Disc Medicine’s Cash Runway And NDA Milestones Could Be A Game Changer For IRON

- Disc Medicine recently reported that it is well-capitalized with over US$800.00 million in cash, has submitted a New Drug Application for bitopertin seeking accelerated FDA review, and released encouraging phase 2 data for DISC-0974 in myelofibrosis, especially in combination with JAK inhibitors.

- An interesting angle is that the company now has sufficient funding to operate through 2029 even if bitopertin does not reach commercial launch, giving it unusual flexibility to advance its hematology pipeline.

- Next, we will explore how this strengthened cash runway and progress toward bitopertin commercialization shape Disc Medicine’s broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Disc Medicine's Investment Narrative?

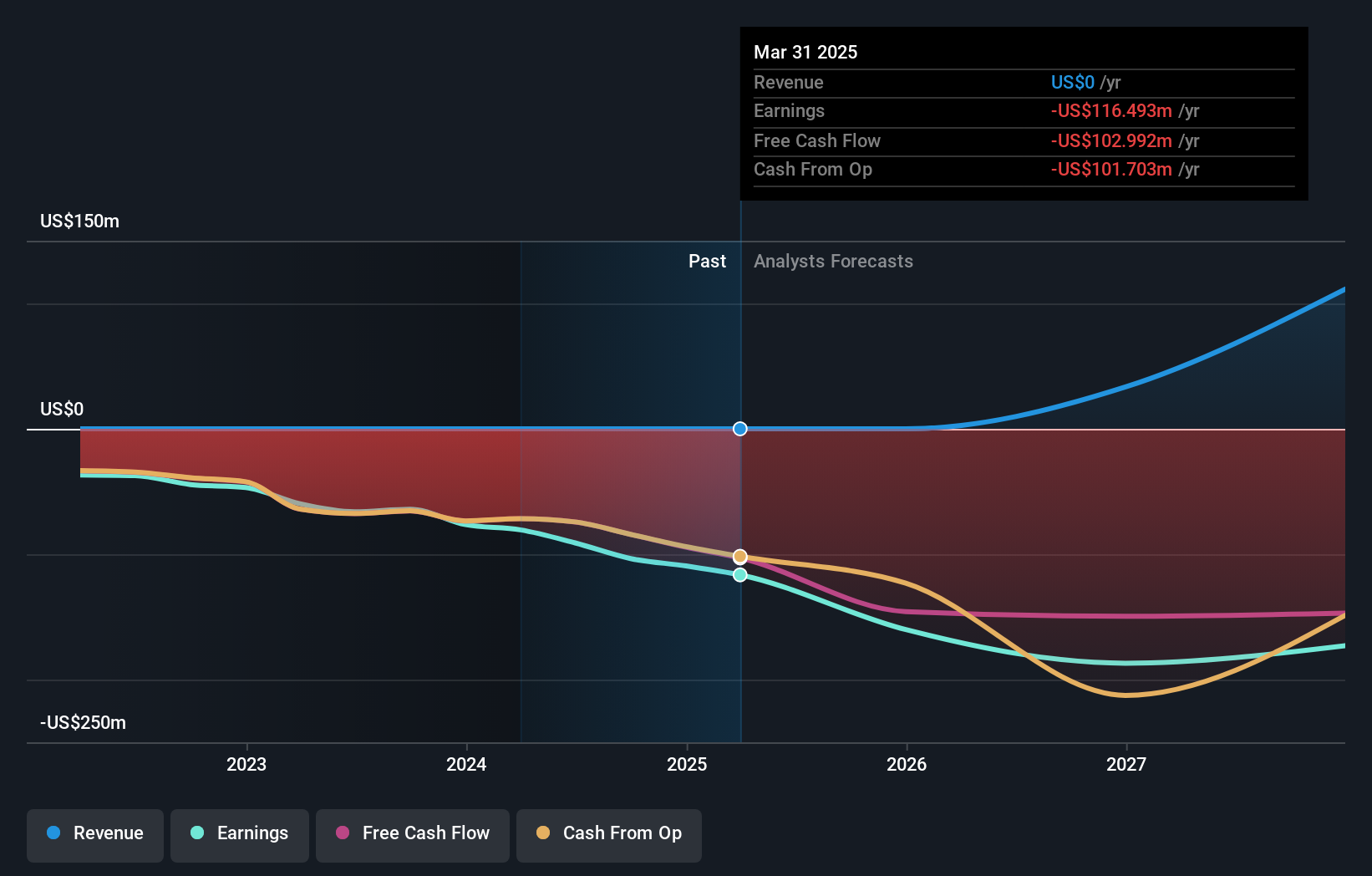

To own Disc Medicine, you have to believe its iron homeostasis platform can translate clinical promise into a durable hematology franchise, not just a one-drug story around bitopertin. The new cash figure of more than US$800.00 million and runway to 2029 meaningfully reshapes the near-term risk profile, taking financing pressure off the table just as the bitopertin NDA seeks accelerated FDA review. That makes regulatory outcomes around bitopertin and the evolution of the DISC-0974 program the key catalysts, with recent Phase 2 myelofibrosis data strengthening the argument that the pipeline has breadth. At the same time, Disc is still loss-making, forecast to remain unprofitable, and carries a history of shareholder dilution, so execution and capital discipline now matter more than ever.

However, one execution risk around commercialization could catch new shareholders off guard. Disc Medicine's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on Disc Medicine - why the stock might be worth as much as 55% more than the current price!

Build Your Own Disc Medicine Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Disc Medicine research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Disc Medicine research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Disc Medicine's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal