Assessing CarMax (KMX) Valuation As Class Action Lawsuits Challenge Its Growth Story

Class action lawsuits put CarMax’s growth story under scrutiny

CarMax (KMX) is back in focus after multiple law firms launched class action lawsuits claiming the company misled investors about its growth drivers, including the role of tariff related car buying.

See our latest analysis for CarMax.

At a share price of US$40.32, CarMax has seen a 1 month share price return of 3.86%, but its 1 year total shareholder return of 49.04% decline points to fading longer term momentum as the class action headlines refocus attention on earlier growth claims.

If this legal overhang has you reassessing used car retail, it could be a good moment to compare CarMax with other auto names through auto manufacturers.

With CarMax trading at US$40.32 and flagged with a value score of 4 plus an estimated 38% intrinsic discount, investors have to ask whether this legal overhang is creating a genuine mispricing or if the market is already adjusting for future growth.

Most Popular Narrative: 5.3% Overvalued

With CarMax last closing at US$40.32 against a widely followed fair value estimate of US$38.31, the current price sits slightly above that narrative marker and puts the focus on how earnings power and margins might evolve from here.

Street research on CarMax has shifted decisively toward caution, but views are not uniformly negative. Recent reports highlight a widening gap between concerns over near term execution risk and lingering confidence in the company’s long term strategic positioning and brand value.

Want to see what is behind that split view? Earnings growth assumptions, margin shifts and the future P/E all sit at the heart of this fair value call.

Result: Fair Value of $38.31 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that fair value story could be knocked off course if wholesale profit per unit continues to tighten or if broader credit expansion forces heavier loan loss provisions.

Find out about the key risks to this CarMax narrative.

Another View: Earnings Multiple Sends A Different Signal

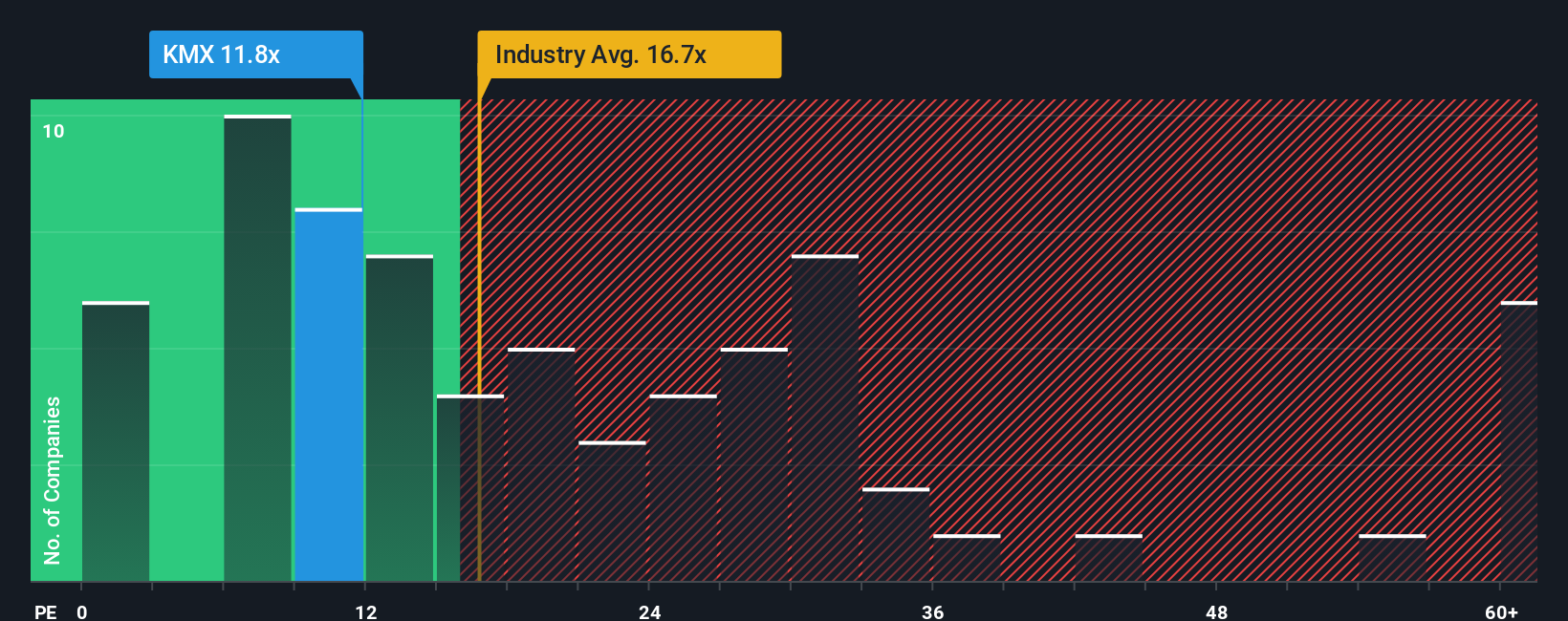

While the narrative fair value of US$38.31 points to CarMax looking 5.3% overvalued at US$40.32, the P/E picture is less clear cut. CarMax trades on 12.5x earnings versus an estimated fair ratio of 17.9x and a US Specialty Retail average of 19.8x, yet it is roughly in line with peers at 12.4x. That mix of apparent discount and peer level pricing raises a simple question for you: is this a value gap worth the legal and earnings risks, or just a value trap in the making?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CarMax Narrative

If you see the numbers differently or would rather stress test the data yourself, you can build a fresh CarMax story in minutes, starting with Do it your way.

A great starting point for your CarMax research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If CarMax has sharpened your thinking, do not stop here. Use the Simply Wall St Screener to quickly surface other opportunities that fit your approach.

- Spot potential bargains by scanning these 880 undervalued stocks based on cash flows that align with discounted cash flow signals and might deserve a closer look.

- Consider fast moving tech trends by checking out these 25 AI penny stocks where artificial intelligence is central to the business model.

- Explore high yield opportunities by reviewing these 14 dividend stocks with yields > 3% that could suit an income focused portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal