Assessing Veeco Instruments (VECO) Valuation After Recent Share Price Momentum

Veeco Instruments (VECO) has been drawing attention after recent share price moves, with the stock up 1.7% over the past day and 6.7% over the past week, in contrast to a small decline over the past month.

See our latest analysis for Veeco Instruments.

At a share price of $31.07, Veeco Instruments has seen short term momentum pick up, with the recent 1 day and 7 day share price returns contrasting with a softer 30 day share price return and longer term total shareholder returns in the mid single to low double digits.

If Veeco’s move has you looking around the semiconductor space, it could be a good moment to weigh it up alongside high growth tech and AI stocks as potential next ideas on your list.

With Veeco delivering annual revenue of $681.4m and net income of $49.2m, plus a value score of 1 and a share price near a $33.50 target, is this a genuine entry point, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 7.3% Undervalued

With Veeco Instruments last closing at US$31.07 against a narrative fair value of US$33.50, the current price sits below that framework of expectations.

Veeco Instruments Future Earnings and Revenue Growth Assumptions How have these above catalysts been quantified? • Analysts are assuming Veeco Instruments's revenue will grow by 3.7% annually over the next 3 years. • Analysts assume that profit margins will shrink from 8.7% today to 8.4% in 3 years time. • Analysts expect earnings to reach $66.0 million (and earnings per share of $0.61) by about September 2028, up from $60.6 million today. • In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 39.4x on those 2028 earnings, up from 24.6x today. This future PE is greater than the current PE for the US Semiconductor industry at 33.5x. • Analysts expect the number of shares outstanding to grow by 5.96% per year for the next 3 years. • To value all of this in today's terms, we will use a discount rate of 10.7%, as per the Simply Wall St company report.

Curious what earnings path and margin profile sit behind that higher future P/E, and how discounting those cash flows supports US$33.50? The full narrative lays out the step by step financial story.

Result: Fair Value of $33.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on assumptions that could be disrupted if key customers reduce capital spending or if China related policy changes affect orders more than expected.

Find out about the key risks to this Veeco Instruments narrative.

Another View: What Our DCF Model Says

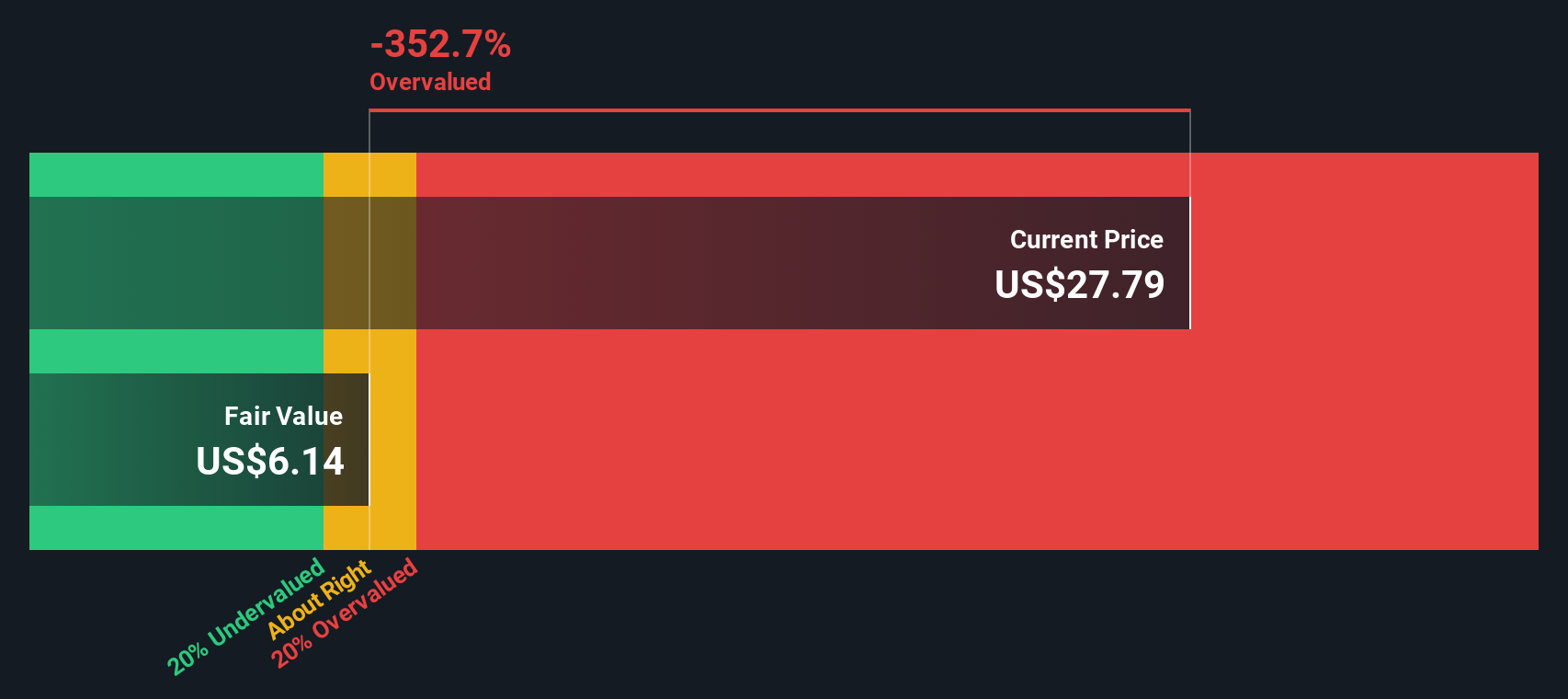

There is also a very different signal from our DCF model, which points to a fair value of about US$12.19 per share. With Veeco trading at US$31.07, that framework implies the shares are expensive rather than 7.3% undervalued. Which story do you find more convincing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Veeco Instruments for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 883 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Veeco Instruments Narrative

If you look at the numbers and come to a different conclusion, or simply want to test your own assumptions, you can quickly build a personal thesis with Do it your way.

A great starting point for your Veeco Instruments research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are weighing up Veeco today, it makes sense to widen your watchlist so you do not miss other opportunities that might suit your style.

- Target potential mispricings by scanning these 883 undervalued stocks based on cash flows that may offer more compelling entry points based on their cash flow profiles.

- Ride major tech shifts by checking out these 25 AI penny stocks that are tied to artificial intelligence themes across different parts of the market.

- Add yield focused names to your radar with these 14 dividend stocks with yields > 3% that could complement growth holdings in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal