Assessing Sezzle (SEZL) Valuation After Growth Update And New $100 Million Buyback Program

Sezzle (SEZL) shares moved higher after the company reported strong growth figures and fundamentals, alongside Board approval of an additional $100 million stock repurchase program, which signaled confidence in its business outlook.

See our latest analysis for Sezzle.

At a share price of $69.31, Sezzle’s recent 6.4% 1-day and 6.6% 7-day share price returns come after a weaker 90-day share price return of 15%, while its 1-year total shareholder return of 63.6% points to momentum that has been building over a longer period as investors reassess growth potential and risk around the buy-now-pay-later model and the new subscription push.

If Sezzle’s rebound has caught your eye, it could be a useful moment to see what else is moving and compare it with fast growing stocks with high insider ownership.

With Sezzle trading at $69.31 against a $103.50 analyst target and reporting solid revenue and net income growth, are investors still underestimating the subscription shift, or is the current price already accounting for potential future gains?

Most Popular Narrative Narrative: 36.1% Undervalued

With Sezzle last closing at $69.31 against a narrative fair value of about $108.50, the gap reflects a very specific earnings and margin story.

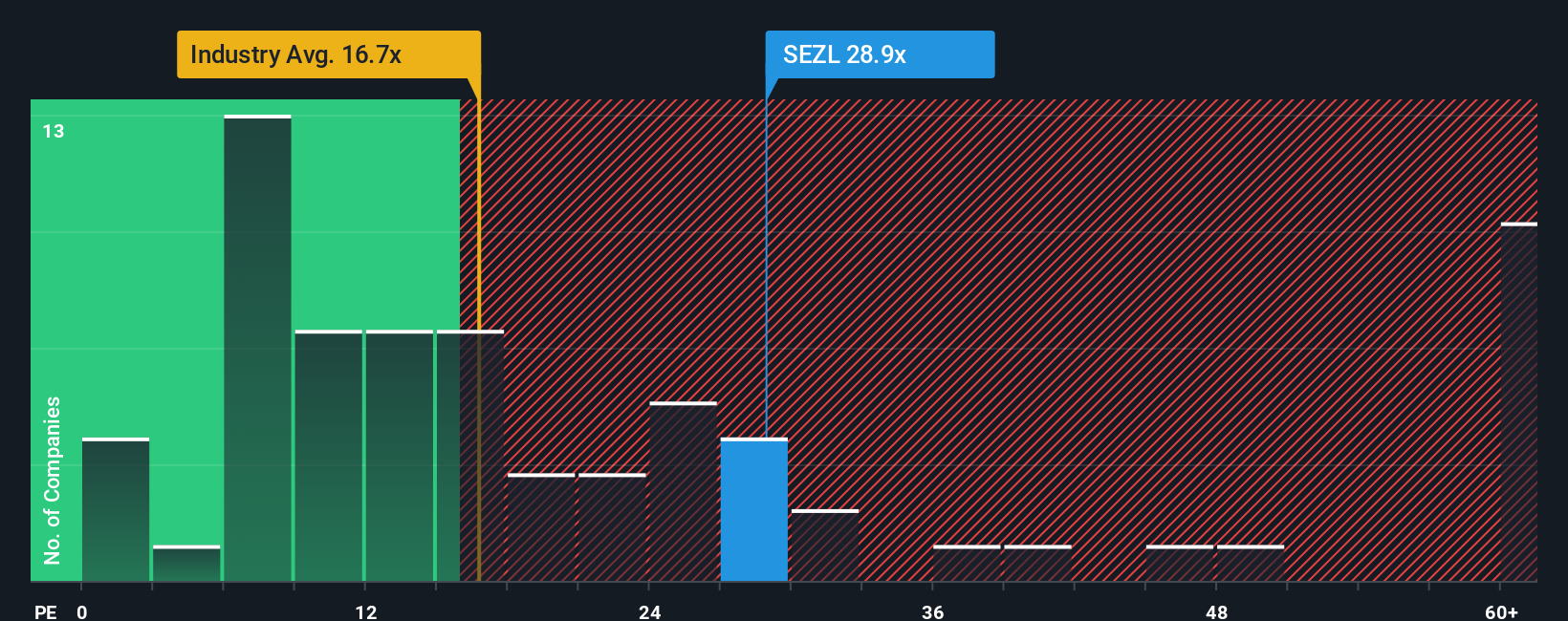

• In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.7x on those 2028 earnings, down from 30.2x today. This future PE is greater than the current PE for the US Diversified Financial industry at 16.5x.

Want to see what kind of revenue ramp and margin profile sit behind that earnings jump? The narrative leans on aggressive growth, firm profitability, and a richer future multiple. The exact mix of assumptions may surprise you.

Result: Fair Value of $108.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could change quickly if heavy marketing spend fails to earn back its cost, or if credit losses on new users start to bite harder.

Find out about the key risks to this Sezzle narrative.

Another Angle On Valuation

Those narrative fair value numbers paint Sezzle as undervalued around $108.50, but the plain P/E story is more mixed. At 20.4x earnings, Sezzle trades well above the US Diversified Financial industry at 14x, yet below a peer average of 58.2x and an estimated fair ratio of 27.4x. That gap suggests both valuation risk if investors start treating it like a typical diversified financial name, and potential upside if sentiment shifts closer to peers or that fair ratio. Which side of that trade do you think the market leans toward over time?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sezzle Narrative

If parts of this story do not quite fit how you see Sezzle, or you would rather weigh the numbers yourself, you can build a custom view in just a few minutes with Do it your way.

A great starting point for your Sezzle research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are narrowing in on Sezzle, this is the perfect moment to widen your watchlist and compare it with other focused ideas built from the same data backbone.

- Spot potential value candidates by scanning these 880 undervalued stocks based on cash flows where prices and cash flows are put side by side in a consistent framework.

- Ride major tech shifts by checking out these 25 AI penny stocks that link artificial intelligence themes with real business models and financials.

- Add high income ideas to your radar by reviewing these 14 dividend stocks with yields > 3% that filter for yields above 3% with supporting fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal