How Schneider Electric’s US$700 Million U.S. Expansion Will Impact Schneider Electric (ENXTPA:SU) Investors

- In recent days, Schneider Electric announced plans to invest over US$700 million in its U.S. operations over the next two years, upgrading, expanding and opening facilities across multiple states and adding more than 1,000 jobs to support energy infrastructure, AI growth and domestic manufacturing.

- This move signals a deeper commitment to the U.S. market and energy security, potentially reinforcing Schneider Electric’s role in supplying critical infrastructure for AI and electrification projects.

- We’ll now explore how Schneider Electric’s over US$700 million U.S. expansion may influence the company’s existing investment narrative and long-term positioning.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Schneider Electric Investment Narrative Recap

To own Schneider Electric, you really have to believe in its role as a core supplier of electrification, grid modernization and digital infrastructure, especially for data centers and AI. The planned US$700 million U.S. investment supports the near term data center and AI infrastructure catalyst, while also slightly increasing the existing risk that heavy capital spending could pressure margins and free cash flow if returns disappoint.

Among recent developments, Schneider Electric’s 800 VDC data center power architecture, designed to support high density AI workloads, is especially relevant here. Combined with the new U.S. factory and upgrade program, it ties the company more tightly to AI infrastructure demand, but also reinforces investors’ need to watch execution risk and the balance between growth investment and profitability.

Yet behind Schneider Electric’s AI and electrification upside, investors should be aware of the mounting risk that heavy investment could...

Read the full narrative on Schneider Electric (it's free!)

Schneider Electric's narrative projects €48.6 billion revenue and €6.7 billion earnings by 2028. This requires 7.3% yearly revenue growth and about a €2.4 billion earnings increase from €4.3 billion today.

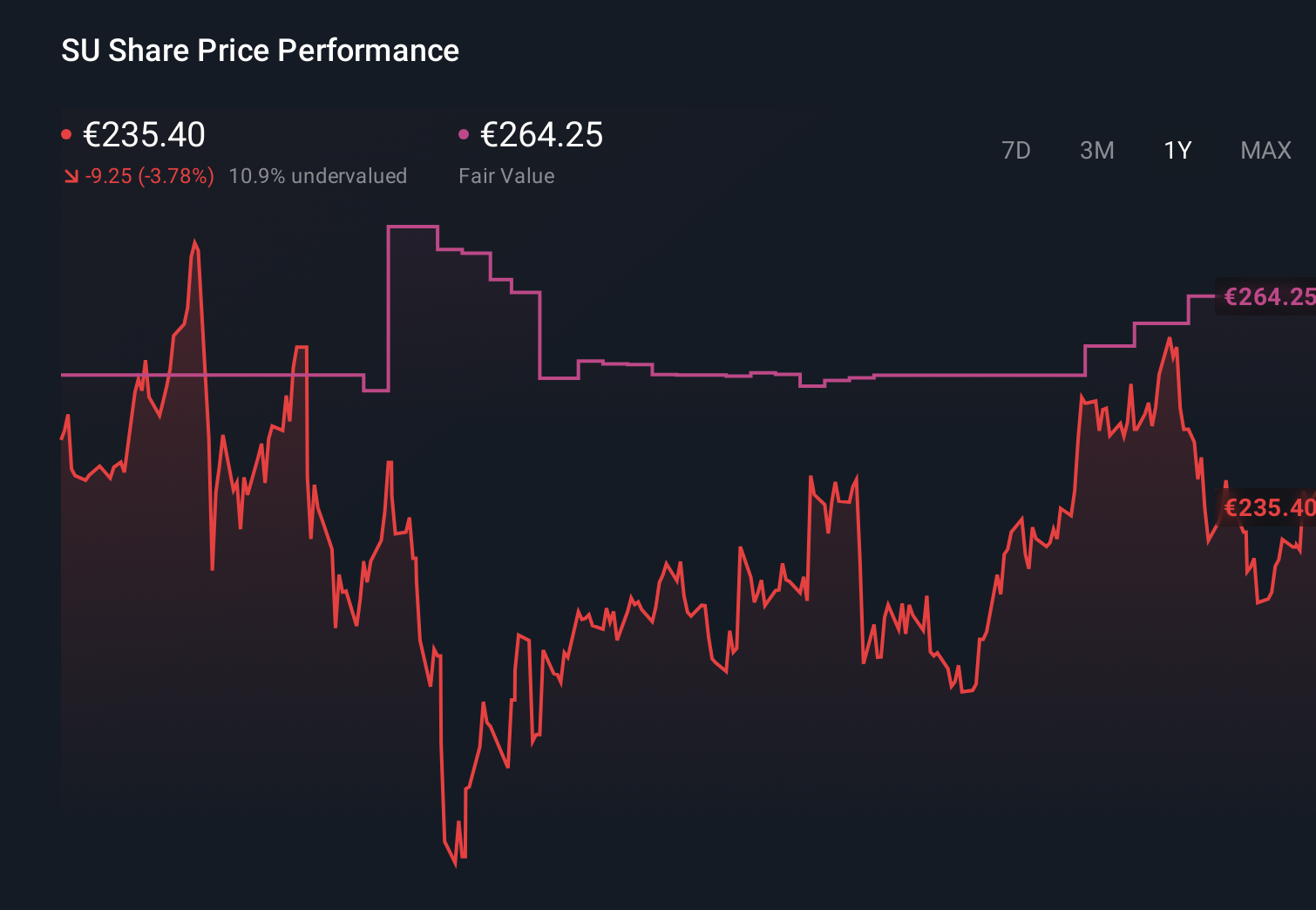

Uncover how Schneider Electric's forecasts yield a €270.55 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Nine fair value estimates from the Simply Wall St Community span roughly €122 to €271 per share, showing how far apart individual views can be. When you set those side by side with Schneider Electric’s heavy investment program and the risk that spending could pressure margins if growth slows, it becomes even more important to compare several perspectives before deciding how this stock might fit in your portfolio.

Explore 9 other fair value estimates on Schneider Electric - why the stock might be worth 49% less than the current price!

Build Your Own Schneider Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Schneider Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Schneider Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Schneider Electric's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal