Bakkafrost (OB:BAKKA) Valuation Check After New Faroe Islands And Scotland Harvest Results

Operating results spark fresh focus on production scale

P/F Bakkafrost (OB:BAKKA) has drawn fresh attention after reporting fourth quarter and year to date 2025 harvest volumes, giving investors a clearer view of salmon output from its Faroe Islands and Scotland operations.

See our latest analysis for P/F Bakkafrost.

Despite the fresh harvest data, the share price has been relatively muted over the past year. The 90 day share price return is 8.5%, while the 1 year total shareholder return shows a 15.7% decline, suggesting longer term holders have felt more pressure than recent traders.

If this production update has you reassessing your watchlist, it could be a useful moment to broaden your search and check out fast growing stocks with high insider ownership.

With shares down 15.7% over the past year but recent returns turning positive, is Bakkafrost quietly trading at a discount to its fundamentals, or is the market already factoring in future harvest growth and efficiency gains?

Most Popular Narrative: 5.3% Undervalued

With P/F Bakkafrost last closing at NOK 509.5 against a narrative fair value of about NOK 538, the valuation debate hinges on whether projected earnings and margins justify that gap.

The company's investments to produce larger and more robust smolt in both the Faroe Islands and Scotland, along with state-of-the-art wellboat and processing capabilities, are driving operational efficiencies and reduced biological risk. This is described as setting up for improved margins and more stable future earnings. Slowing global salmon supply growth (especially after the recent surge in Norway) is expected to align with rising demand, which the narrative argues could create more favorable market pricing and volume stability for Bakkafrost, supporting both revenues and margin recovery from current trough levels.

Curious how higher earnings, wider margins and a lower future P/E are all baked into one fair value number? The narrative leans on ambitious revenue expansion, a sharp step up in profitability and a discount rate that keeps those future cash flows meaningful today. Want to see which specific growth path has to play out for that valuation to stack up?

Result: Fair Value of $538.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the bullish case still rests on salmon prices stabilising and Scottish operations improving, so any renewed price pressure or biological setbacks could quickly challenge this upbeat narrative.

Find out about the key risks to this P/F Bakkafrost narrative.

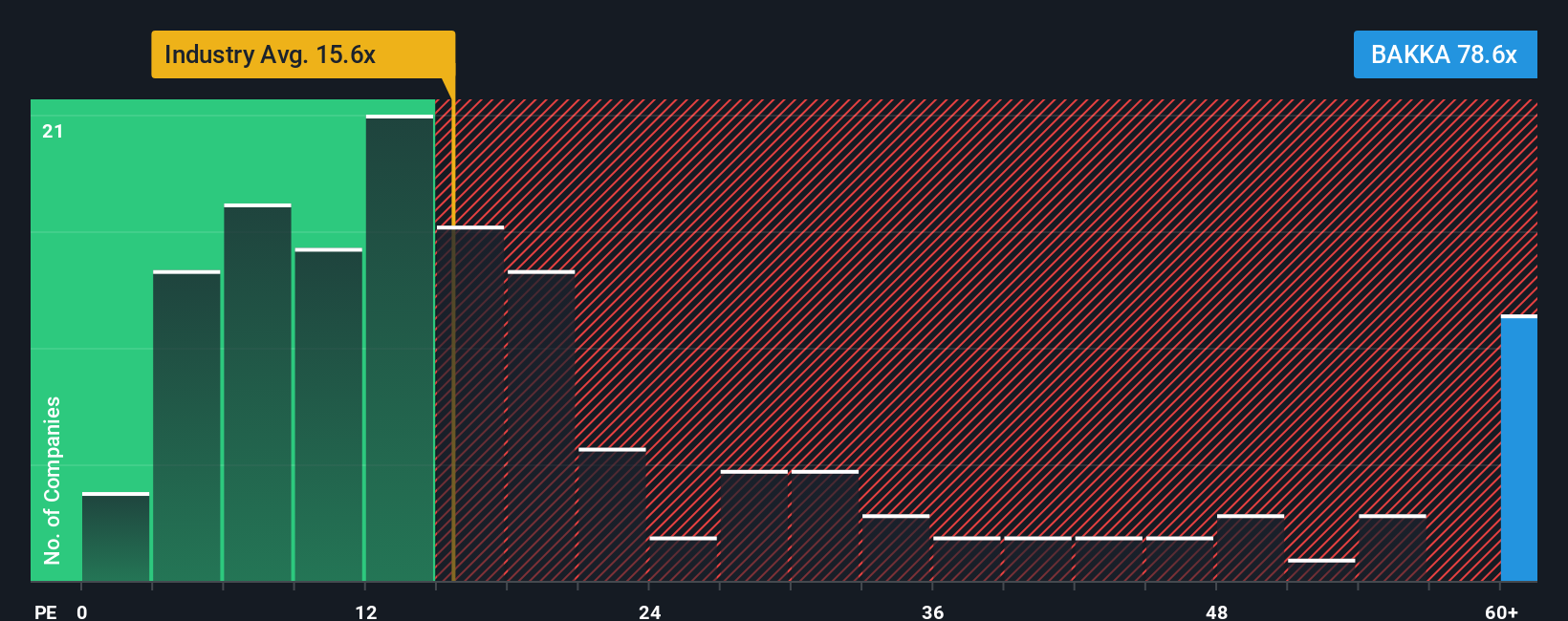

Another View: Rich multiples temper the undervaluation story

That 5.3% gap to the narrative fair value looks tempting, but the market is also pricing P/F Bakkafrost on a P/E of 46x. That is higher than both its peer group at 29.7x and the wider European food sector at 16.2x, even though the fair ratio points to 51.3x.

So while the fair value model hints at upside, the current P/E already assumes a lot is going right, with less room for earnings disappointments or weaker salmon pricing. Is this a mispriced opportunity or simply the market paying up early for the growth story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own P/F Bakkafrost Narrative

If you look at the numbers and reach a different conclusion, or simply want your own angle on Bakkafrost, you can build a fresh narrative in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding P/F Bakkafrost.

Looking for more investment ideas?

If this Bakkafrost update has sharpened your thinking, do not stop here. Use the same structured approach to hunt for other opportunities that fit your style.

- Zero in on income potential by scanning these 14 dividend stocks with yields > 3% that might align better with a yield focused approach.

- Chase growth stories by running through these 25 AI penny stocks that tie real business models to artificial intelligence themes.

- Hunt for value opportunities with these 880 undervalued stocks based on cash flows that currently trade below what their cash flows might justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal