A Look At Trane Technologies (TT) Valuation After CES 2026 Data Center Cooling Commentary

Trane Technologies (TT) is back in focus after comments at CES 2026 suggested Nvidia’s Rubin chip platform could cut data center cooling needs, prompting investors to reassess HVAC exposure alongside a more cautious sector outlook.

See our latest analysis for Trane Technologies.

At a share price of $390.97, Trane’s recent 7 day and 30 day share price declines of 0.19% and 2.61% sit alongside a 90 day drop of 8.30%, as investors factor in the more cautious sector commentary, the Nvidia Rubin data center comments, and the December agreement to buy Stellar Energy’s Digital business. Even so, the 1 year total shareholder return of 3.88% and very large 3 and 5 year total shareholder returns suggest momentum has cooled recently compared with its longer track record.

If the data center headlines have you rethinking industrial and HVAC exposure, it could be a useful moment to scan fast growing stocks with high insider ownership as a way to surface fresh ideas beyond the usual names.

So with Trane’s shares easing back, recent annual revenue and net income growth, and a price target that sits above the current US$390.97 level, is this a genuine opening or is the market already pricing in future growth?

Most Popular Narrative: 18.9% Undervalued

Compared with the last close at US$390.97, the most followed narrative points to a higher fair value, built on specific growth and margin assumptions.

The analysts have a consensus price target of $457.597 for Trane Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $544.0, and the most bearish reporting a price target of just $265.0.

Want to see what is driving that valuation gap? The narrative leans on steady revenue expansion, firmer margins, and a richer earnings multiple than the wider building sector. Curious how those pieces fit together in the cash flow model and price target math?

Result: Fair Value of $482.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on continued strength in data centers and healthcare, and any further weakness in the Transport segment could quickly challenge those margin and growth assumptions.

Find out about the key risks to this Trane Technologies narrative.

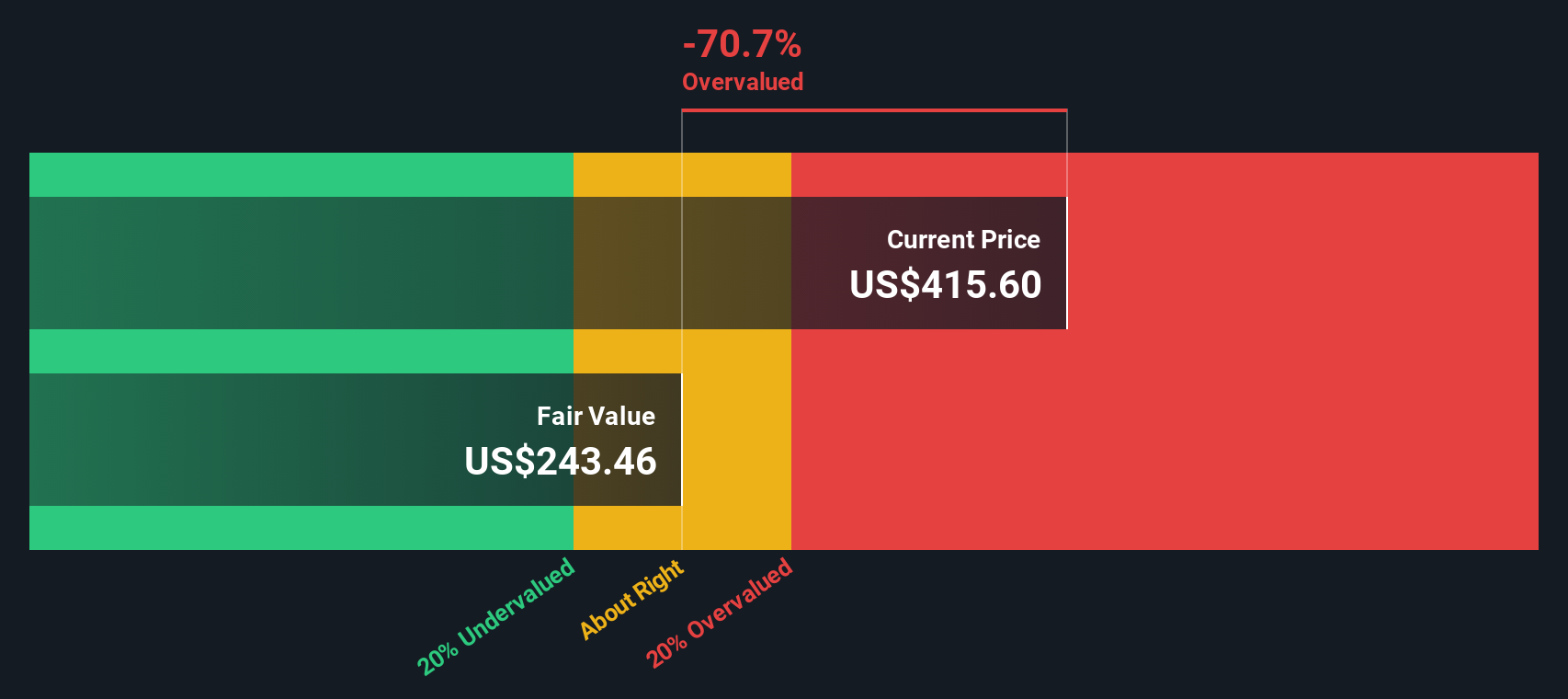

Another View: SWS DCF Says Overvalued

The most popular narrative points to an 18.9% discount to fair value, but our DCF model tells a different story. At US$390.97, Trane sits above an SWS DCF fair value estimate of US$302.58, which flags the shares as overvalued on this cash flow view. If you place more weight on cash flows than on earnings multiples, this presents a very different signal to consider.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Trane Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 883 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Trane Technologies Narrative

If you look at the numbers and come to a different conclusion, or just want to test your own thesis in detail, you can build a custom Trane view in minutes by starting with Do it your way.

A great starting point for your Trane Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Trane has you rethinking where your money works hardest, do not stop here. Use the screeners below to spot opportunities others might miss.

- Target potential mispricing by reviewing these 883 undervalued stocks based on cash flows that align with your return expectations and risk comfort.

- Back bold growth themes by scanning these 25 AI penny stocks that sit at the intersection of computing power, automation and real world demand.

- Position your portfolio for income potential by focusing on these 14 dividend stocks with yields > 3% that may complement growth focused holdings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal