3 ASX Stocks Estimated To Be Up To 49.6% Below Intrinsic Value

The Australian market has been experiencing mixed sentiments, with the ASX trending downward despite a surge in materials, as investors weigh global events and resource price fluctuations. In this environment, identifying undervalued stocks becomes crucial for investors seeking opportunities; these stocks are considered to be trading below their intrinsic value and may offer potential for growth when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tasmea (ASX:TEA) | A$4.16 | A$8.25 | 49.6% |

| Smart Parking (ASX:SPZ) | A$1.22 | A$2.26 | 46.1% |

| Resolute Mining (ASX:RSG) | A$1.27 | A$2.40 | 47% |

| Lynas Rare Earths (ASX:LYC) | A$13.15 | A$23.37 | 43.7% |

| LGI (ASX:LGI) | A$4.10 | A$7.66 | 46.4% |

| Kogan.com (ASX:KGN) | A$3.80 | A$6.91 | 45% |

| Guzman y Gomez (ASX:GYG) | A$20.94 | A$38.53 | 45.6% |

| Cromwell Property Group (ASX:CMW) | A$0.46 | A$0.85 | 46.2% |

| Betmakers Technology Group (ASX:BET) | A$0.185 | A$0.34 | 45.3% |

| Airtasker (ASX:ART) | A$0.355 | A$0.63 | 43.5% |

Let's dive into some prime choices out of the screener.

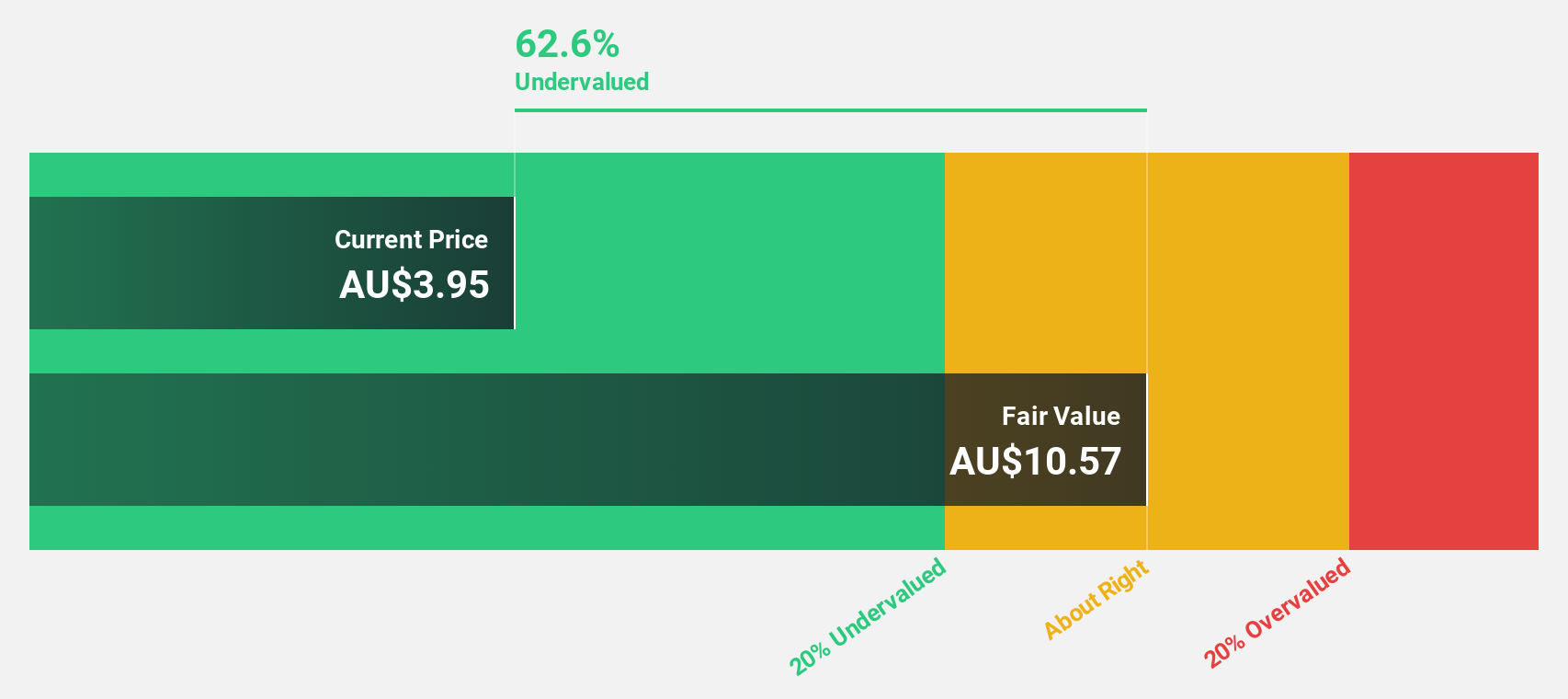

Kogan.com (ASX:KGN)

Overview: Kogan.com Ltd is an online retailer operating in Australia with a market capitalization of A$374.31 million.

Operations: The company generates revenue from its online retail operations, with A$330.44 million from Kogan.Com in Australia, A$7.30 million from Mighty Ape in Australia, A$35.56 million from Kogan.Com in New Zealand, and A$114.81 million from Mighty Ape in New Zealand.

Estimated Discount To Fair Value: 45%

Kogan.com is trading at A$3.8, significantly below its estimated fair value of A$6.91, suggesting it is highly undervalued based on discounted cash flows. While the company’s revenue growth forecast of 6.3% per year outpaces the Australian market average, its dividend yield of 3.68% lacks earnings coverage. Expected profit growth over the next three years positions Kogan.com above average market growth, with a forecasted return on equity reaching 30.2%.

- Our earnings growth report unveils the potential for significant increases in Kogan.com's future results.

- Delve into the full analysis health report here for a deeper understanding of Kogan.com.

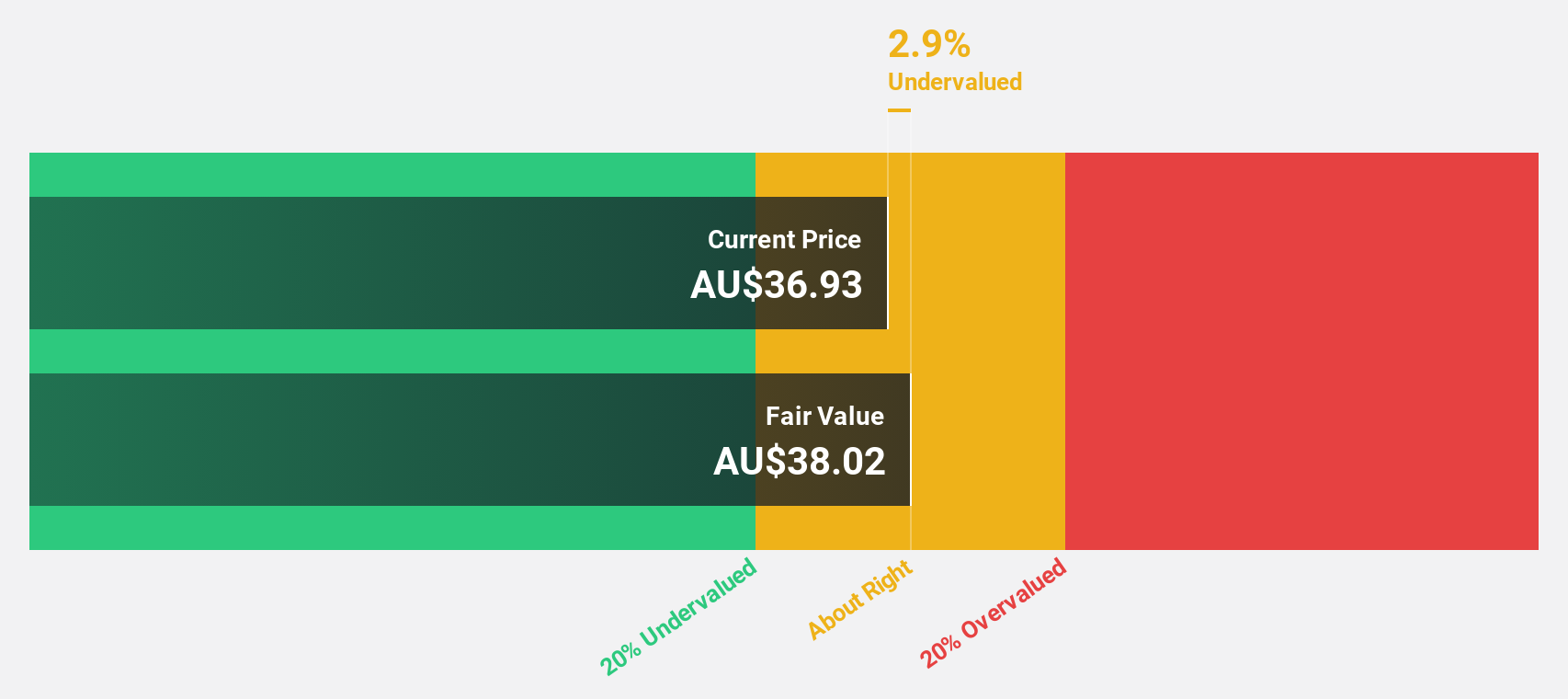

Supply Network (ASX:SNL)

Overview: Supply Network Limited supplies aftermarket parts for the commercial vehicle market in Australia and New Zealand, with a market cap of A$1.40 billion.

Operations: The company's revenue segment consists of A$349.46 million from providing aftermarket parts for the commercial vehicle market in Australia and New Zealand.

Estimated Discount To Fair Value: 14.4%

Supply Network, currently priced at A$32.05, trades below its estimated fair value of A$37.44, indicating it is undervalued based on cash flows. The company's revenue growth forecast of 11% per year surpasses the Australian market average and supports a strong return on equity expected to reach 36.6% in three years. Although earnings are projected to grow faster than the market at 14.4% annually, they remain below significant growth levels.

- According our earnings growth report, there's an indication that Supply Network might be ready to expand.

- Take a closer look at Supply Network's balance sheet health here in our report.

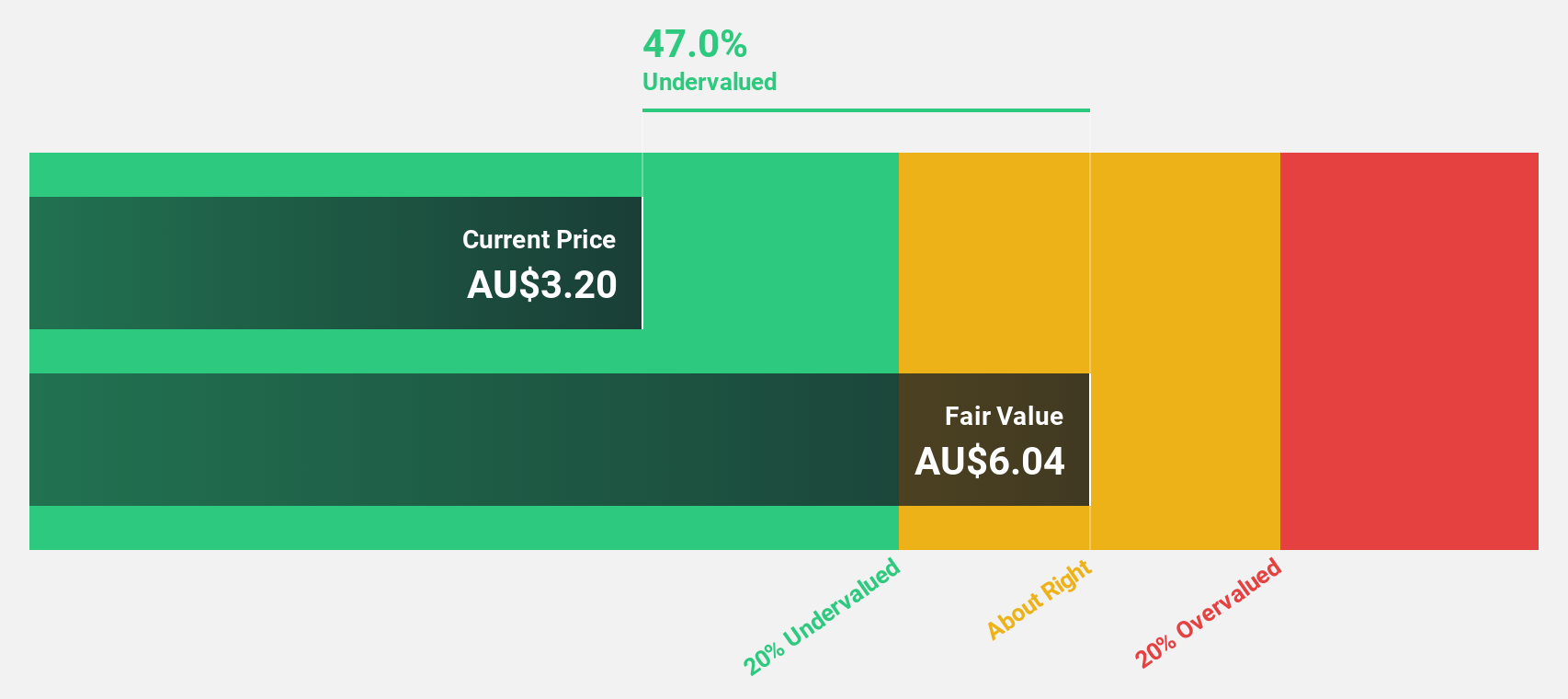

Tasmea (ASX:TEA)

Overview: Tasmea Limited offers shutdown, maintenance, emergency breakdown, and capital upgrade services in Australia, with a market cap of A$1.08 billion.

Operations: Tasmea's revenue is derived from several segments, including A$87.06 million from Water & Fluid, A$103.07 million from Civil Services, A$212.71 million from Electrical Services, and A$144.87 million from Mechanical Services.

Estimated Discount To Fair Value: 49.6%

Tasmea, trading at A$4.16, is significantly undervalued compared to its fair value estimate of A$8.25, based on cash flow analysis. The company anticipates robust revenue growth of 26.9% annually, outpacing the Australian market's average growth rate. However, earnings growth is projected at a moderate 16% per year with high debt levels posing financial challenges. Recent equity offerings totaling A$27.5 million may impact cash flows and shareholder value in the short term.

- Our expertly prepared growth report on Tasmea implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Tasmea with our detailed financial health report.

Summing It All Up

- Click through to start exploring the rest of the 34 Undervalued ASX Stocks Based On Cash Flows now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal