Assessing Lotus Technology (NasdaqGS:LOT) Valuation After Independent Auditor Change

Auditor change puts Lotus Technology (NasdaqGS:LOT) under a governance spotlight

Lotus Technology (NasdaqGS:LOT) has replaced KPMG Huazhen LLP with Grant Thornton Zhitong Certified Public Accountants LLP as its independent auditor, a governance development that can shape how investors assess the company’s financial reporting.

See our latest analysis for Lotus Technology.

The auditor change follows a volatile period for Lotus Technology, with the $1.50 share price sitting above recent lows, a 1 month share price return of 9.5% and a 1 year total shareholder return decline of 62.4%. This suggests short term momentum while longer term sentiment has weakened.

If this governance update has you reassessing the sector, it could be a good moment to look across other automakers using our screener for auto manufacturers.

With Lotus Technology trading at $1.50, carrying a value score of 1 and recent returns that mix short-term gains with a 62.4% 1-year decline, you have to ask: is there hidden upside here, or is the market already pricing in all the future growth?

Most Popular Narrative: 50% Undervalued

With Lotus Technology last closing at US$1.50 versus a most-followed fair value of US$3.00, the narrative is effectively pricing in a much stronger future earnings and revenue profile than the market is currently reflecting.

The recently completed funding agreements, including a US$300 million convertible note with ATW Partners and new credit facilities from Geely, enhance balance sheet flexibility and ensure sufficient capital for accelerated product development, technology innovation, and global expansion, supporting higher future revenues and improved operating margins.

Curious what kind of revenue surge, margin turnaround, and valuation multiple are being baked into that US$3.00 fair value? The narrative leans on aggressive top line expansion, a swing from deep losses to positive earnings, and a premium P/E that assumes investors will treat Lotus more like a high growth tech name rather than a traditional automaker. Want to see exactly how those moving parts stack up over the next few years?

Result: Fair Value of US$3.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the sharp drops in deliveries and revenue, along with ongoing net losses, could challenge the idea that Lotus will reach those optimistic earnings and margin targets.

Find out about the key risks to this Lotus Technology narrative.

Another Angle on Valuation

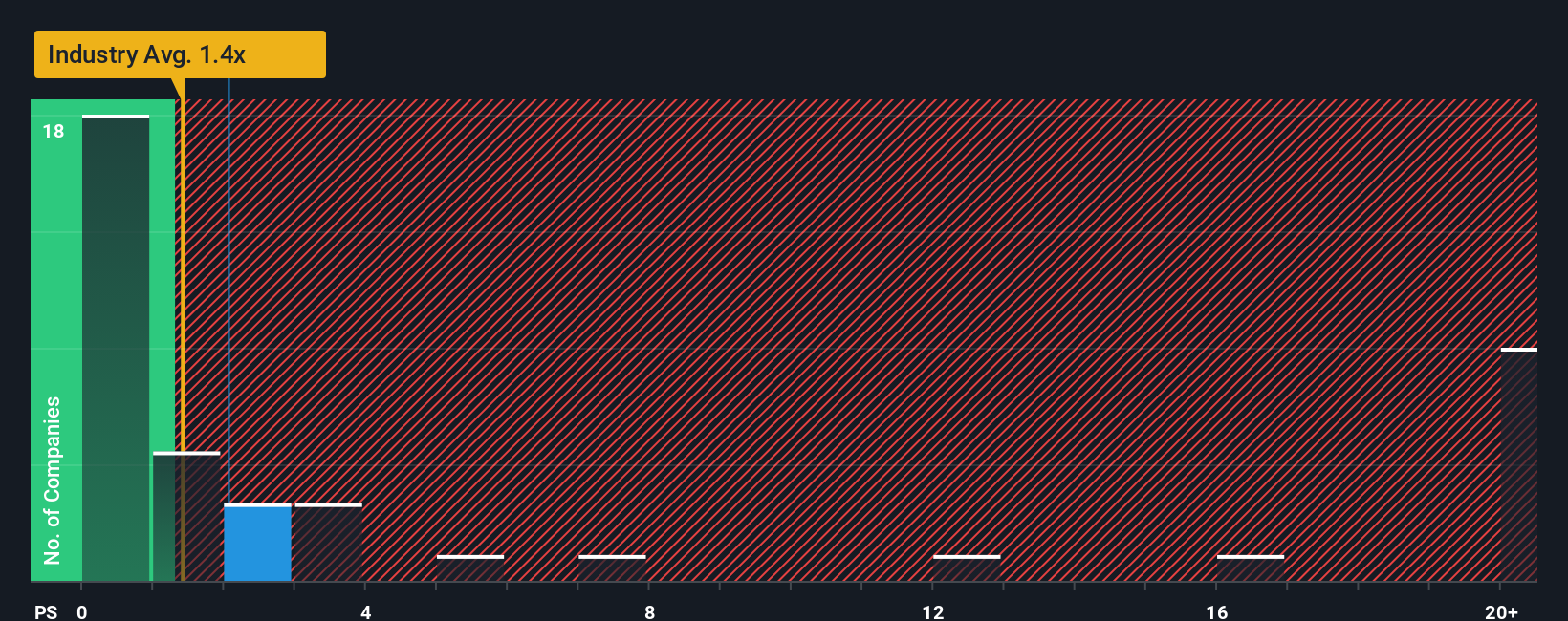

That 50% “undervalued” story leans heavily on future earnings and premium pricing. The current P/S of 1.6x looks expensive next to the US Auto industry at 0.7x and even slightly rich versus a 1.5x fair ratio. This means there is less margin for error if the growth narrative wobbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lotus Technology Narrative

If this version of the story does not fully match your view, you can stress test the assumptions, reshape the thesis, and build your own in minutes with Do it your way.

A great starting point for your Lotus Technology research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Lotus Technology has caught your attention, do not stop there. Broaden your watchlist with a few focused screens that surface very different kinds of opportunities.

- Target potential deep value by scanning these 883 undervalued stocks based on cash flows that analysts have pre filtered using discounted cash flow estimates.

- Ride powerful structural themes by checking out these 25 AI penny stocks that are building businesses around artificial intelligence.

- Strengthen your income focus by reviewing these 14 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal