Wall Street is still optimistic, but the threat is here! Nvidia (NVDA.US)'s “4 trillion myth” is facing an unprecedented challenge

With the opening of 2026, the world's highest-capitalized company's roots in the stock market are showing signs of shaking.

The Zhitong Finance App learned that since reaching a record high on October 29, Nvidia (NVDA.US) stock price has fallen 9.1% cumulatively, and its performance is far inferior to the S&P 500 index. This reflects investors' growing concerns about the sustainability of artificial intelligence (AI) spending and the chip giant's market dominance.

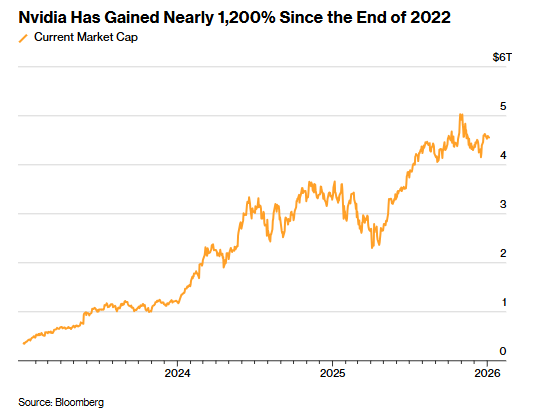

The recent decline was particularly notable. Looking back at the day the closing price set a record, Nvidia's stock price had risen by more than 1,300% from the end of 2022, and the company's market capitalization surpassed 5 trillion US dollars, a sharp jump from about 400 billion US dollars less than three years ago. Today, however, its market value has evaporated to 460 billion US dollars in just a few months, narrowing the three-year cumulative increase to nearly 1,200%.

Meanwhile, the dominant AI chip maker is facing unprecedented fierce competition, with rivals not only including peers such as AMD (AMD.US), but also its biggest customers — such as Google (GOOGL.US) and Amazon (AMZN.US). What worries Wall Street even more is that Nvidia's investment in multiple customers may be interpreted as boosting demand through artificial means.

“The risk has clearly risen,” said Joanne Feeney, partner and portfolio manager at Advisors Capital Management with an asset management scale of $130 billion.

If Nvidia continues this decline, it will have an impact on most stock investors. Compiled data shows that since the start of the current bull market in October 2022, the share has contributed about 16% to the increase in the S&P 500 index. Apple (AAPL.US) has the second-highest contribution rate, accounting for only about 7%.

Despite this, market demand for Nvidia shares remains strong. Even though the market's profit expectations are high, its valuation is still lower than many of its big tech peers. The Santa Clara, California-based company expects sales to grow 53% and profit to grow 57% in the next fiscal year ending January 2027. In contrast, Apple's expected increase in these two indicators is only about 10%.

Wall Street's attitude towards Nvidia has not changed either. Of the 82 analysts covering the company, 76 gave a buy rating, and only 1 recommended selling. The Wall Street average price target means there is room for 37% increase over the next 12 months, which will push its market capitalization above $6 trillion.

“Nvidia is still poised to be one of the fastest-growing companies in the open market,” Feeney said. “Isn't this a company worth owning? The answer is yes.”

Nvidia CEO Hwang In-hoon revealed during a speech at the Las Vegas Consumer Electronics Show (CES) on Monday that the company's next chip, codenamed Rubin, will be released within the year, and customers will soon be able to experience this new technology.

“The market demand for Nvidia GPUs is exploding,” said Hwang In-hoon. “The core driving force behind it is the exponential expansion in the scale of AI models — their complexity is growing tenfold almost every year.”

Competition in the chip market is heating up

As the absolute leader in the AI accelerator field, Nvidia holds more than 90% of the market share, but the rising momentum of competitors is increasing.

According to the data, AMD has received large-scale data center orders from OpenAI and Oracle (ORCL.US), and its data center business revenue is expected to surge 60% in 2026, reaching nearly $260 billion. Meanwhile, the four major customers, Google, Amazon, Meta (META.US), and Microsoft (MSFT.US), together contributed more than 40% of Nvidia's revenue. To reduce costs, these tech giants are developing their own chips — after all, Nvidia's single chip can sell for more than 30,000 US dollars.

“As long as there are more cost-effective options, companies will inevitably switch to cheaper chips,” said Michael O'Rourke, chief market strategist at investment agency Jonestrading. “Obviously, Nvidia will face serious challenges in maintaining 90% of the market share.”

As early as 10 years ago, Google began research and development of the first tensor processor (TPU) and optimized it for AI model training and inference tasks. Google's newly released Gemini AI chatbot was highly praised by the market, and this product was built based on a self-developed chip. In October of last year, Google announced that it had reached a chip cooperation agreement worth tens of billions of dollars with AI company Anthropic; in November of the same year, there were reports that Meta was in talks to rent Google Cloud's chips in 2026 and plans to deploy them in its own data center in 2027.

The surge in demand for such customized chips has also led to the rise of Broadcom (AVGO.US) — Broadcom manufactures AI semiconductor chips specifically for tech giants. The rapid growth of its ASIC business has helped Broadcom rank among the companies with the highest market capitalization in the world. Currently, the market capitalization of $1.6 trillion has surpassed Tesla (TSLA.US).

On December 24 of last year, Nvidia announced that it would license technology from startup chip company Groq and hire its executives. This move seems to confirm the rising trend of market demand for more specialized and lower-cost chips. Nvidia plans to incorporate the core technology of Groq chips into future product designs to enter the field of low latency semiconductors — an AI software operation scheme similar to ASIC.

However, analysts Kunjan Sobhani and Oscar Hernandez Tejada pointed out that given the huge gap in AI computing power demand, even if tech giants speed up the deployment of self-developed chips, they are still buying Nvidia chips on a large scale. As a result, Nvidia's market share is expected to remain stable in the foreseeable future.

“The market has seriously underestimated Nvidia's position in the industry,” Morgan Stanley analyst Joseph Moore and others wrote in a research report published this month (the agency maintains a buy rating on Nvidia shares). “We have always believed that in the field of cloud computing, Nvidia's solutions will bring the highest return on investment.”

According to forecasts, the total capital expenditure of the four companies Amazon, Microsoft, Google, and Meta will exceed 400 billion US dollars in 2026, most of which will be used to purchase data center equipment. Furthermore, in the next few years, these companies will also spend hundreds of billions of dollars leasing data center space built by third parties. Even though outsiders have doubts about whether OpenAI, which is losing money, can deliver on its promises, the company announced that it will invest 1.4 trillion US dollars in computing power construction over the next few years.

Profit margins and valuation pressure are highlighted

As competitors launch cheaper alternatives, investors are closely watching Nvidia's profit margins changes — after all, any loosening of the pricing strategy will be directly reflected in profit margin metrics.

Nvidia's gross profit margin in the 2024 and 2025 fiscal years (the core measure of corporate profitability) stabilized at around 75%, but in fiscal 2026, due to mass production of Blackwell series chips driving up costs, gross margin declined. The company expects gross margin for the 2026 fiscal year ending January 31, 2026 to fall to 71.2%, and plans to rise back to around 75% in the 2027 fiscal year. It can be seen from this that once gross margin falls short of expectations, Wall Street will surely sound the alarm.

However, relatively low valuations are still a key factor in attracting investors to stick with Nvidia. Based on the expected price-earnings ratio for the next 12 months, Nvidia's current valuation is 25 times higher than Meta among the “Big Seven”; compared with the S&P 500 index constituent stocks, its valuation is less than one-quarter of individual stocks, including tax reporting software giant Intu.US (INTU.US).

“The current market's valuation logic for Nvidia seems to presuppose that the industry cycle has peaked, AI deployment has completely stalled, and the future is fraught with thorns,” said Vivek Arya, a semiconductor industry analyst at Bank of America. “But from an investor's perspective, this is just a good layout opportunity — this kind of valuation logic is very different from market sentiment during the peak of the internet bubble.”

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal