Is Infineon (XTRA:IFX) Using PSOC Edge To Quietly Reshape Its Edge AI Moat?

- Mouser Electronics recently began shipping Infineon Technologies’ new PSOC Edge machine learning microcontrollers, which combine Arm Cortex-M55 processors, M33 coprocessors, and Infineon’s NNLite accelerator to power responsive, low‑power edge AI devices for smart home, robotics, industrial, and HMI applications.

- An interesting angle is how PSOC Edge’s always-on AI capabilities, coupled with ModusToolbox and DEEPCRAFT Studio support, aim to simplify engineers’ adoption of voice, audio, and vision features across next-generation IoT and industrial designs.

- Next, we’ll examine how Infineon’s PSOC Edge launch and Mouser distribution support its investment narrative around edge AI and industrial growth.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Infineon Technologies Investment Narrative Recap

To own Infineon, I think you need to believe in its ability to turn semiconductor content in AI, industrial and IoT devices into durable, higher quality earnings, despite recent margin pressure and one off charges. Mouser’s rollout of PSOC Edge looks supportive of Infineon’s edge AI catalyst but does not materially alter near term risks around tariff exposure, EV demand softness, and ongoing inventory and idle cost headwinds.

The recent collaboration with NVIDIA on high voltage DC power architectures for AI data centers ties directly into Infineon’s power and sensor growth story, which sits alongside PSOC Edge as part of a broader AI and industrial opportunity set. Together, these developments frame why many investors are watching how quickly Infineon can convert product wins into better fab utilization and improved profitability over time.

But while these growth drivers are attractive, investors should also be aware of the ongoing risk that elevated inventories and idle charges could...

Read the full narrative on Infineon Technologies (it's free!)

Infineon Technologies' narrative projects €19.1 billion revenue and €3.4 billion earnings by 2028. This requires 9.4% yearly revenue growth and about a €2.3 billion earnings increase from €1.1 billion today.

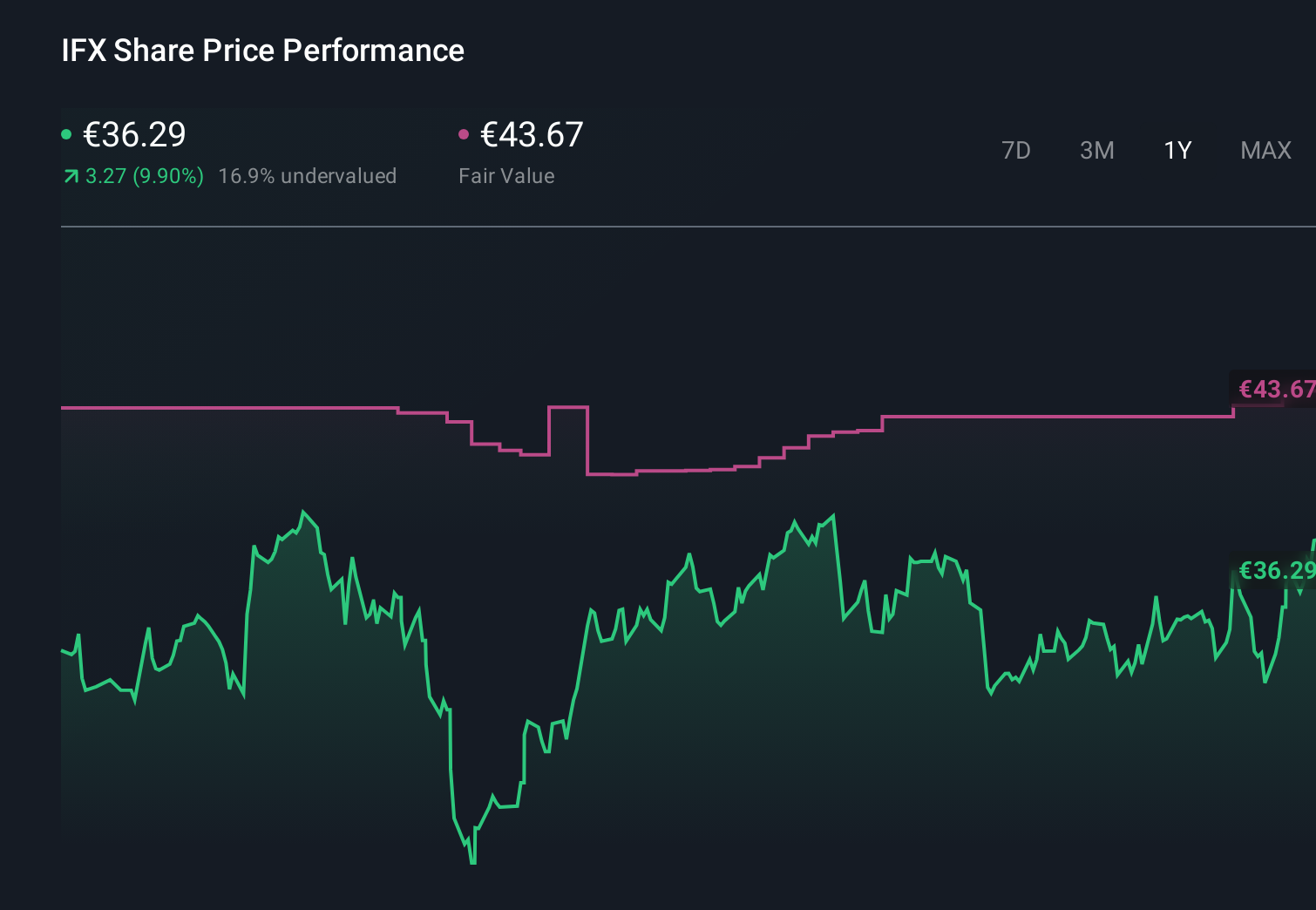

Uncover how Infineon Technologies' forecasts yield a €43.67 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community value Infineon between €32.93 and €54.46 per share, highlighting a wide range of expectations. Against this, the company’s heavy capital and R&D needs and integration efforts, alongside its AI centric product push, give you several different angles to weigh when thinking about how its performance might evolve from here.

Explore 6 other fair value estimates on Infineon Technologies - why the stock might be worth 21% less than the current price!

Build Your Own Infineon Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Infineon Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Infineon Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Infineon Technologies' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal