Assessing CF Industries (CF) Valuation After CEO Transition Hydrogen Push And New Share Buyback

CF Industries Holdings (CF) is back in focus after announcing a CEO handover from Tony Will to Chris Bohn, a fresh multi billion dollar hydrogen investment push, and a new US$2b share buyback authorization.

See our latest analysis for CF Industries Holdings.

The leadership handover and fresh hydrogen spending come as CF Industries’ 7 day share price return of 4.33% contrasts with a 90 day share price decline of 11.5% and a 1 year total shareholder return decline of 7.39%. This suggests short term momentum has picked up, while longer term gains remain more modest at 3.69% over three years and 95.68% over five years.

If CF’s mix of energy transition projects and buybacks has your attention, this could be a good moment to look beyond fertilizers and check out aerospace and defense stocks as another way to source ideas.

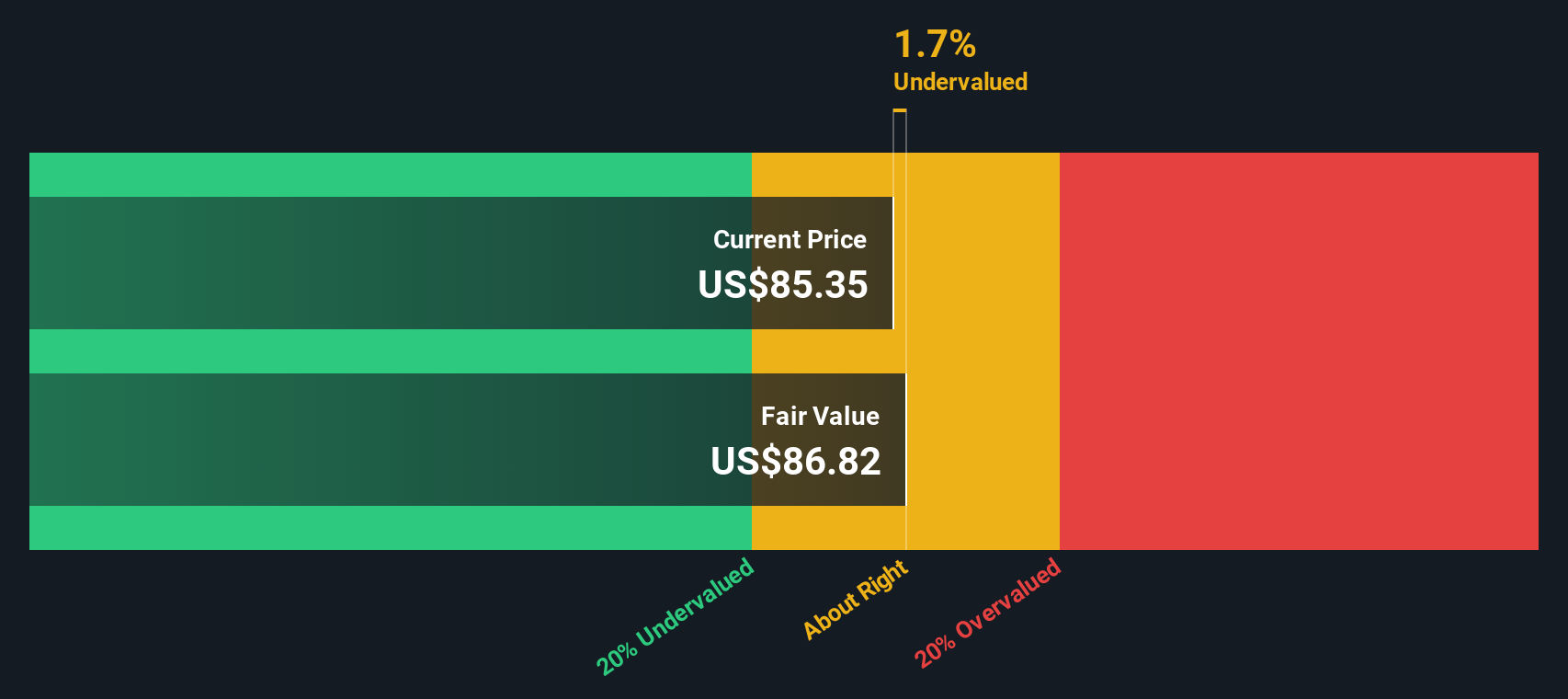

With CF trading at US$80.26 against an average analyst price target of US$91.72 and an intrinsic value estimate that sits above the current price, you have to ask: is this a genuine opportunity, or is the market already pricing in future growth?

Most Popular Narrative: 12.5% Undervalued

The widely followed narrative sets CF Industries Holdings' fair value at US$91.72 per share, compared with the last close of US$80.26. This frames a discount that hinges on specific earnings, margin, and cash flow assumptions.

While carbon capture and blue/green ammonia projects are expected to deliver incremental EBITDA from tax credits and product premiums, heavy reliance on government incentives and early-stage clean ammonia markets introduces long-term regulatory and adoption risks, threatening the stability of projected future cash flows and margins.

Curious how a modest decline in revenues, lower margins, and shrinking earnings still support that fair value? The answer lies in one crucial earnings multiple and an aggressive pace of share count reduction. Want to see how those moving pieces fit together in the full model?

Result: Fair Value of $91.72 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that hinges on tight nitrogen markets and supportive policy; if supply loosens or fertilizer and clean ammonia demand softens, those earnings and multiples could look stretched.

Find out about the key risks to this CF Industries Holdings narrative.

Another View: Our DCF Puts CF Above Fair Value

Some analysts view CF Industries as 12.5% undervalued at US$91.72. By contrast, our DCF model suggests a fair value estimate of US$70.40 compared with the current share price of US$80.26. This difference raises a simple question: are earnings and cash flow assumptions already too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CF Industries Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 883 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CF Industries Holdings Narrative

If you look at the numbers and come to a different conclusion, or prefer to test your own assumptions directly in the model, you can build a custom CF Industries view in just a few minutes by starting with Do it your way.

A great starting point for your CF Industries Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If CF is just one piece of your watchlist, now is the time to widen your search and pressure test your thinking with other focused stock ideas.

- Target potential value opportunities by scanning these 883 undervalued stocks based on cash flows that currently trade below what their cash flows may imply.

- Position yourself for possible trends in digital finance by reviewing these 79 cryptocurrency and blockchain stocks tied to blockchain and cryptocurrency themes.

- Zero in on potential income ideas by checking these 14 dividend stocks with yields > 3% that offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal