Assessing CIBC (TSX:CM) Valuation After David MacNaughton Joins As Advisor To The CEO

Canadian Imperial Bank of Commerce (TSX:CM) has drawn fresh attention after appointing former Canadian ambassador to the U.S., David MacNaughton, as a strategic advisor to its Office of the CEO, with a focus on policy and stakeholder insights.

See our latest analysis for Canadian Imperial Bank of Commerce.

MacNaughton’s appointment comes as CIBC’s share price, last closing at CA$127.72, sits on top of a 13.82% 90 day share price return, alongside a 47.96% 1 year total shareholder return and 3 and 5 year total shareholder returns of 160.26% and 187.73% respectively. This suggests momentum has been building over time while the bank continues to access capital markets through recent fixed income offerings and investor outreach events.

If this kind of leadership shift has you thinking more broadly about where to put fresh capital, it could be a good time to check out solid balance sheet and fundamentals stocks screener (None results).

With the shares trading at CA$127.72, sitting on strong recent returns and an implied 30.68% discount to some intrinsic value estimates but slightly above the average analyst target, you have to ask: is there still a clear opportunity here, or is the market already baking in future growth?

Most Popular Narrative Narrative: 2.3% Overvalued

With Canadian Imperial Bank of Commerce trading at CA$127.72 against a narrative fair value of CA$124.88, the gap is small but raises questions about what is baked into those forecasts.

The analysts have a consensus price target of CA$108.409 for Canadian Imperial Bank of Commerce based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$118.0, and the most bearish reporting a price target of just CA$78.0.

Want to see what is driving that fair value estimate? The story leans heavily on steady revenue gains, firm margins and a specific earnings multiple. Curious which assumptions really move the needle here and how sensitive the valuation is to them? The full narrative lays out the equations behind that CA$124.88 figure.

Result: Fair Value of $124.88 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story can change quickly if Canadian housing weakens and mortgage delinquencies rise further, or if higher regulatory and compliance costs start to squeeze returns.

Find out about the key risks to this Canadian Imperial Bank of Commerce narrative.

Another View: Market Multiple Checks

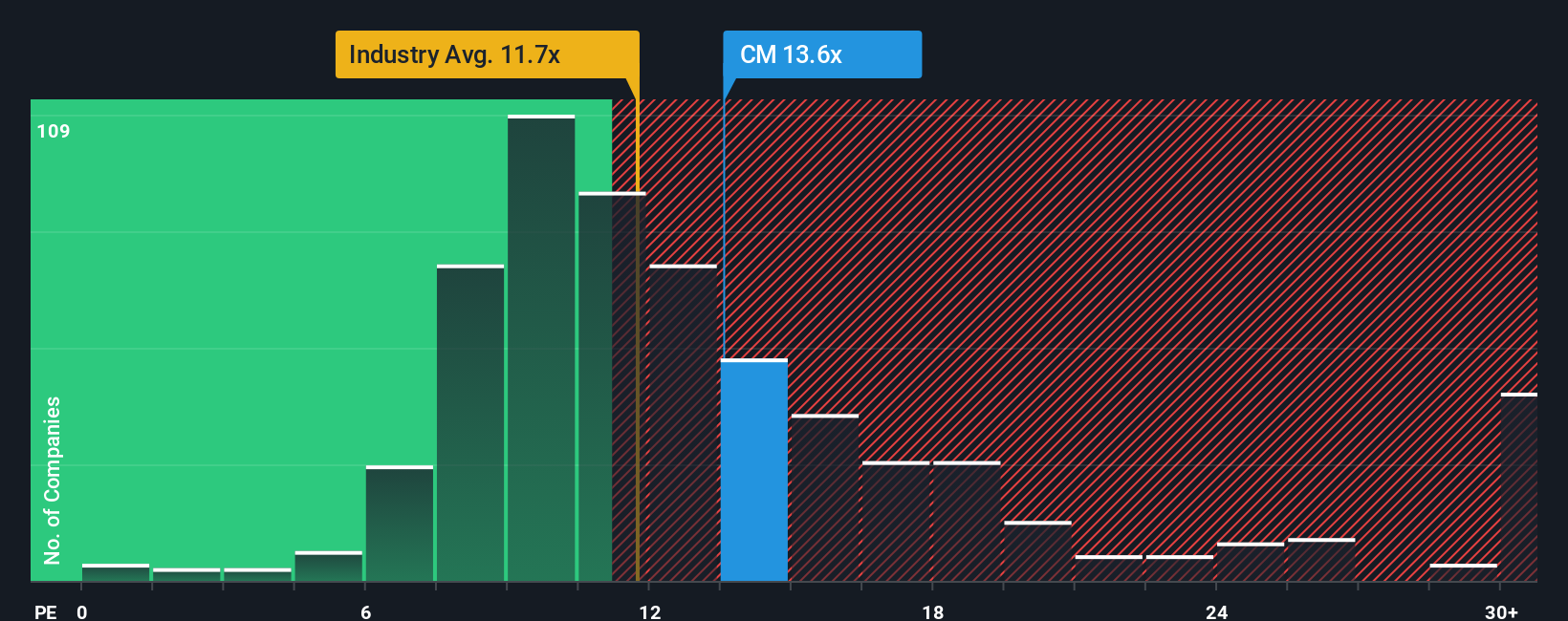

If you look at CIBC through its P/E, the picture is less clear cut. The shares trade on 14.7x earnings, which is below a peer average of 15.6x, roughly in line with a fair ratio of 14.7x, yet above the wider North American banks group at 12x. That mix of signals leaves a simple question for you: is this a reasonable premium for the story so far, or does it cap your room for error?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Canadian Imperial Bank of Commerce Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a fresh, data driven story in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Canadian Imperial Bank of Commerce.

Ready for more investment ideas beyond CIBC?

If you are serious about putting fresh capital to work, do not stop at one bank. Use the Simply Wall St screener to hunt for your next idea.

- Spot potential recovery stories early by scanning these 3557 penny stocks with strong financials that already show solid fundamentals rather than just hype.

- Target future facing themes by checking out these 25 AI penny stocks that sit at the intersection of artificial intelligence and real revenue.

- Hunt for mispriced opportunities with these 880 undervalued stocks based on cash flows that screen for businesses trading below what their cash flows might justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal