US Undiscovered Gems To Explore In January 2026

As the Dow Jones Industrial Average reaches new record highs, bolstered by recent geopolitical developments, investors are increasingly turning their attention to the potential of small-cap stocks in the United States. In this environment of heightened market activity and economic optimism, identifying promising yet overlooked companies can offer unique opportunities for growth.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Security Federal | 20.04% | 5.77% | 1.59% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| NameSilo Technologies | 12.63% | 14.48% | 3.12% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Agencia Comercial Spirits (AGCC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Agencia Comercial Spirits Ltd, along with its subsidiaries, operates in the importation, procurement, distribution, and sale of bottled, raw cask, and proprietary brand whisky products across Taiwan and international markets; it has a market capitalization of $372.64 million.

Operations: Agencia Comercial Spirits generates revenue primarily from trading and wholesale of whisky products, amounting to $3.04 million. The company's market capitalization stands at $372.64 million.

Agencia Comercial Spirits (AGCC) has shown impressive earnings growth of 46.4% over the past year, outpacing the Retail Distributors industry by a significant margin. Despite its modest revenue of US$3 million, AGCC's financial health is robust with more cash than total debt and interest payments well covered by EBIT at 445 times. Recent developments include an IPO raising US$7 million and inclusion in the NASDAQ Composite Index, which may enhance visibility. Leadership changes have brought experienced figures like Li Qiang to the board, potentially bolstering strategic direction and international expansion efforts.

Climb Global Solutions (CLMB)

Simply Wall St Value Rating: ★★★★★☆

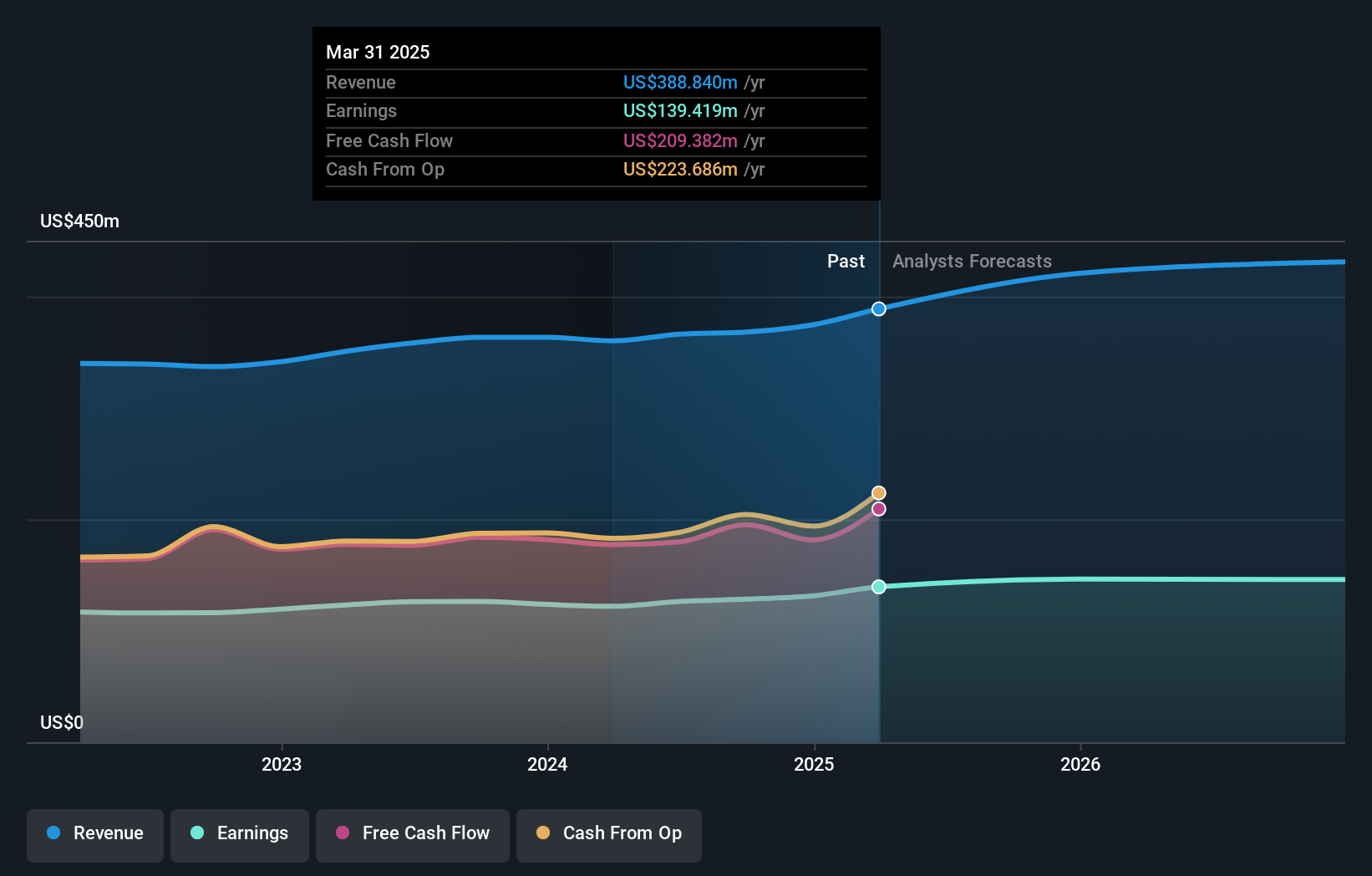

Overview: Climb Global Solutions, Inc. is a value-added IT distribution and solutions company operating in the United States, Canada, Europe, and the United Kingdom with a market cap of $492.49 million.

Operations: Climb Global Solutions generates revenue primarily from its Distribution segment, which accounts for $595 million, while the Solutions segment contributes $25.43 million.

Climb Global Solutions, a small player in the electronics space, has been making waves with its impressive earnings growth of 27.5% over the past year, outpacing the industry's 10.9%. Trading at a significant 45.3% below its estimated fair value, it seems to offer an attractive entry point for investors. The company is free cash flow positive and boasts high-quality earnings with more cash than total debt, indicating robust financial health. Despite a slight increase in debt-to-equity ratio from 0% to 0.3% over five years, Climb's interest coverage remains strong due to higher interest earned compared to paid amounts.

1st Source (SRCE)

Simply Wall St Value Rating: ★★★★★★

Overview: 1st Source Corporation, with a market cap of $1.55 billion, operates as the bank holding company for 1st Source Bank, offering commercial and consumer banking services, trust and wealth advisory services, and insurance products to individual and business clients in the United States.

Operations: With a market cap of $1.55 billion, 1st Source Corporation generates revenue primarily from its commercial banking segment, which accounts for $405.36 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

1st Source, a financial entity with $9.1 billion in total assets and $1.3 billion equity, offers an interesting investment case due to its strong fundamentals. With total deposits at $7.4 billion and loans amounting to $6.8 billion, it ensures a net interest margin of 3.6%, indicating efficient operations. The bank's allowance for bad loans stands at 0.9% of total loans, reflecting prudent risk management practices supported by primarily low-risk funding sources comprising 95% customer deposits. Despite significant insider selling recently, the company repurchased shares worth $9.8 million in the latest buyback initiative, signaling confidence in its valuation and future prospects.

- Click here and access our complete health analysis report to understand the dynamics of 1st Source.

Explore historical data to track 1st Source's performance over time in our Past section.

Key Takeaways

- Click here to access our complete index of 298 US Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal