Australian Ethical Investment And 2 Other Undiscovered Gems In Australia

As the Australian market navigates a post-holiday slump, with key indices trending downward despite a rally in the materials sector, investors are keenly watching for opportunities amidst fluctuating commodity prices and geopolitical developments. In this dynamic environment, identifying stocks that can thrive involves looking at companies with strong fundamentals and potential to capitalize on emerging trends, such as those in ethical investment and innovative sectors.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Joyce | NA | 9.93% | 17.54% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Euroz Hartleys Group | NA | 1.82% | -25.32% | ★★★★★★ |

| Argosy Minerals | NA | -12.81% | -19.89% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Energy World | NA | -47.50% | -44.86% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

| Reef Casino Trust | 19.84% | 6.96% | 10.88% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Australian Ethical Investment (ASX:AEF)

Simply Wall St Value Rating: ★★★★★★

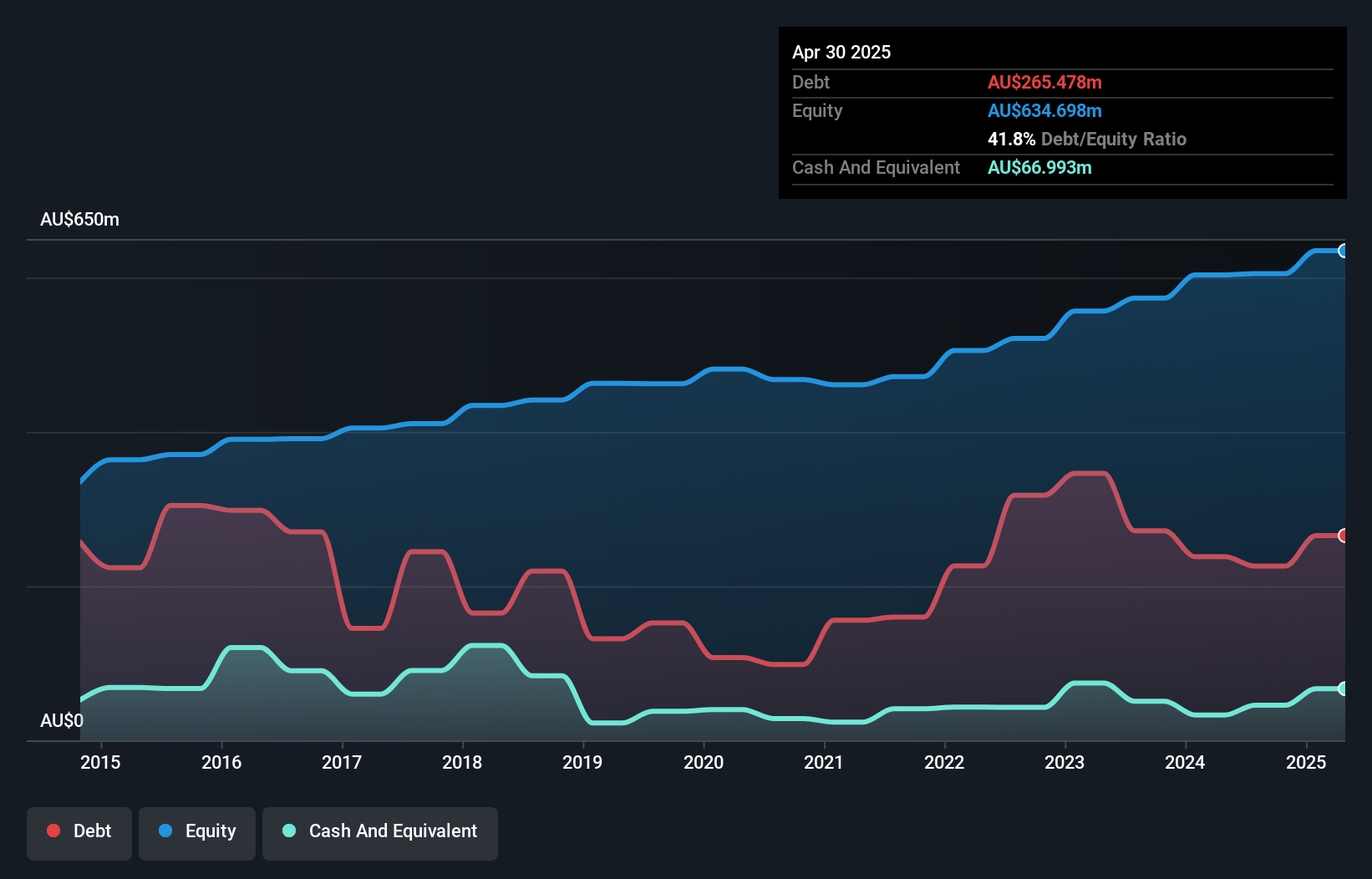

Overview: Australian Ethical Investment Ltd is a publicly owned investment manager with a market cap of A$581.84 million, focusing on ethical and sustainable investment strategies.

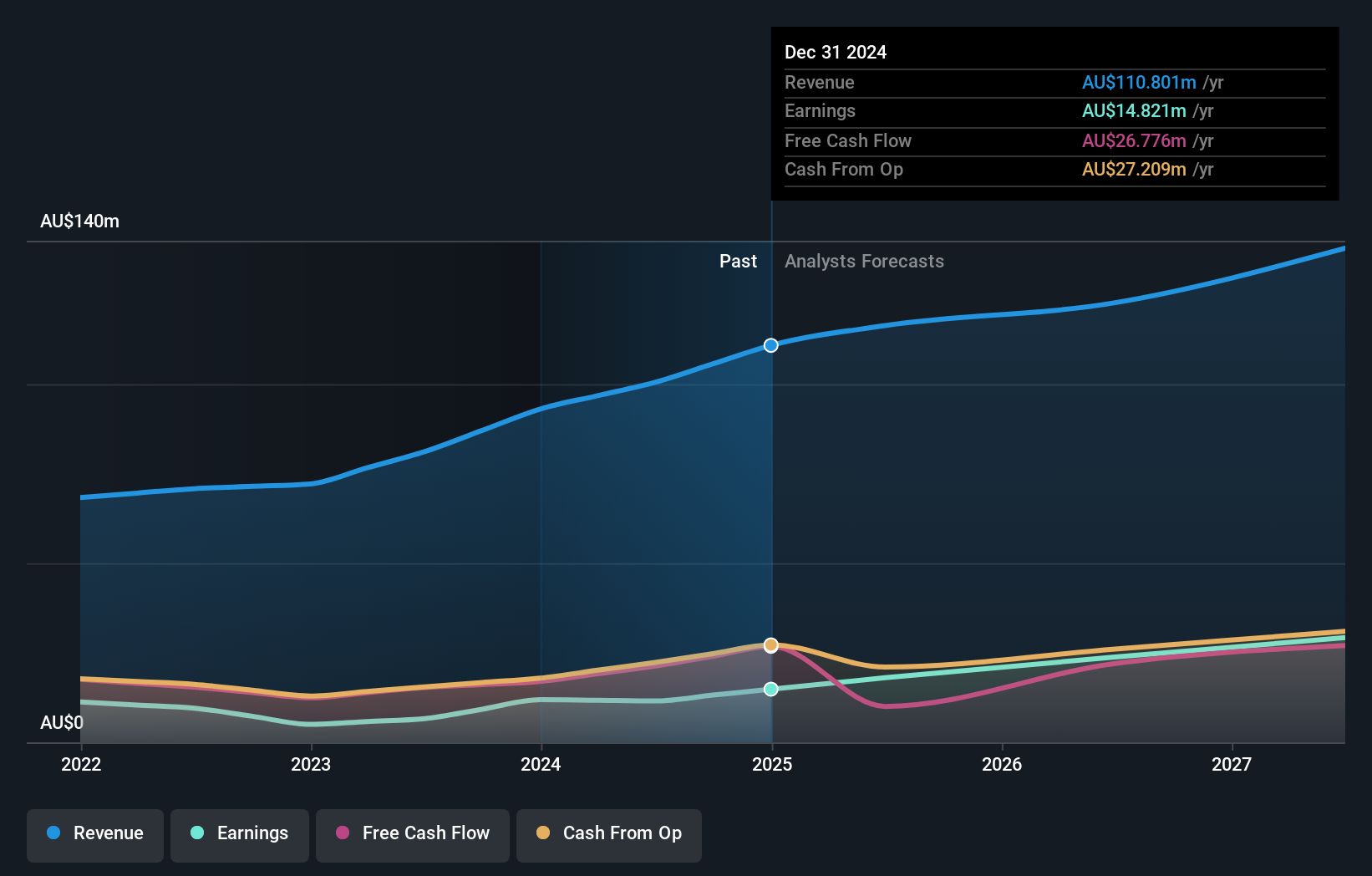

Operations: The company generates revenue primarily from its funds management segment, amounting to A$119.38 million.

Australian Ethical Investment, a smaller player in the financial sector, has been making waves with its impressive performance metrics. Over the past year, earnings surged by 75.1%, outpacing the industry average of 6%. The company is debt-free and boasts high-quality earnings, suggesting a robust financial health. With levered free cash flow reaching A$26.35 million as of June 2025 and no debt for over five years, it seems well-positioned for continued growth. Earnings are projected to grow at an annual rate of 18.34%, painting a promising picture for future prospects in ethical investing.

Advanced Innergy Holdings (ASX:AIH)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Advanced Innergy Holdings Limited specializes in the design, engineering, manufacturing, and installation of essential insulation, buoyancy, cable protection, and fire protection systems for energy and industrial sectors with a market capitalization of approximately A$405.45 million.

Operations: Advanced Innergy Holdings generates revenue through the design, engineering, manufacturing, and installation of insulation, buoyancy, cable protection, and fire protection systems. The company has a market capitalization of approximately A$405.45 million.

Advanced Innergy Holdings, a compact player in the machinery sector, has shown impressive financial strides. Their earnings skyrocketed by 163% over the past year, outpacing the industry's 13.6% growth rate. Despite a high net debt to equity ratio of 55%, their interest payments are comfortably covered by EBIT at 3.8 times. The company reported A$150 million from its recent IPO and trades at 32% below estimated fair value, suggesting potential upside for investors. With revenue climbing to £150 million and net income more than doubling to £10 million in fiscal year 2025, AIH seems poised for continued expansion with forecasted revenue growth of nearly A$388 million in 2026.

Ricegrowers (ASX:SGLLV)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ricegrowers Limited is a rice food company with operations spanning Australia, New Zealand, the Pacific Islands, Europe, the Middle East, Africa, Asia, and North America and has a market cap of A$1.13 billion.

Operations: Ricegrowers Limited generates revenue primarily from its rice food segment, with reported figures reaching A$1.82 billion. The company's financial performance is influenced by various factors, including market conditions across its diverse geographical operations.

Ricegrowers, a key player in the rice industry, is capitalizing on expanding markets like the Middle East and the U.S., driven by growing demand. The company reported A$882.34 million in sales for the half-year ending October 2025, with net income rising to A$35.95 million from A$31.25 million a year prior. Its earnings per share increased to A$0.534 from A$0.472, indicating strong operational performance despite sales dipping slightly from last year’s figures of A$910.67 million. With a satisfactory net debt to equity ratio of 23%, Ricegrowers is well-positioned for strategic acquisitions and continued growth initiatives.

Next Steps

- Delve into our full catalog of 60 ASX Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal