Assessing Align Technology (ALGN) Valuation After Recent Share Price Momentum And Mixed Returns

Align Technology (ALGN) is back on investor radars after recent share price moves, with the stock showing mixed returns over the past month and past 3 months, compared with a weaker one year performance.

See our latest analysis for Align Technology.

Recent share price momentum has picked up, with a 90 day share price return of 20.32% from a last close of $160.13, although the 1 year total shareholder return of a 26.40% decline highlights that longer term performance remains weak and sentiment is still rebuilding.

If Align Technology’s moves have caught your attention, it could be a good moment to widen your watchlist and compare it with other healthcare stocks.

So with Align Technology trading at $160.13, an indicated 40.22% intrinsic discount and a modest 12.28% gap to analyst targets, is this a genuine mispricing, or are investors already accounting for future growth in the current price?

Most Popular Narrative: 10.9% Undervalued

Compared with Align Technology’s last close of $160.13, the most followed narrative points to a fair value of $179.80. It frames the current discount through a detailed multi year earnings and margin story.

Analysts are assuming Align Technology's revenue will grow by 4.6% annually over the next 3 years.

Analysts assume that profit margins will increase from 11.0% today to 14.9% in 3 years time.

Curious what kind of revenue path, margin lift, and earnings multiple are needed to back that fair value estimate? The full narrative lays out the entire playbook in numbers.

Result: Fair Value of $179.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also need to weigh the risk that weaker orthodontic case starts and a shift toward lower priced products could keep margins and earnings under pressure.

Find out about the key risks to this Align Technology narrative.

Another View: Rich Earnings Multiple Versus Fair Ratio

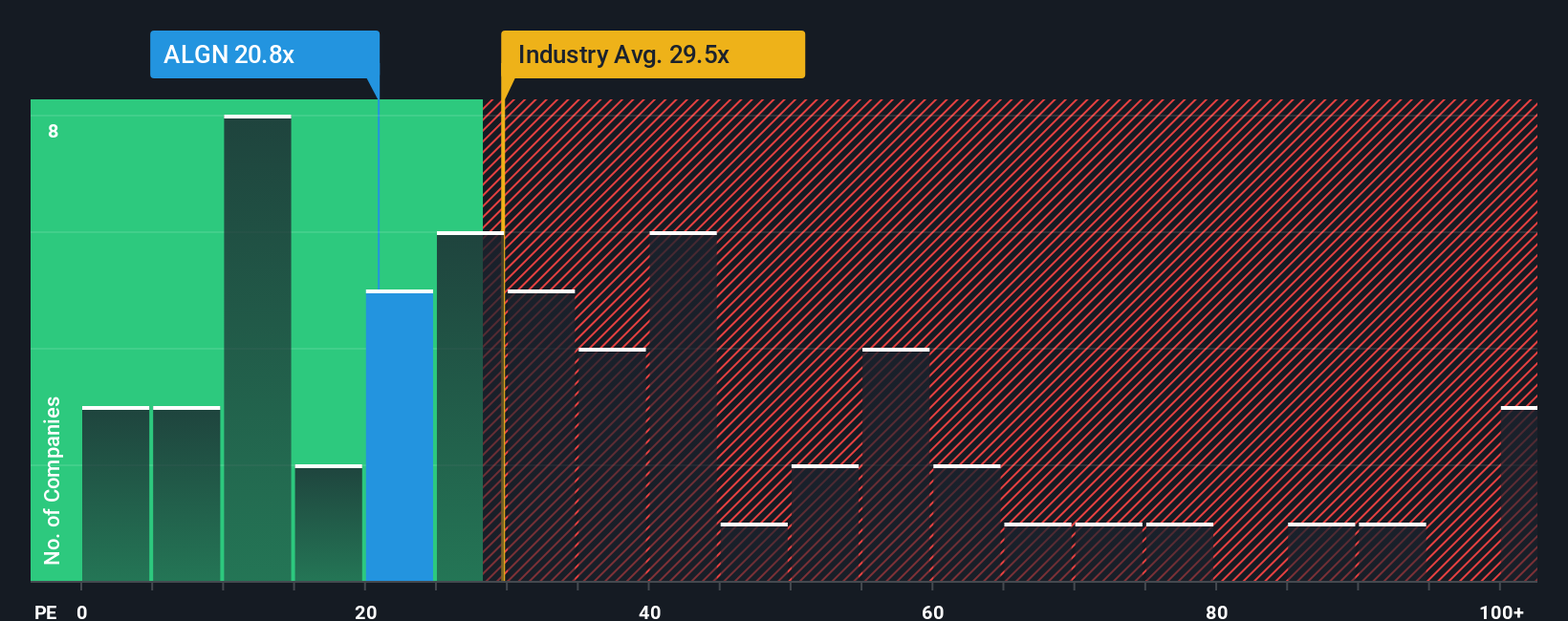

Our DCF work sees Align Technology as undervalued, yet the earnings multiple tells a different story. At a P/E of 30.4x versus the US Medical Equipment industry at 29.9x, the shares trade richer than peers and also above our fair ratio of 27.9x. This suggests there is less margin for error if expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Align Technology Narrative

If you see the story differently, or simply want to test your own assumptions against the numbers, you can build a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Align Technology.

Looking for more investment ideas?

If Align Technology is on your radar, do not stop there. Casting a wider net across sectors can help you spot opportunities you might otherwise miss.

- Spot potential early movers by checking out these 3556 penny stocks with strong financials that already pair smaller size with solid underlying financials.

- Lean into long term themes by scanning these 29 healthcare AI stocks that link medical expertise with data driven decision making.

- Strengthen your income watchlist by tracking these 14 dividend stocks with yields > 3% that offer yields above 3% alongside equity exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal