Do W. R. Berkley’s New Legal Leadership Roles Reframe Its Risk Governance Story for Investors (WRB)?

- W. R. Berkley Corporation recently elevated Lee Iannarone to executive vice president and appointed Stephen Kennedy as senior vice president and general counsel, with both leadership changes effective January 2, 2026, following their prior legal and compliance-focused roles within the company.

- By moving two experienced in-house legal leaders into broader executive and governance positions, W. R. Berkley is reinforcing risk oversight and operational control across its insurance and reinsurance businesses.

- We’ll explore how promoting Lee Iannarone to oversee certain businesses could influence W. R. Berkley’s investment narrative and risk profile.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

W. R. Berkley Investment Narrative Recap

To own W. R. Berkley, you need to be comfortable with a commercial insurer that leans on underwriting discipline in competitive property and reinsurance markets, where pricing and loss trends can shift quickly. The elevation of Lee Iannarone and Stephen Kennedy appears incremental rather than a material change to the near term story, with the key catalyst still being how effectively Berkley maintains underwriting profitability, and the main risk remaining pressure on margins from increasing competition and potential loss cost inflation.

Among recent announcements, the October 2025 earnings release stands out, with revenue of US$3,768.24 million and net income of US$511.03 million in the third quarter, and net income of US$1,329.89 million over the first nine months. For investors, those figures frame the current earnings base that could be affected, positively or negatively, by any shift in underwriting discipline or competitive intensity in Berkley’s core commercial and reinsurance lines.

But investors should also recognize how rising competition and weakening pricing discipline could...

Read the full narrative on W. R. Berkley (it's free!)

W. R. Berkley's narrative projects $14.3 billion revenue and $2.0 billion earnings by 2028. This implies 0.0% yearly revenue growth and an earnings increase of about $0.2 billion from $1.8 billion today.

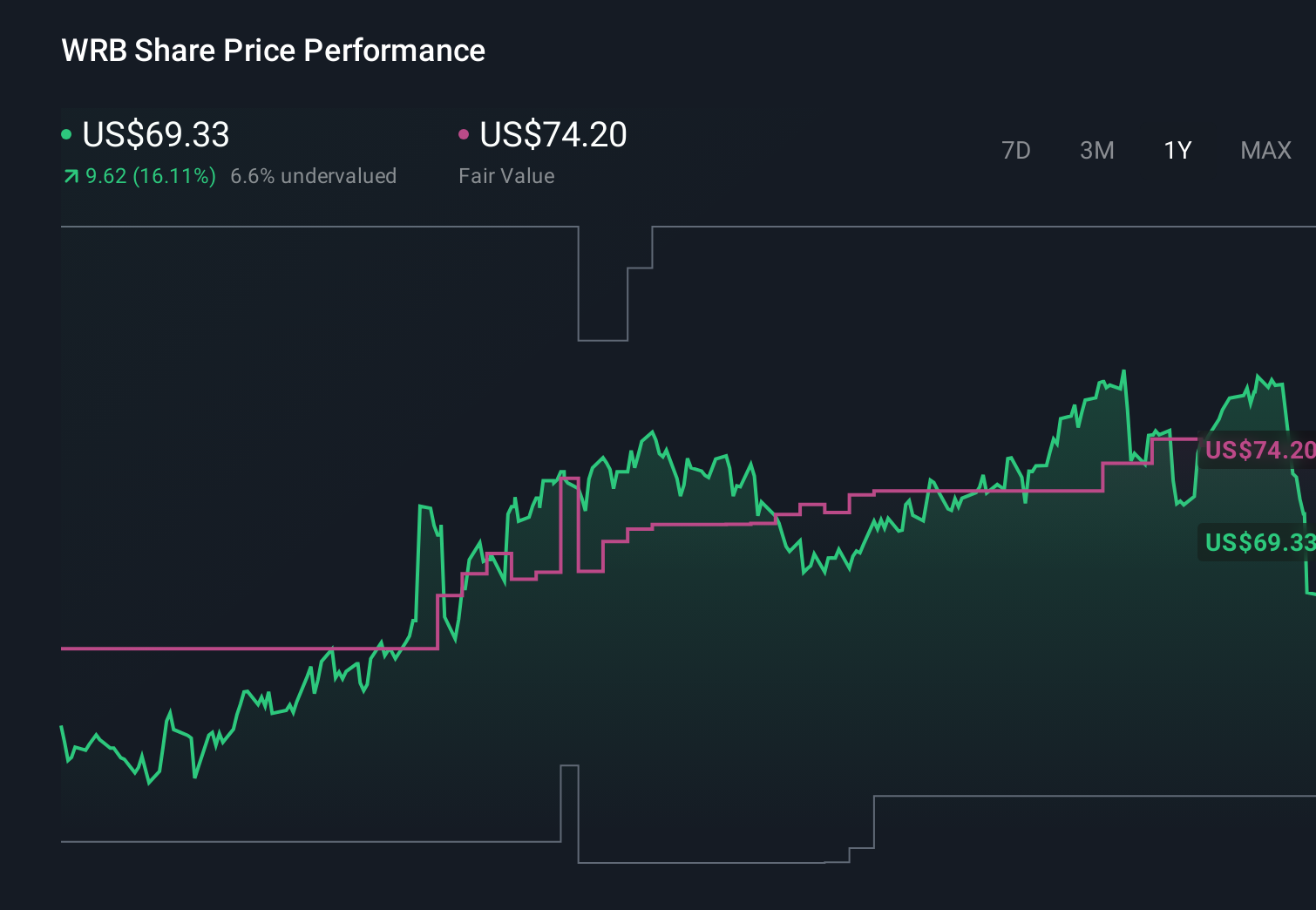

Uncover how W. R. Berkley's forecasts yield a $74.20 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community value W. R. Berkley between US$26.69 and about US$120.86, showing how far opinions can spread. Set against this wide range, the risk that intensifying property and reinsurance competition could pressure underwriting profitability gives you a concrete issue to weigh as you compare those different views.

Explore 4 other fair value estimates on W. R. Berkley - why the stock might be worth as much as 71% more than the current price!

Build Your Own W. R. Berkley Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your W. R. Berkley research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free W. R. Berkley research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate W. R. Berkley's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal