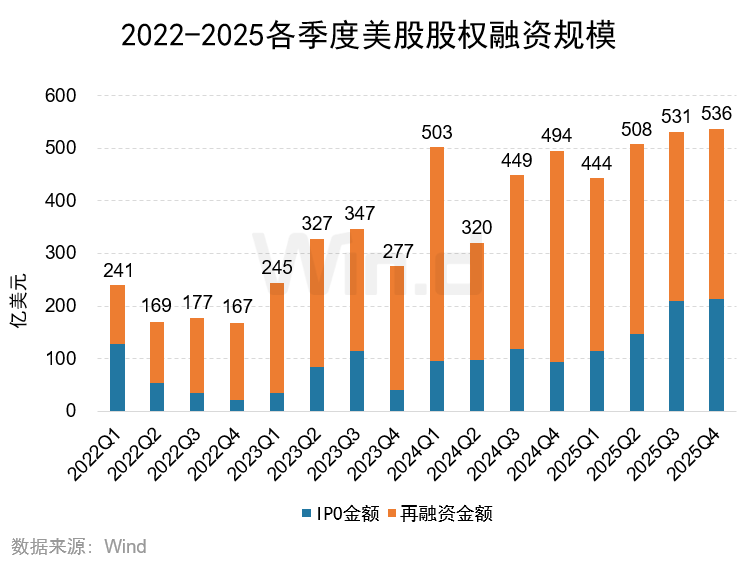

1.1 Trends in the size of equity financing

In 2025, the total amount of equity financing in the US primary market was US$201.8 billion, up 14.27% from US$176.6 billion in 2024. Among them, the IPO financing scale was US$68.4 billion, up 67.95% from 2024; the refinancing scale was US$133.4 billion, down 1.82% from 2024.

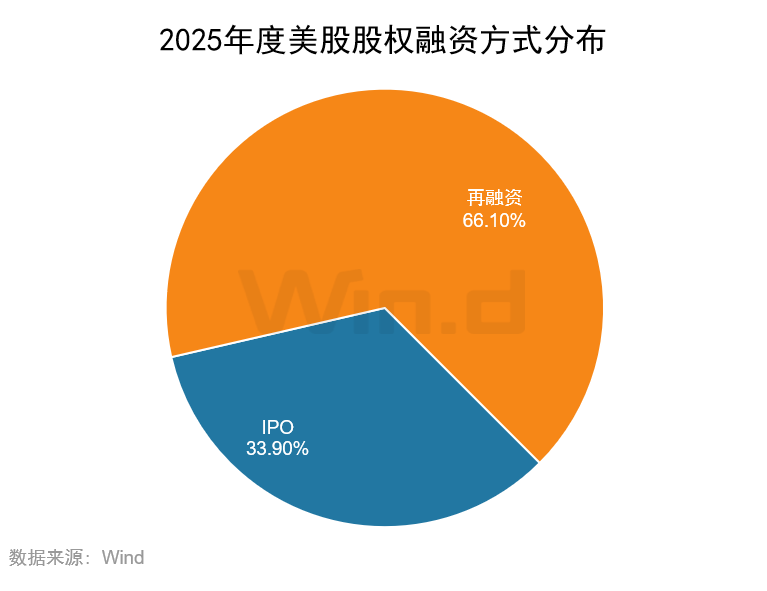

1.2 Distribution of financing methods

Looking at specific financing methods, the total IPO financing scale in 2025 was US$68.418 billion, accounting for 33.90% of the total equity financing scale in the primary market; the refinancing scale was US$133.419 billion, accounting for 66.10%.

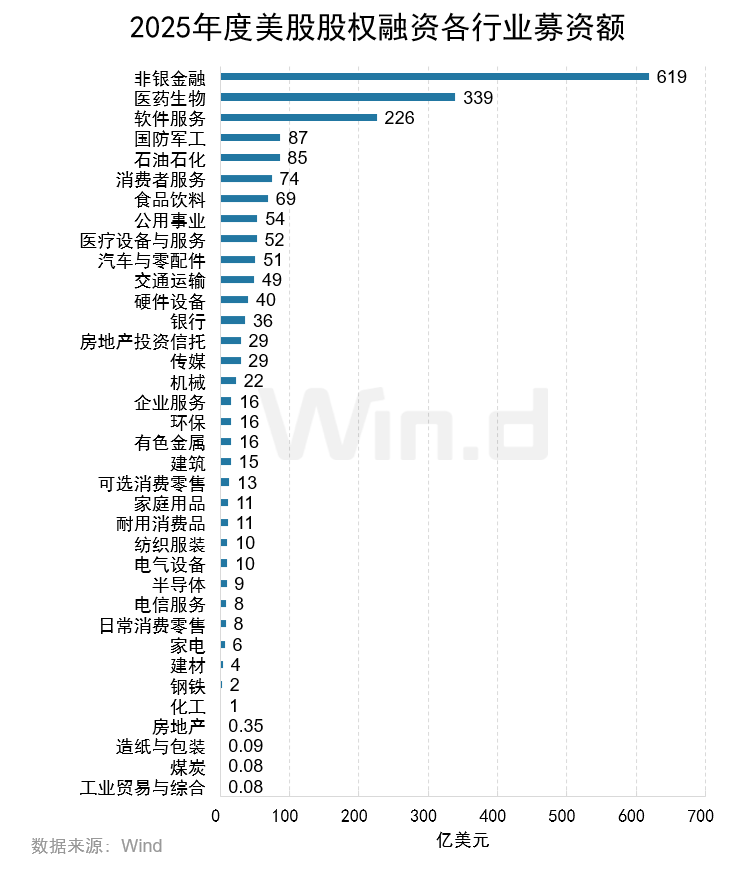

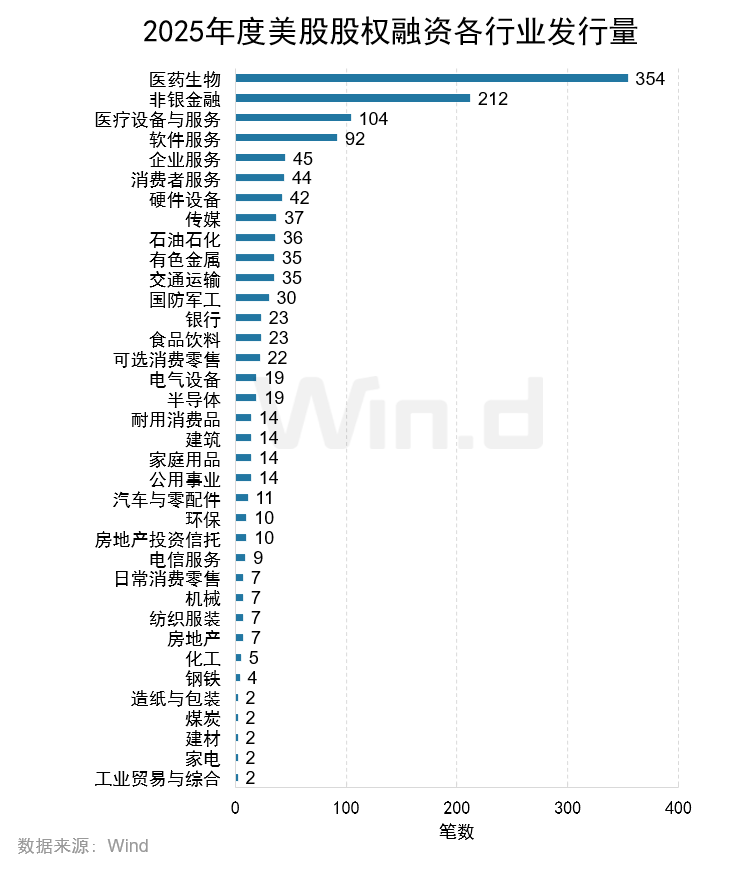

1.3 Distribution of financing entities by industry

Judging from the distribution of financing conditions in various industries, the non-bank finance industry ranked first, with a total financing scale of 61.9 billion US dollars; the pharmaceutical and biological industry ranked second, with a total financing scale of 33.9 billion US dollars; and the software services industry ranked third with a financing scale of 22.6 billion US dollars.

Judging from the number of financing incidents in various industries, the pharmaceutical and biological industry topped the list with 354 financing incidents; the non-bank finance industry ranked second with 212 financing incidents; and the medical equipment and services industry ranked third with 104 financing incidents.

Debut

2.1 Trends in the number of IPOs issued and the scale of financing

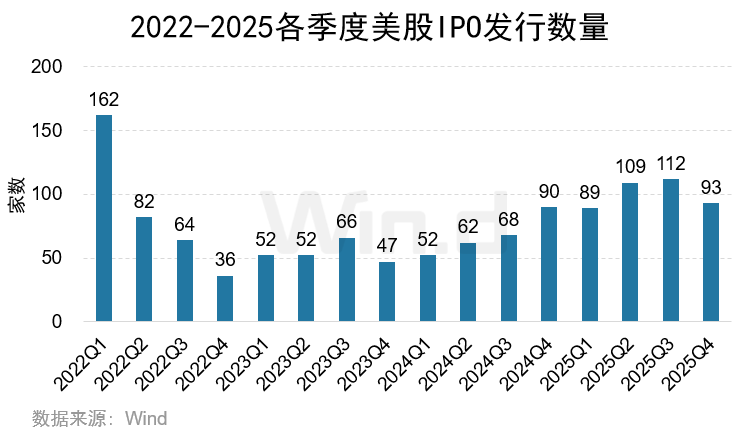

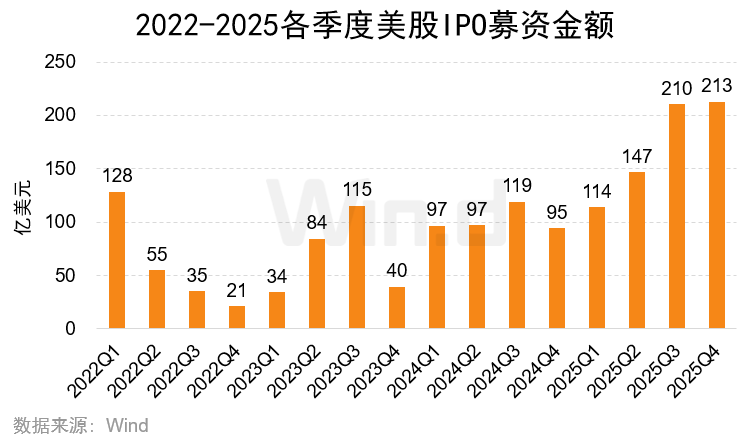

In 2025, a total of 403 US stock companies were successfully listed, an increase of 131 over 2024; the total amount of financing was 68.4 billion US dollars, an increase of 67.95% over 2024 billion. Among them, the number of IPOs issued in the fourth quarter was 93, an increase of 3 over the same period in 2024; the amount of IPOs raised was US$21.3 billion, up 125.32% from 2024.

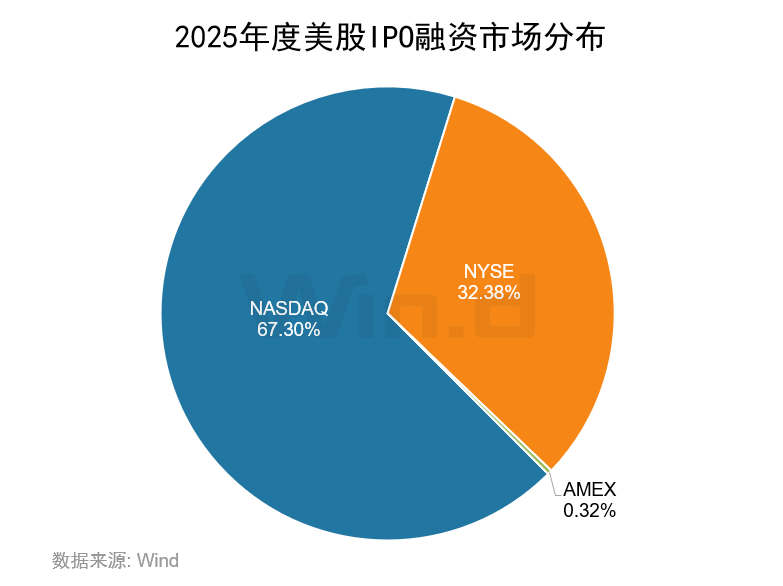

2.2 Distribution of the IPO market

Looking at the distribution of the IPO market, in 2025, the market with the largest number of US IPOs was NASDAQ, with a total of 313 companies listed, with a total fund-raising scale of 46.042 billion US dollars, accounting for 67.30% of the total US stock market; the NYSE achieved 66 IPOs, with a total capital raised of 22.155 billion US dollars, accounting for 32.38% of the total US stock market; the AMEX exchange achieved 24 IPOs with a capital raised of US$221 million.

2.3 Distribution of major IPOs by industry

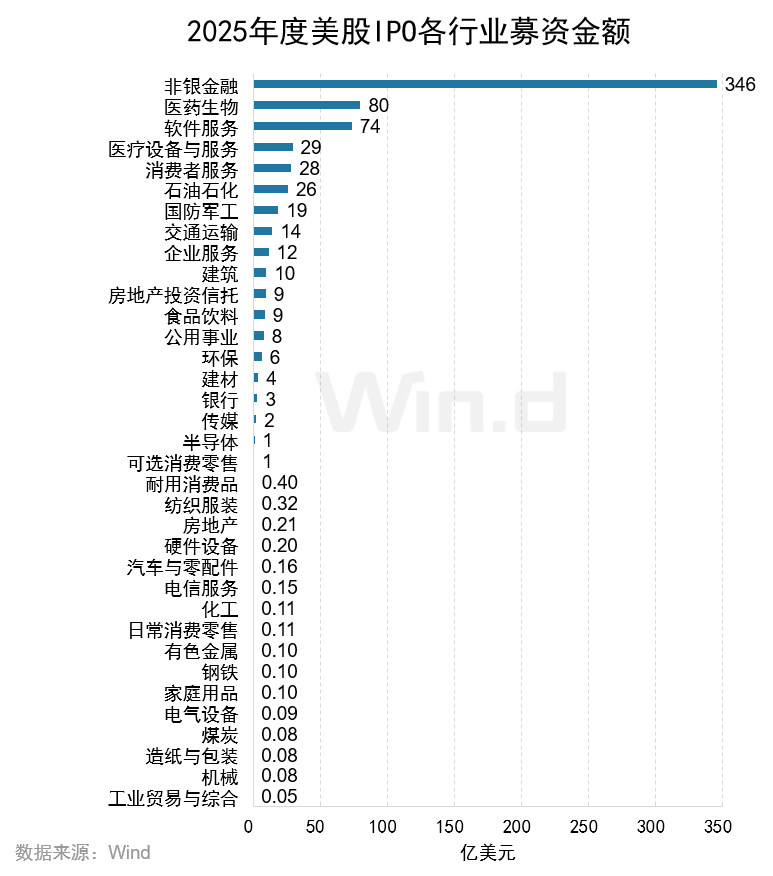

Judging from the distribution of listed major industries, the industry with the highest IPO fund-raising scale was non-bank finance, which raised 34.6 billion US dollars; the pharmaceutical and biological industry ranked second, with 8 billion US dollars raised; and the software services industry ranked third with a capital raised of 7.4 billion US dollars.

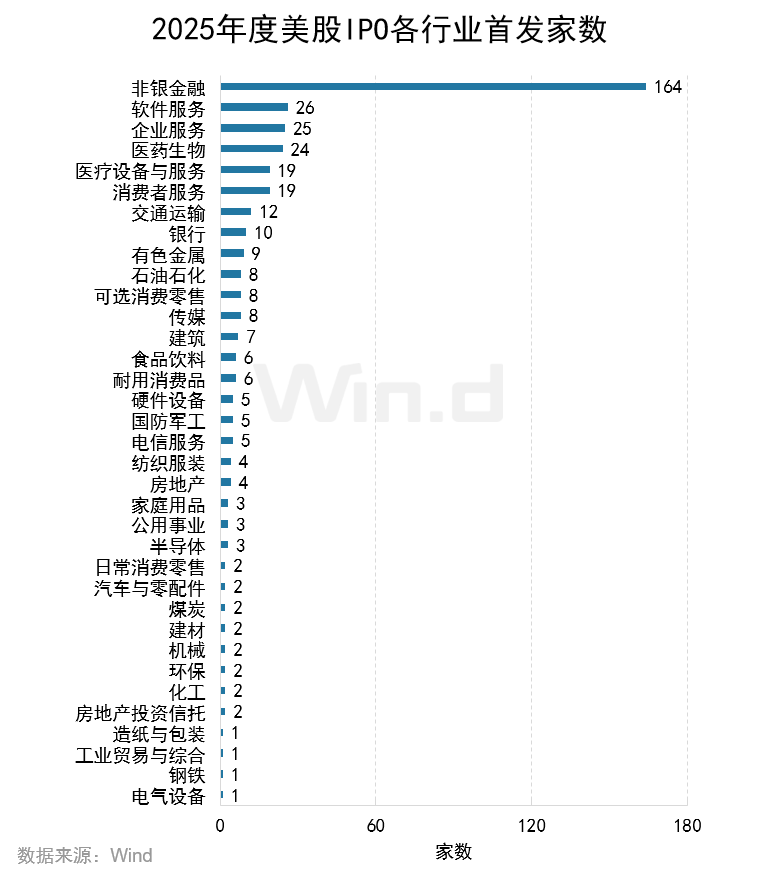

Judging from the number of IPOs issued in various industries, the non-bank finance industry is at the top of the list, with a total of 164 IPOs; the software services industry ranks second with 26 projects, and enterprise services ranks third with 25 projects.

2.4 IPO financing range statistics

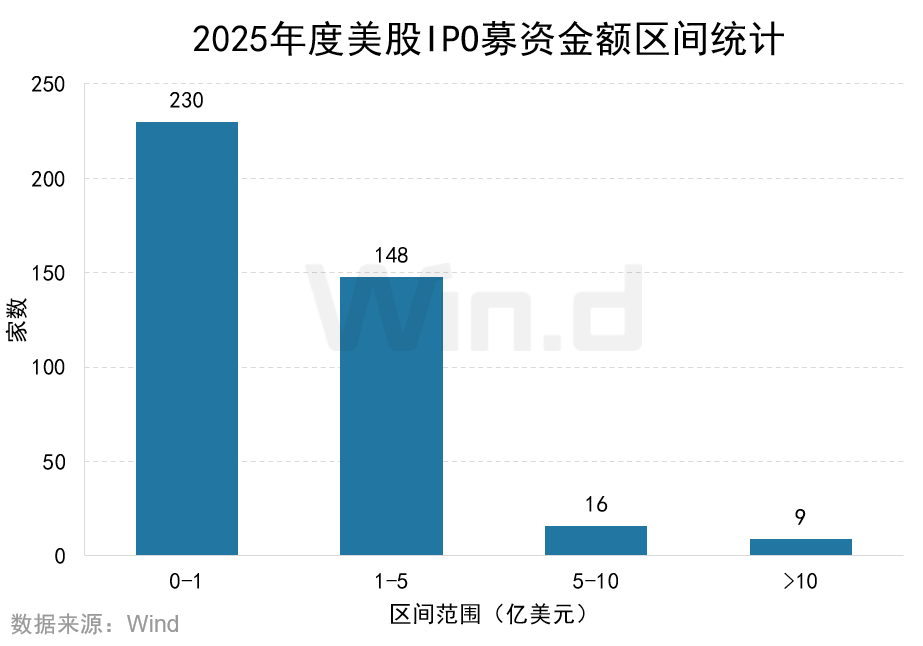

In 2025, there were a total of 230 companies with an IPO financing scale of 100 million US dollars or less, accounting for 57% of the total number of IPOs; the number of companies with a financing scale of US$1-500 million was 148; and there were 16 companies with a financing scale of US$5 to 1 billion, and 9 companies with a financing scale of US$1 billion or more.

2.5 Top 10 IPO Financing Amounts

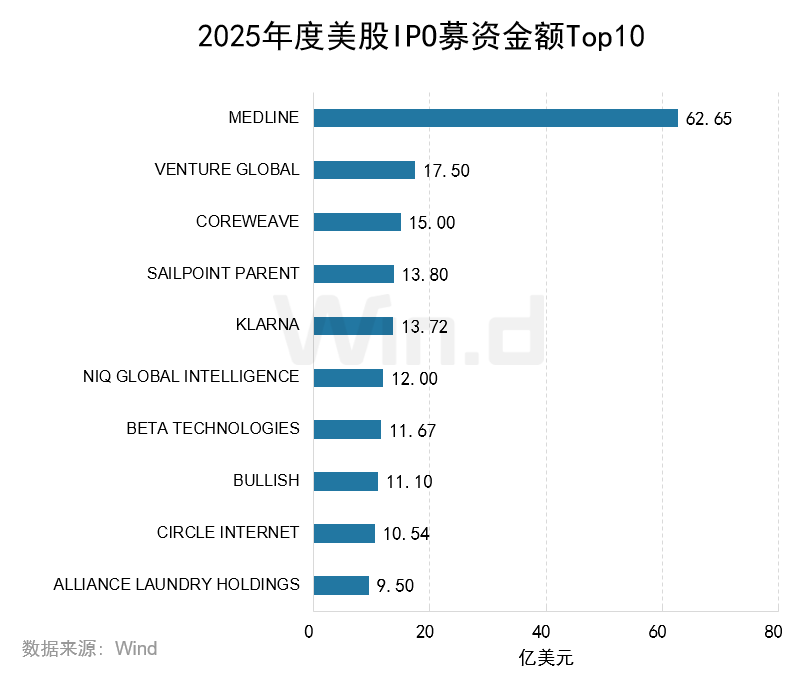

The company with the highest amount of IPO financing was Medline, with $6.265 billion; Venture Global and Coreweave ranked second and third with $1.75 billion and $150 billion respectively. The top ten IPOs raised a total of US$17.749 billion, accounting for 25.94% of the total amount of IPOs raised.

2.6 Number of SPAC IPOs issued and size of financing

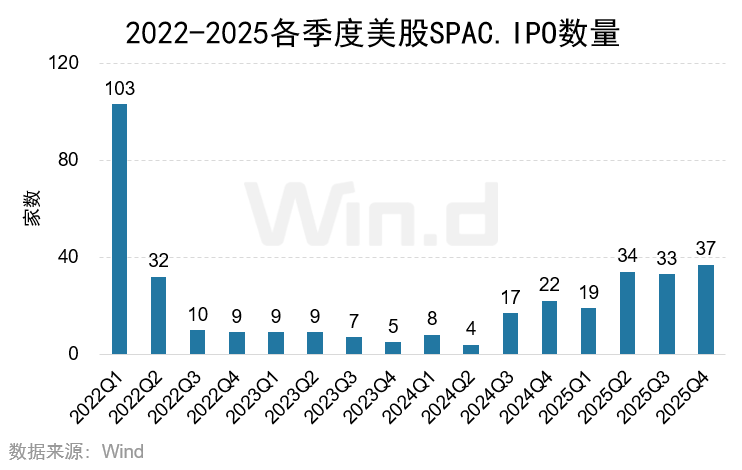

A total of 123 SPACs were listed in 2025, an increase of 72 over 2024; the capital raised was US$23.4 billion, a sharp increase of 153.75% over 2024.

2.7 Number of IPOs issued and scale of financing

In 2025, a total of 68 Chinese companies went public in the US, an increase of 7 over 2024. The financing scale was US$1.1 billion, down 62.88% from 2024. Only two leading companies raised over 100 million dollars, namely Bawang Chaji (US$411 million) and Yasheng Pharmaceuticals (US$126 million).

Refinancing section

3.1 Refinancing trends

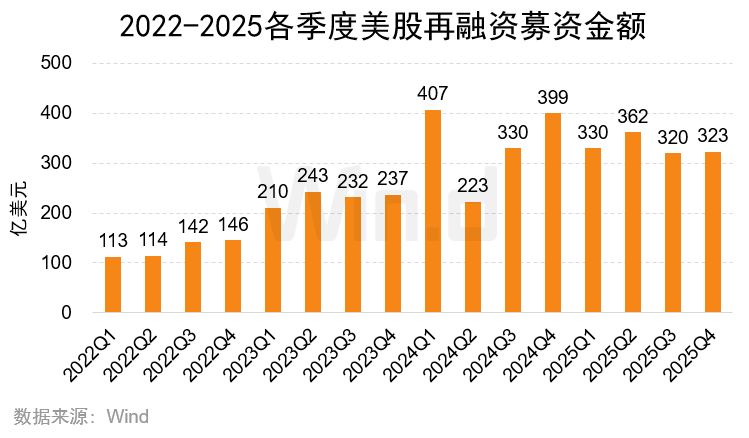

The total amount raised in refinancing in the US stock market in 2025 was US$133.4 billion, down 1.82% from 2024; there were 912 refinancing incidents, up 2.36% from 891 in 2024. Among them, capital raised in the fourth quarter was US$32.3 billion, a year-on-year decrease of 19.24%; there were 247 refinancing incidents, an increase of 2.07% year-on-year.

3.2 Market distribution of refinancing projects

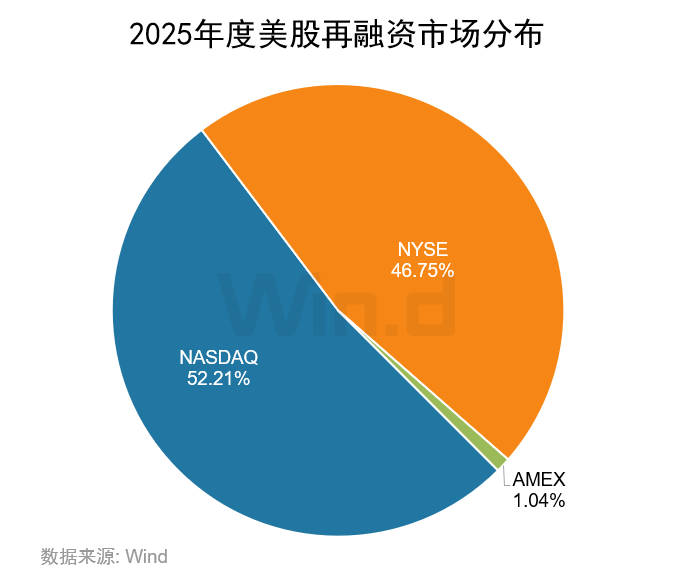

In terms of market distribution, the NASDAQ market had the highest number of refinancing incidents in 2025, with a total of 734 cases, with a refinancing scale of US$69.654 billion; the NYSE had a total of 125 refinancing cases, raising US$62.373 billion; and the AMEX exchange had only 53 refinancing projects, raising US$1,392 billion.

3.3 Distribution of major refinancing industries

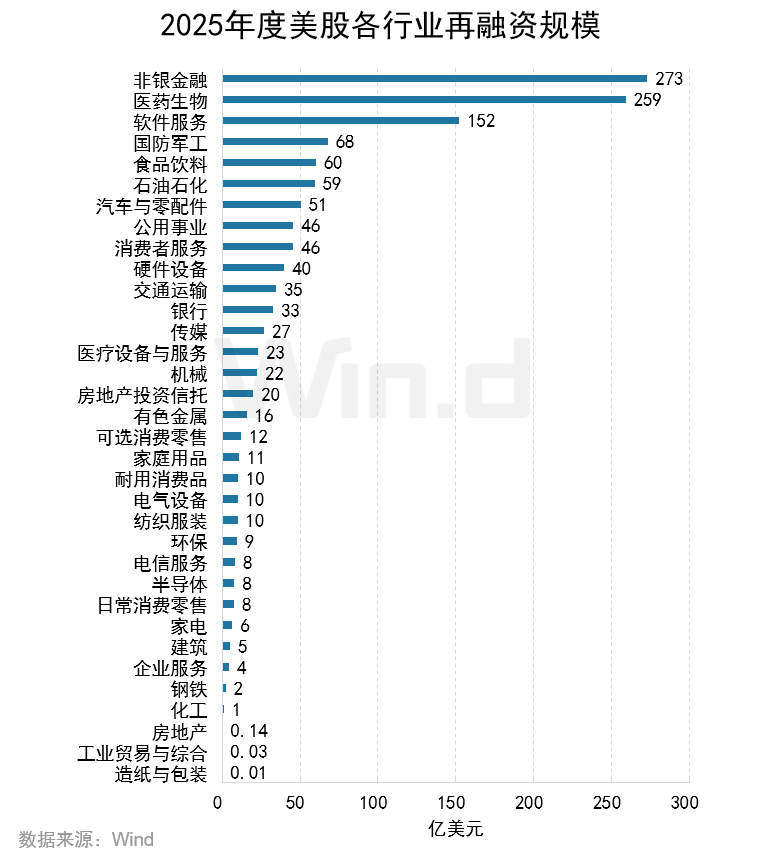

The industry with the highest amount raised in refinancing in 2025 was non-bank finance, with a refinancing scale of 27.3 billion US dollars; the pharmaceutical and biological industry ranked second with the amount raised of 25.9 billion US dollars; and the software services industry ranked third with the amount raised of 15.2 billion US dollars.

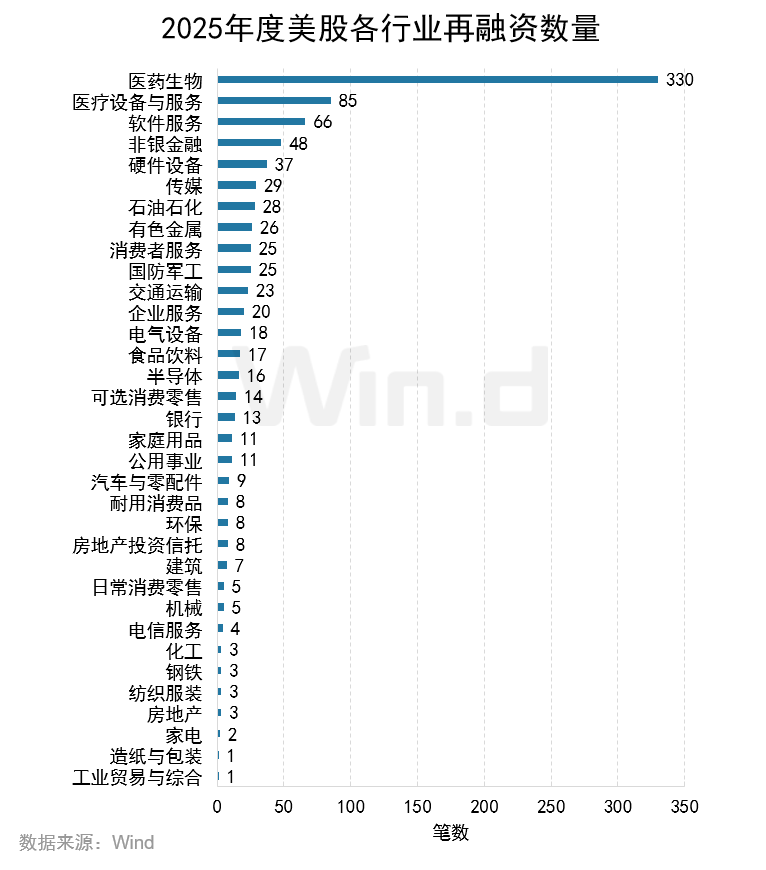

In terms of the number of refinancing, the number of refinancing in the pharmaceutical and biological industry was 330, ranking first; the medical equipment and service industry ranked second with 85; and the software service industry ranked third with 66.

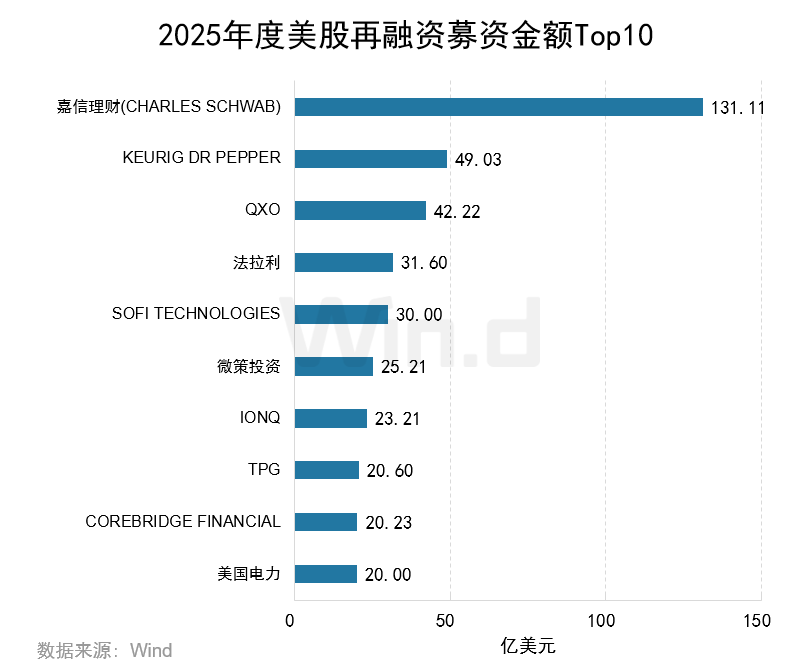

3.4 Top 10 refinancing project financing

The company with the highest amount of refinancing in 2025 was Charles Schwab (Charles Schwab), with US$13.111 billion; Keurig Dr Pepper and QXO ranked second and third with US$4.903 billion and US$4.222 billion respectively.

Agency section

4.1 IPO underwriting scale ranking

In 2025, in terms of IPO underwriting amount, Cantor FitzGerald topped the IPO underwriting list with an underwriting amount of US$6.484 billion, with 34 underwriters; Goldman Sachs ranked second with an underwriting amount of US$6.354 billion, with 36 underwriters; and Morgan Stanley ranked third with an underwriting amount of US$5.956 billion, with 35 underwriters.

4.2 Ranking of the number of IPO underwriters

In terms of the number of IPOs underwritten, Goldman Sachs topped the list with participation in 36 IPO underwriting projects; Morgan Stanley ranked second with 35 participating companies; and Cantor Fitzgerald ranked third with 34 participating companies.

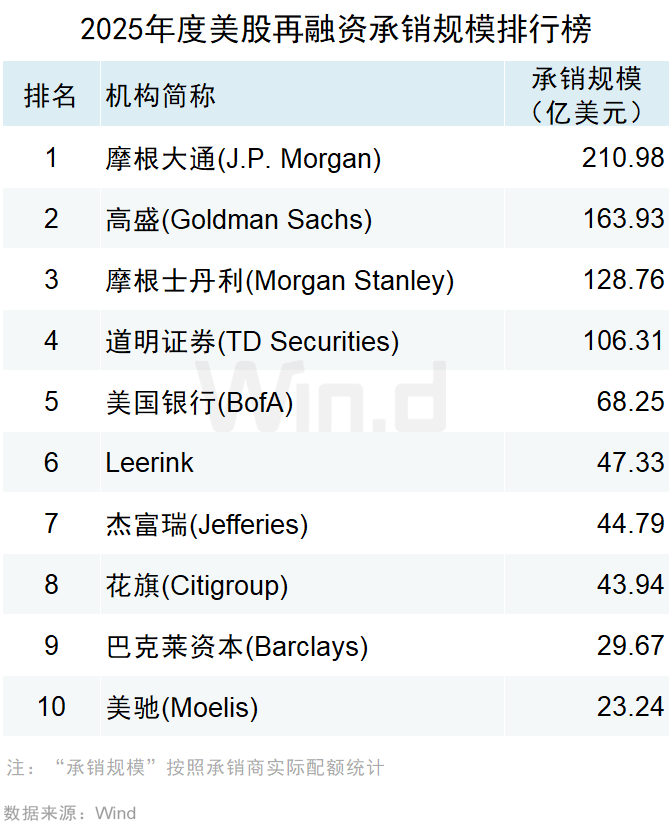

4.3 Ranking of refinancing underwriting scale

In terms of refinancing, J.P. Morgan ranked first with an underwriting scale of US$21.98 billion, with 91 underwriting cases; Goldman Sachs ranked second with an underwriting scale of US$16.393 billion, with 73 underwriting cases; and Morgan Stanley ranked third with an underwriting amount of US$12.876 billion, with 74 underwriting cases.

4.4 Ranking of the number of refinancing underwriters

H.C. Wainwright participated in 121 refinancing events in 2025, ranking first in the number of refinancing underwriters; J.P. Morgan ranked second with 91 refinancing underwriters; and Maxim (Maxim) ranked third with 81 refinancing underwriters.

Distribution agency section

5.1 List of IPO accountants

Withum ranked first in the list of accountants by participating in the IPOs of 75 listed companies; WWC ranked second, which participated in the IPO projects of 29 companies; Deloitte (Deloitte) ranked third, participating in the IPOs of 19 companies.

5.2 List of IPO lawyers

In terms of IPO lawyers, Ogier (Ogier) participated in the IPO projects of 73 companies, ranking first; Maples and Calder (Maples and Calder) participated in 49 companies, ranking second; and Loeb (Loeb) participated in 45 companies, ranking third.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal