BridgeBio Pharma (BBIO) Valuation Check After Insider Selling And Upcoming Infigratinib Trial Updates

BridgeBio Pharma (BBIO) is back in the spotlight as investors weigh recent insider selling against upcoming catalysts, including a January 9 webinar on infigratinib and a J.P. Morgan Healthcare Conference presentation.

See our latest analysis for BridgeBio Pharma.

The share price closed at US$73.42 after a 6.15% one day share price decline and a softer 7 day share price return. However, a 32.77% 90 day share price return and very large 3 year total shareholder return suggest longer term momentum and changing expectations around BridgeBio Pharma’s clinical pipeline and risk profile. Upcoming infigratinib data and conference appearances are now key sentiment drivers.

If BridgeBio’s recent swings have your attention, this could be a useful moment to scan other healthcare stocks that are reacting to clinical and regulatory milestones in different ways.

With BridgeBio delivering strong multi year shareholder returns alongside continued losses and a rich late stage pipeline, the key question now is simple: are markets leaving meaningful upside on the table or already pricing in future growth?

Most Popular Narrative: 13.3% Undervalued

The most followed narrative sees BridgeBio’s fair value at about US$84.65 per share compared with the last close of US$73.42, highlighting a valuation gap to the current price.

The analysts have a consensus price target of $63.81 for BridgeBio Pharma based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $95.0, and the most bearish reporting a price target of just $41.0.

Curious what kind of revenue surge, margin shift and earnings profile need to align to support that fair value gap? The full narrative spells it out.

Result: Fair Value of $84.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on Phase 3 outcomes landing as hoped and on Attruby sustaining its current role, with trial setbacks or tougher competition capable of quickly flipping the story.

Find out about the key risks to this BridgeBio Pharma narrative.

Another Angle On Valuation

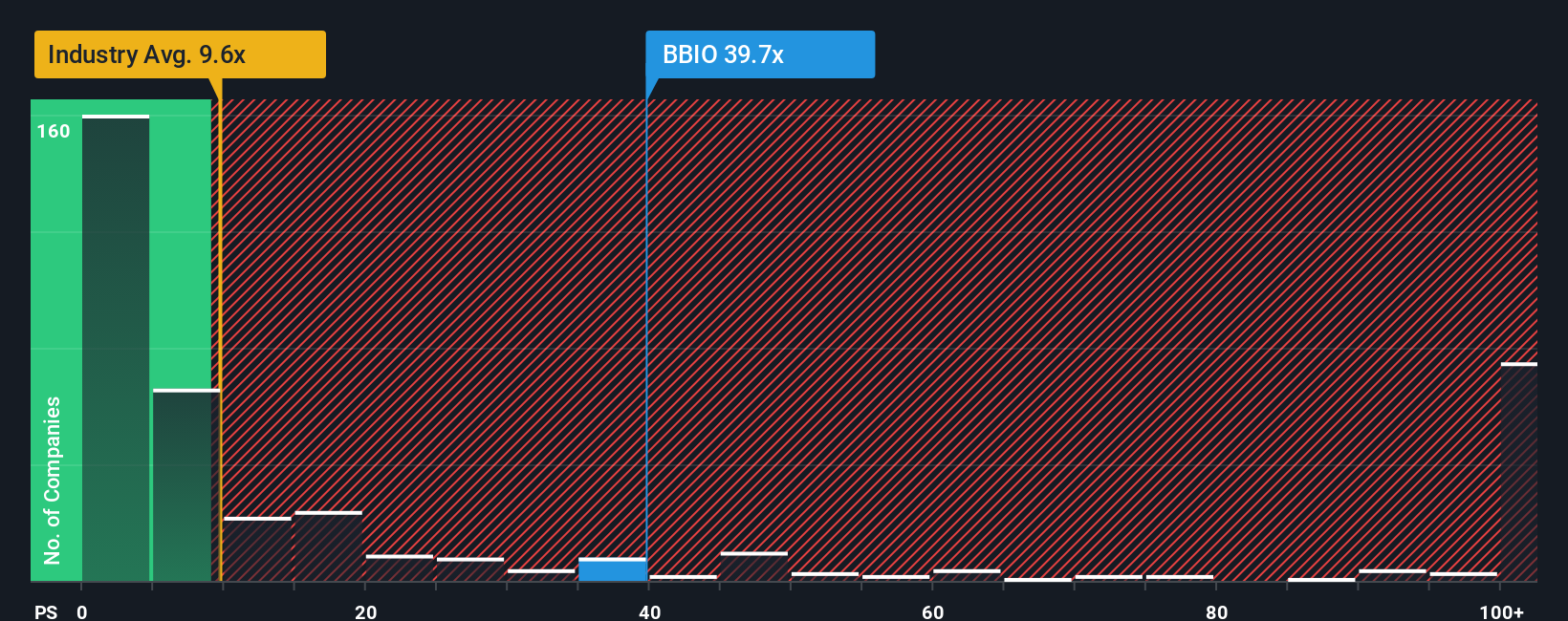

That 13.3% undervaluation story sits alongside a very different signal from simple sales based metrics. BridgeBio trades on a P/S ratio of 40x, compared with a fair ratio of 26.4x and averages of 11.7x for US biotechs and 17.9x for peers, which screens as expensive rather than cheap. For you, that raises the question of which yardstick feels more realistic if the clinical story hits bumps in the road.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BridgeBio Pharma Narrative

If you see the story differently, or prefer to weigh the data yourself, you can shape a fresh BridgeBio view in minutes: Do it your way.

A great starting point for your BridgeBio Pharma research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If BridgeBio has you thinking about what else might be out there, do not stop here; cast the net wider and let data surface fresh possibilities for you.

- Chase potential mispricings by scanning these 882 undervalued stocks based on cash flows, where market expectations and underlying cash flows can tell very different stories.

- Spot future facing themes by checking out these 25 AI penny stocks, focused on companies using artificial intelligence in ways that could reshape entire sectors.

- Strengthen your income focus by reviewing these 14 dividend stocks with yields > 3%, centered on businesses offering dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal