How NIVEA’s New Natural Crème Line At Beiersdorf (XTRA:BEI) Has Changed Its Investment Story

- Beiersdorf has introduced NIVEA Crème Natural Touch in Germany, a new vegan line extension using 99% natural-origin ingredients and a 99.9% biodegradable formula, following six years of research and consumer testing.

- This reformulation of the company’s flagship product underlines how Beiersdorf is tying its core NIVEA brand directly to its Net Zero 2045 sustainability ambition.

- We’ll now examine how anchoring NIVEA Crème to a more natural, biodegradable formula could influence Beiersdorf’s broader investment narrative.

This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

Beiersdorf Investment Narrative Recap

To own Beiersdorf, you need to believe that NIVEA’s brand strength and science-based skincare innovation can compound steadily, even as competition and retailer pressure weigh on volumes and pricing. The NIVEA Crème Natural Touch launch supports the innovation and sustainability story, but its near term financial impact and effect on the key catalyst of margin improvement, as well as on the biggest risks around retailer relations and cost inflation, looks limited for now.

The launch of NIVEA Crème Natural Touch sits beside Beiersdorf’s multi-year partnership with Rubedo Life Sciences, which targets cellular aging in skincare. Together, they point to a broader push into science-backed and potentially higher priced skincare offerings that tie into the existing catalyst of premiumization across NIVEA and Eucerin, even as the group contends with cost pressures and market competition in mass channels.

Yet investors should not ignore the risk that retailer pressure in Europe could still disrupt shelf space and pricing power if...

Read the full narrative on Beiersdorf (it's free!)

Beiersdorf's narrative projects €11.0 billion revenue and €1.2 billion earnings by 2028. This requires 3.8% yearly revenue growth and about a €318 million earnings increase from €882.0 million today.

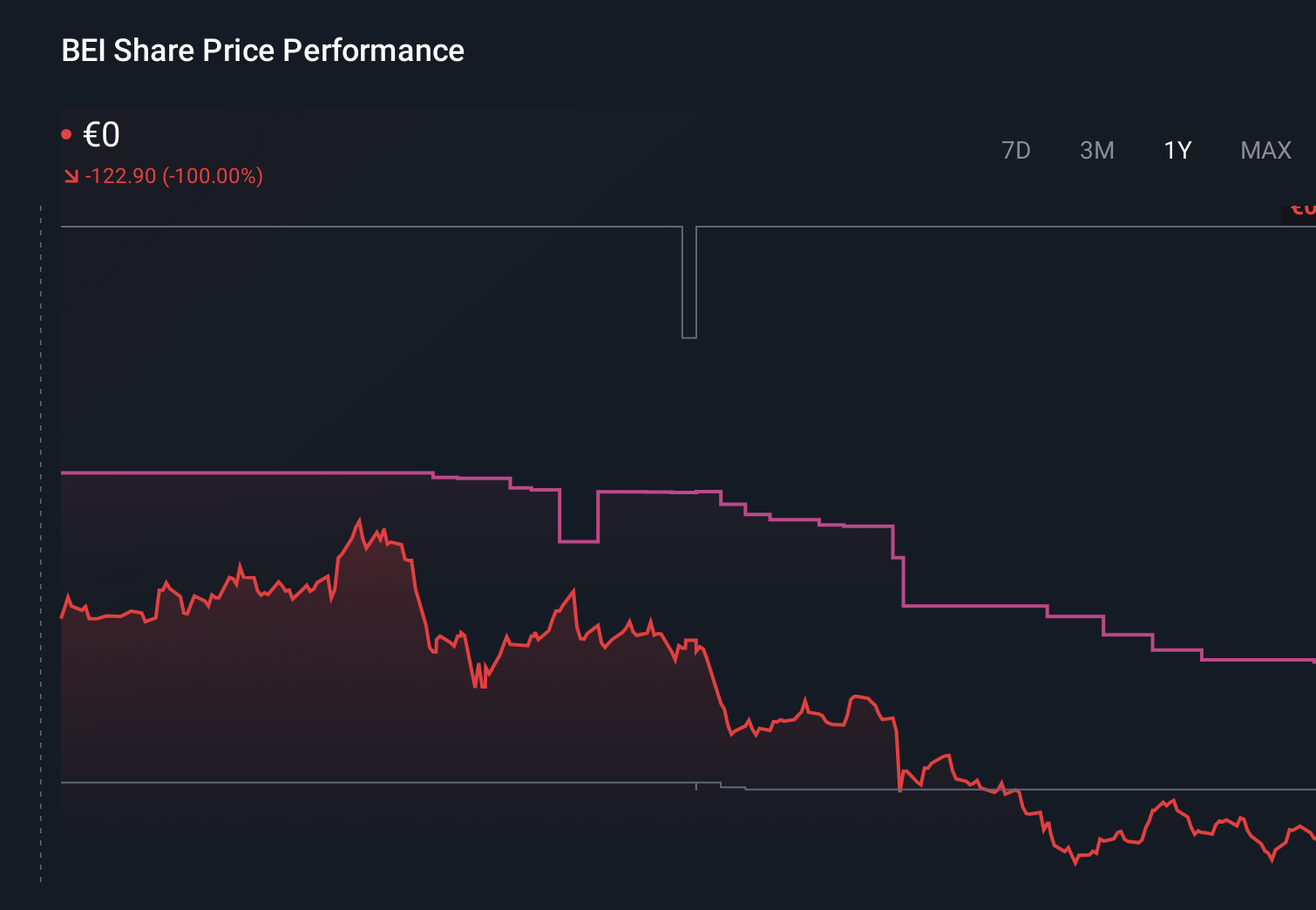

Uncover how Beiersdorf's forecasts yield a €116.00 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community currently see Beiersdorf’s fair value anywhere between €96.95 and €163.77, underlining how far opinions can diverge. Set against this spread, the key risk around retailer pushback in Europe could influence how confidently you view the company’s ability to convert product innovation like NIVEA Crème Natural Touch into sustained earnings power.

Explore 4 other fair value estimates on Beiersdorf - why the stock might be worth just €96.95!

Build Your Own Beiersdorf Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Beiersdorf research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Beiersdorf research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Beiersdorf's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal