A Look At Lincoln National (LNC) Valuation After Recent Share Price Momentum

Short term move and recent performance context

With no single headline event driving trading, Lincoln National (LNC) has still drawn attention after a 2.8% one day move, along with gains over the past week, month, and past 3 months.

See our latest analysis for Lincoln National.

The recent 1 day share price return of 2.75% at a latest share price of US$46.25 sits within a stronger trend, with a 30 day share price return of 8.21%, a 90 day share price return of 15.97%, and a 1 year total shareholder return of 53.40%. This suggests momentum has been building as investors reassess growth prospects and risks for Lincoln National.

If you are weighing Lincoln National against other opportunities in financials and beyond, this can be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

With Lincoln National trading in line with analyst price targets yet showing a large modelled intrinsic discount of about 62%, the key question is simple: is the market overlooking value here, or already pricing in future growth?

Most Popular Narrative Narrative: 5.1% Overvalued

With Lincoln National last closing at US$46.25 against a narrative fair value of about US$44.00, the story frames shares as slightly ahead of that estimate while hinging heavily on earnings durability and business mix.

The analysts have a consensus price target of $41.727 for Lincoln National based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $52.0, and the most bearish reporting a price target of just $37.0.

Curious what earnings path and margin profile support that fair value and target range, and how the future P/E fits in relative to today? The key numbers might surprise you.

Result: Fair Value of $44 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that earnings story can quickly change if legacy variable annuity guarantees strain capital or if fee based businesses continue to see outflows that pressure revenue and margins.

Find out about the key risks to this Lincoln National narrative.

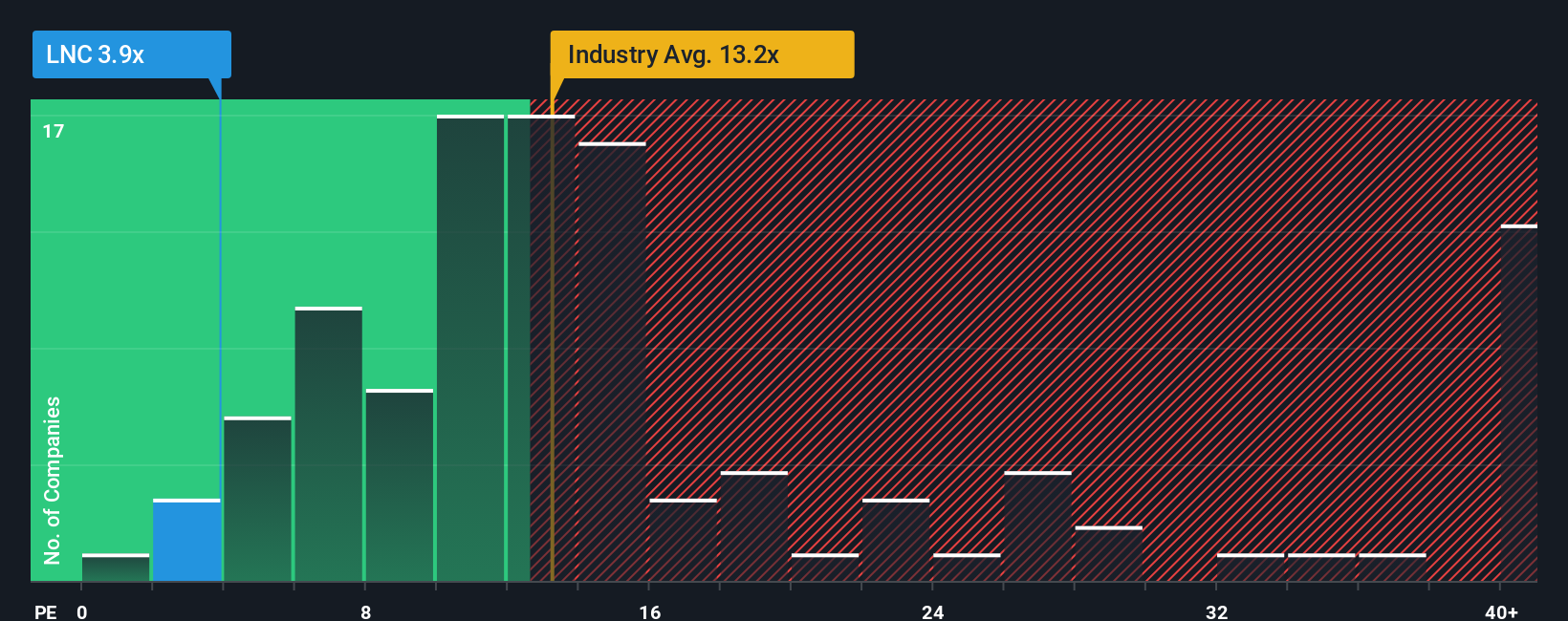

Another View: What The P/E Gap Is Telling You

Our earlier narrative fair value of about US$44 suggests Lincoln National looks slightly expensive at US$46.25. Yet on earnings, the picture flips. The shares trade on a P/E of 4.4x versus an estimated fair ratio of 12.8x, and around 12.9x for the wider US insurance group.

That kind of gap can point to either a meaningful opportunity or a clear warning that the market expects weaker earnings quality or slower growth to persist. The question for you is simple: do you think sentiment eventually moves closer to that fair ratio, or stays where it is?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lincoln National Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to test your own assumptions, you can build a custom Lincoln National view in just a few minutes with Do it your way.

A great starting point for your Lincoln National research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Lincoln National has sharpened your thinking, do not stop here. Your next strong idea might sit just one filter away in the wider market.

- Spot potential value early by scanning these 3553 penny stocks with strong financials that pair smaller share prices with stronger underlying fundamentals.

- Tap into fast moving trends across artificial intelligence with these 25 AI penny stocks that focus on companies tied to this theme.

- Zero in on price and cash flow alignment using these 882 undervalued stocks based on cash flows to find ideas that match your return and risk preferences.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal