Assessing State Street (STT) Valuation After Recent Share Price Momentum

Assessing State Street after recent share performance

State Street (STT) has drawn fresh attention after a recent stretch of positive share performance, with the stock showing gains over the past week, month, past 3 months and year. This has prompted investors to reassess its valuation and fundamentals.

See our latest analysis for State Street.

At a share price of $133.01, State Street’s recent 30 day share price return of 7.60% and 90 day share price return of 13.99% sit alongside a 1 year total shareholder return of 40.19%. This combination suggests momentum has been building over time as investors reassess both growth potential and risk.

If State Street’s recent climb has caught your eye, it can be helpful to see what else is moving in related areas, including solid balance sheet and fundamentals stocks screener (None results).

With the shares at $133.01 and an indicated intrinsic discount of about 14%, plus only a small gap to the average analyst target, the key question now is whether State Street is still undervalued or if the market is already pricing in potential future growth.

Most Popular Narrative Narrative: 2% Overvalued

With State Street closing at $133.01 against a narrative fair value of about $130.14, the story centers on modest upside already reflected in the price.

Bullish analysts are broadly constructive on State Street, pointing to a blend of equity market leverage, operating efficiency opportunities, and a refreshed leadership backdrop as catalysts that could unlock additional shareholder value beyond current expectations.

Across recent notes, target price increases and new positive ratings signal growing confidence that the company can translate higher market levels and disciplined cost management into better through cycle earnings power, even as the rate environment becomes more challenging.

Curious what sits behind that confidence shift? The narrative leans on measured revenue growth, wider margins, and a future earnings multiple that still assumes some discipline.

Result: Fair Value of $130 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upbeat story can quickly be tested if fee pressure in ETFs bites harder than expected, or if faster blockchain adoption weakens demand for traditional custody services.

Find out about the key risks to this State Street narrative.

Another View: Earnings Multiple Tells a Different Story

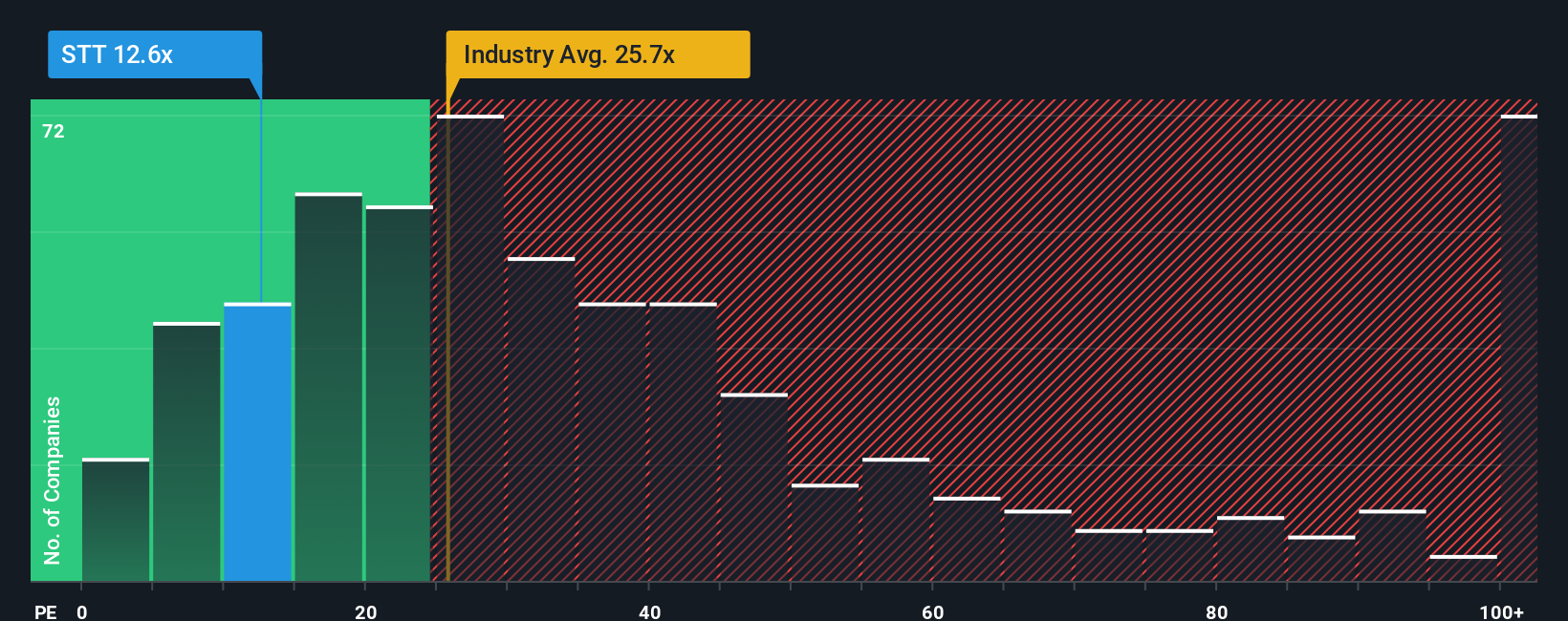

While the narrative fair value comes out slightly below the current US$133.01 price, the earnings multiple points a different way. State Street trades on a P/E of 13.5x, compared with 18.9x for peers and 25.6x for the wider US Capital Markets group, and a fair ratio of 16.8x. If the market moved closer to that fair ratio, the gap could matter for anyone weighing upside against the risk that sentiment cools. Which version of fair value do you think matters more for your own thesis?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own State Street Narrative

If you see the numbers differently or prefer to stress test the assumptions yourself, you can build a custom State Street story in minutes: Do it your way.

A great starting point for your State Street research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If State Street is on your watchlist, do not stop there. Use the screener to spot other opportunities that might fit your goals just as well.

- Target potential value opportunities by checking out these 880 undervalued stocks based on cash flows that line up with your expectations on cash flow strength.

- Zero in on income potential by scanning these 14 dividend stocks with yields > 3% that could complement a long term, yield focused portfolio.

- Lean into transformative themes by reviewing these 25 AI penny stocks that are tied to real business models rather than hype alone.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal