A Look At Construction Partners (ROAD) Valuation After Recent Share Price Gains

Construction Partners (ROAD) has recently drawn attention after its shares closed at US$113.74, with returns of 1.4% over the past day and 3.4% over the past week catching investor interest.

See our latest analysis for Construction Partners.

The recent 10.4% 1 month share price return comes after a softer 90 day share price return of 9.1%. Meanwhile, the 1 year and 3 year total shareholder returns of 26.7% and over 3x suggest momentum has generally been building over time.

If Construction Partners has you thinking about where else growth and ownership can align, this is a good moment to broaden your search with fast growing stocks with high insider ownership.

With the shares at US$113.74, an intrinsic value marker that sits at a premium, and a 1 year return of 26.7%, the core question is whether ROAD is still mispriced or if the market is already pricing in future growth.

Most Popular Narrative: 11.1% Undervalued

With ROAD at US$113.74 against a narrative fair value of US$128, the current price sits below what that narrative considers reasonable.

Strong backlog coverage (80 to 85% of next 12 months' revenue) and recurring state/city DOT contracts, underpinned by secular demand for maintenance and expansion of aging U.S. road infrastructure, provide visibility and stability for future cash flows and support sustainable long-term earnings growth.

Curious what justifies that higher fair value? The narrative leans heavily on faster revenue expansion, rising margins, and a future earnings multiple that assumes meaningful profit compounding.

Result: Fair Value of $128 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on public infrastructure funding remaining stable and on Construction Partners managing labor and raw material cost pressures that could squeeze those margin assumptions.

Find out about the key risks to this Construction Partners narrative.

Another View: Rich Multiples Raise the Bar

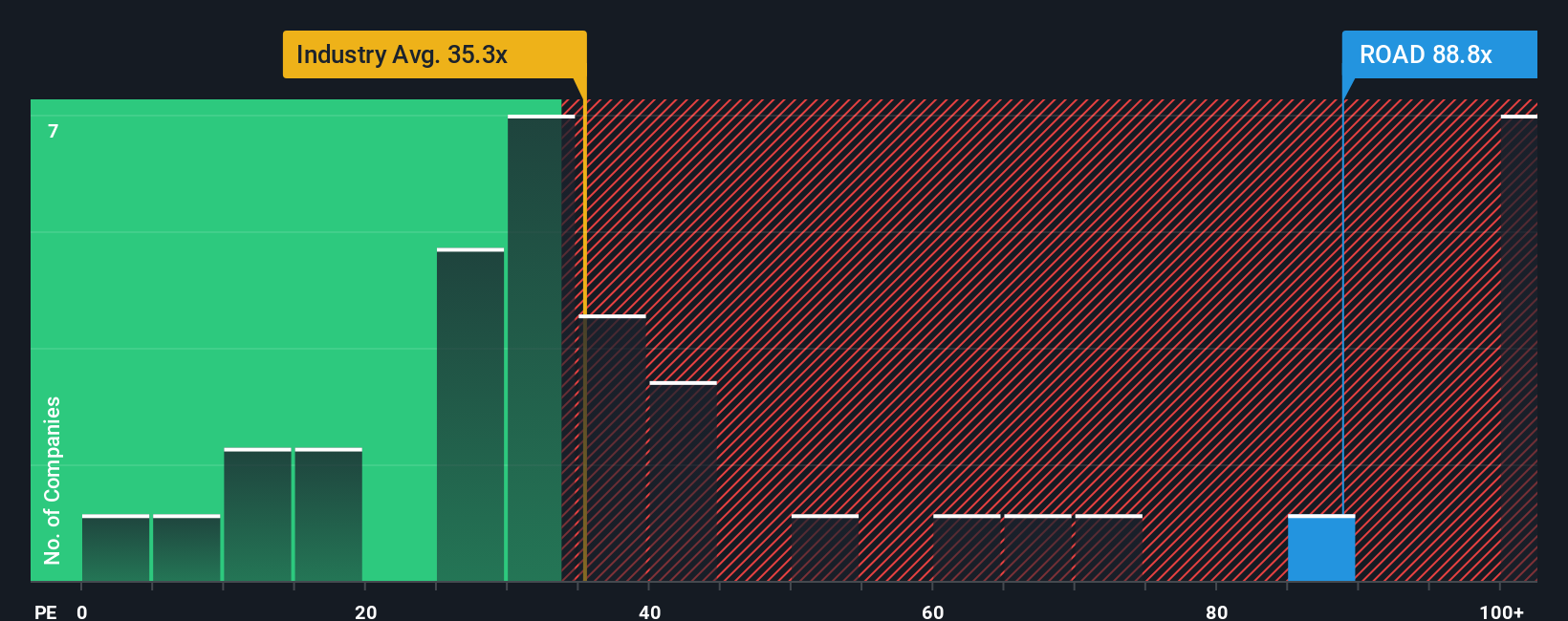

That 11.1% narrative discount to US$128 is only one side of the story. On simple P/E terms, Construction Partners looks expensive at 63.2x, compared with 30.5x for the US Construction industry, 23.7x for peers, and a fair ratio of 31.6x.

Put plainly, the current price already bakes in a lot of optimism, and the gap to both peers and the fair ratio suggests limited room for disappointment before sentiment shifts. The key question is whether you think ROAD’s growth and quality justify paying roughly double what the model and peers imply.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Construction Partners Narrative

If you see the numbers differently or want to test your own assumptions against the data, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Construction Partners research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If ROAD has sharpened your interest, do not stop here. Use the Simply Wall St screener to quickly uncover more focused ideas that match your style.

- Target potential value opportunities by scanning these 883 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Explore longer term trends in healthcare and AI by filtering through these 29 healthcare AI stocks with robust fundamentals.

- Tap into digital asset themes by checking out these 79 cryptocurrency and blockchain stocks linked to blockchain and cryptocurrency adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal