Assessing Sands China (SEHK:1928) Valuation After NBA China Games 2026 Promoter Role

Sands China (SEHK:1928) is back in focus after being confirmed as the Official Promoter for the NBA China Games 2026 at The Venetian Arena in Macao, featuring the Dallas Mavericks and Houston Rockets.

See our latest analysis for Sands China.

Alongside the NBA China Games announcement and the renewal of its shared services agreement with Las Vegas Sands Corp. through 2028, Sands China’s recent share price performance has been mixed. A 1-day share price return of 0.96% contrasts with a 30-day share price return decline of 6.82% and a relatively modest 1-year total shareholder return of 2.60%. This points to momentum that has softened over the medium term compared with the longer 3- and 5-year total shareholder return declines of 30.09% and 35.27% respectively.

If this kind of event driven story interests you, it could be worth widening your search to other travel and leisure names using fast growing stocks with high insider ownership.

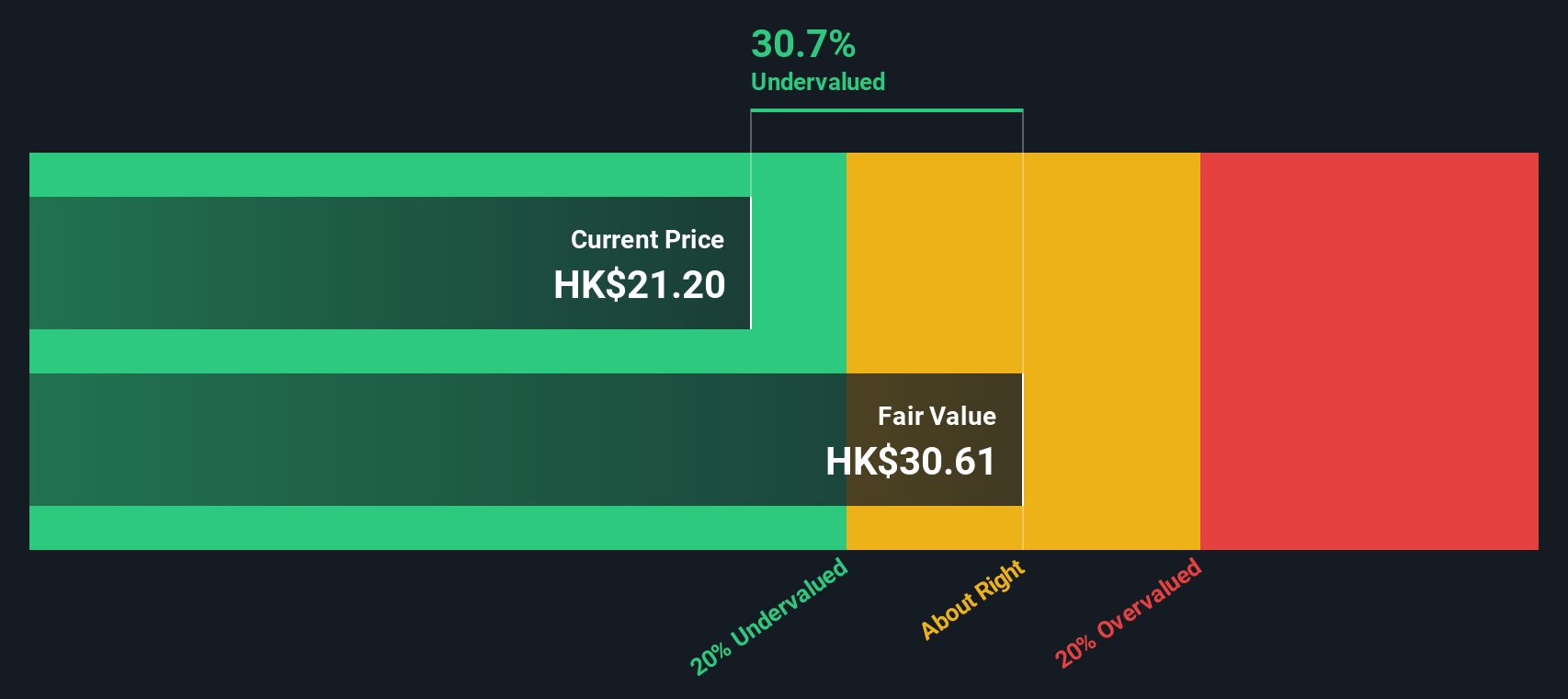

With revenue and net income both growing and the shares trading at an indicated discount to some valuation estimates, the key question now is whether Sands China is still undervalued or whether the market already reflects its future potential.

Price-to-Earnings of 22.6x: Is it justified?

Sands China is currently trading on a P/E of 22.6x, while the last close sits at HK$19.94, so the key question is whether that earnings multiple stacks up against peers and estimated fair value.

The P/E ratio compares the company’s share price with its earnings per share, so it effectively tells you how much investors are paying for each dollar of current earnings. For casino and resort operators like Sands China, P/E is a common way to gauge how the market is pricing current profitability relative to the broader Hong Kong hospitality space.

Here, the story is mixed. On one side, Sands China is described as trading at a 31.8% discount to an internal fair value estimate, with the SWS DCF model suggesting a fair value of HK$29.24 compared with the current HK$19.94. On the other side, the current P/E of 22.6x is described as expensive relative to every benchmark cited. This hints that the market is placing a rich tag on current earnings even though some models suggest the share price sits below fair value.

Compared with the Hong Kong Hospitality industry average P/E of 15.9x, Sands China’s 22.6x multiple is significantly higher. It also sits above an estimated fair P/E of 20.8x and a peer average of 14x. Across all three comparisons, the stock is described as expensive on a P/E basis, which suggests the market is assigning a premium earnings multiple that could move closer to those lower reference points if sentiment or expectations change.

Explore the SWS fair ratio for Sands China

Result: Price-to-Earnings of 22.6x (OVERVALUED)

However, you also have to weigh risks such as softer medium term share returns and any shift in Macao tourism that could challenge current earnings assumptions.

Find out about the key risks to this Sands China narrative.

Another View: DCF Points to Undervaluation

While the 22.6x P/E suggests Sands China is expensive compared with the Hong Kong Hospitality average of 15.9x and a fair ratio of 20.8x, our DCF model tells a different story. At HK$19.94, the shares sit 31.8% below an estimated fair value of HK$29.24. This raises a simple question: is the earnings multiple too rich, or is the DCF too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sands China for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 880 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sands China Narrative

If you see the numbers differently or prefer to work through the data yourself, you can shape your own view in minutes with Do it your way.

A great starting point for your Sands China research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a broader watchlist, do not stop at one stock. Use the tools available and keep fresh ideas flowing into your process.

- Target potential value opportunities by spotting companies that appear mispriced on cash flow metrics through these 880 undervalued stocks based on cash flows.

- Tap into the growth story around machine learning and automation by scanning these 25 AI penny stocks.

- Strengthen your income focus by zeroing in on companies offering higher yields using these 14 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal