A Look At Hims & Hers Health (HIMS) Valuation As Insider Selling And Investor Caution Raise Questions

Recent attention on Hims & Hers Health (HIMS) centers on insider selling by senior executives and large position shifts by institutional investors, following a recent pullback in the share price and elevated trading volumes.

See our latest analysis for Hims & Hers Health.

At a share price of $34.71, Hims & Hers Health has seen a 1-day share price return of 3.89% and a 7-day share price return of 5.05%. However, the 30-day share price return shows an 11.45% decline, and the 90-day share price return shows a 40.33% decline, suggesting that recent momentum has been fading. This comes even as the 1-year total shareholder return of 25.44% and a very large 3-year total shareholder return signal a strong longer term story that recent insider selling and valuation questions have brought back under scrutiny.

If this kind of volatility has you reassessing your options, it could be a good time to scan other healthcare stocks that fit your risk and return preferences.

So with insiders selling, institutions reshuffling and the shares sitting at a discount to some valuation estimates, is Hims & Hers Health now trading below its true worth, or is the market already factoring in the company’s future growth?

Most Popular Narrative: 21.8% Undervalued

Against a last close of $34.71, the most followed narrative pegs Hims & Hers Health’s fair value at $44.36, framing the current pullback as a discount that hinges on ambitious growth and margin assumptions.

On valuation, some research suggests that fair value estimates in the low to mid 50 dollar range remain achievable if Hims and Hers can execute on category expansion while maintaining disciplined customer acquisition and gradually improving unit economics. However, the path to that outcome is viewed as increasingly sensitive to GLP 1 pricing and competitive intensity in weight loss.

Curious how a mid 40s fair value connects to double digit revenue growth, rising earnings and a premium future P/E? The real story is in the detailed revenue mix, margin path and discount rate assumptions behind this narrative. If you want to see exactly which growth bets have to pay off for that valuation to hold, the full breakdown is worth a close read.

Result: Fair Value of $44.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on smooth execution, and tighter GLP 1 pricing or tougher rules on direct to consumer marketing could quickly challenge those fair value assumptions.

Find out about the key risks to this Hims & Hers Health narrative.

Another View Using Earnings Multiples

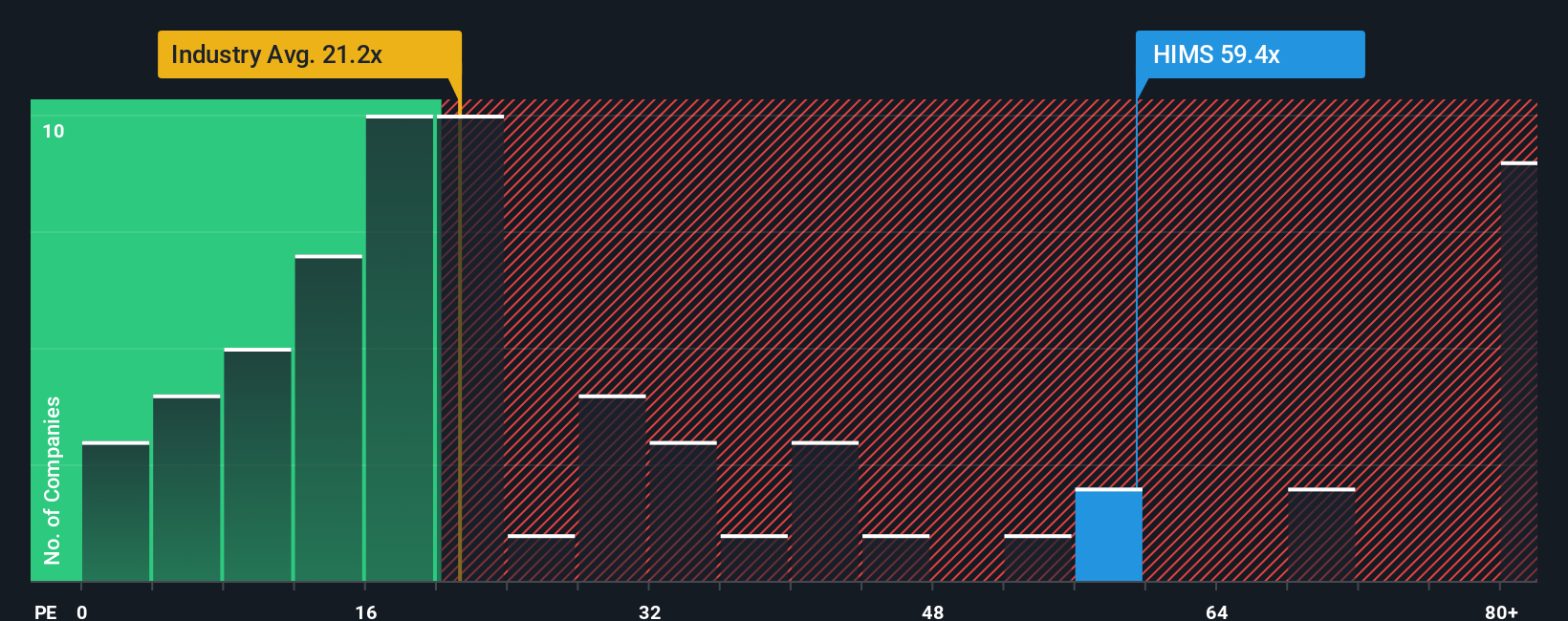

That 21.8% “undervalued” fair value of $44.36 sits next to a very different signal from earnings multiples. At a P/E of 59.1x, Hims & Hers Health trades well above the US Healthcare industry at 23.3x, the peer average at 32.6x, and our fair ratio of 27.6x. This points to valuation risk if expectations cool.

In simple terms, the market is already paying a high price for future growth. The question is whether you think Hims & Hers can deliver enough earnings over time to justify that premium, or whether the share price eventually drifts closer to that fair ratio.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hims & Hers Health Narrative

If you look at the same numbers and reach a different conclusion, or prefer to test your own assumptions, you can build a custom view in minutes with Do it your way.

A great starting point for your Hims & Hers Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Hims & Hers Health has you thinking more broadly about your portfolio, this is a moment to actively scan other opportunities before the market moves on without you.

- Spot potential value early by scanning these 3557 penny stocks with strong financials that pair smaller market sizes with financial strength and clearer business models.

- Explore structural growth themes by checking out these 25 AI penny stocks that link artificial intelligence with revenue and balance sheet data.

- Review potential mispriced opportunities by looking at these 880 undervalued stocks based on cash flows where discounted cash flows and fundamentals highlight gaps between price and underlying business quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal