A Look At Solaris Energy Infrastructure (SEI) Valuation As Data Center Power Role Expands And Execution Risks Loom

Recent commentary on Solaris Energy Infrastructure (SEI) has focused on its role in supplying off grid power to data centers, with roughly 900 MW of open capacity that could be contracted in the coming year.

See our latest analysis for Solaris Energy Infrastructure.

At a latest share price of $52.9, Solaris Energy Infrastructure has seen a 5.25% 1 day share price return and 14.75% 7 day share price return, alongside a 1 year total shareholder return of 83.5% and a very large 5 year total shareholder return. This suggests recent momentum is building on an already strong longer term record as investors weigh data center growth potential against execution risks around permitting, land and infrastructure buildout.

If Solaris’s data center opportunity has caught your attention, it could be a good moment to see what else is out there with fast growing stocks with high insider ownership as a starting point.

With SEI trading at $52.9 after an 83.5% 1 year total return and a very large 5 year record, investors now have to ask whether there is still value left or the market is already pricing in future growth.

Most Popular Narrative: 18.1% Undervalued

With Solaris Energy Infrastructure last closing at $52.90 against a narrative fair value of $64.60, the valuation case leans toward upside based on projected fundamentals.

The accelerating demand for grid resiliency, electrification of industries, and AI-driven data center power needs is creating strong, ongoing demand for Solaris's modular, scalable power generation solutions, positioning the company for revenue growth as delivery of new capacity ramps through 2026 and beyond.

Curious what kind of revenue, margin expansion and future earnings multiple are baked into that fair value? The narrative leans on aggressive growth, richer profitability and a premium earnings multiple that would usually be reserved for higher growth sectors.

Result: Fair Value of $64.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that growth story depends on converting uncontracted capacity into long term deals, as well as keeping project costs, supply chains and permitting delays from eroding margins.

Find out about the key risks to this Solaris Energy Infrastructure narrative.

Another View: Rich Market Multiple Raises the Bar

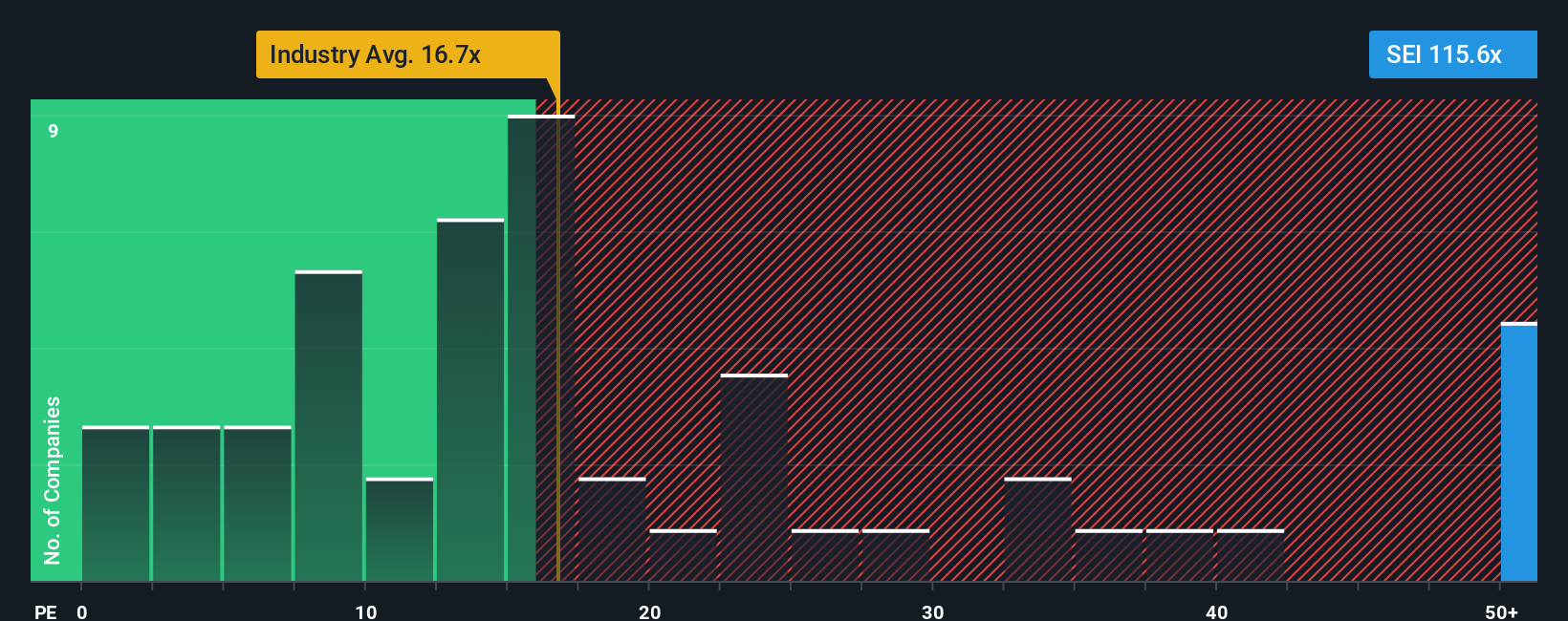

While the narrative fair value suggests SEI is 18.1% undervalued, the current P/E of 71.1x tells a tougher story. That is far above the US Energy Services average of 20.1x and a fair ratio of 26.5x, which points to meaningful valuation risk if expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Solaris Energy Infrastructure Narrative

If you look at these numbers and come to a different conclusion, or just prefer to rely on your own work, you can build a personalized Solaris view in a few minutes with Do it your way.

A great starting point for your Solaris Energy Infrastructure research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Solaris has sharpened your thinking, do not stop here. Use the screener to spot fresh ideas that match your style before others move first.

- Chase potential income opportunities by scanning these 14 dividend stocks with yields > 3% that might suit a portfolio focused on regular cash returns.

- Hunt for growth potential in future tech by sorting through these 29 quantum computing stocks that are tied to cutting edge computing themes.

- Expand your opportunity set across digital assets with these 79 cryptocurrency and blockchain stocks that give stock market exposure to cryptocurrency and blockchain trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal