Energy storage explosion, tight supply and demand, and rising prices GGII released the top ten predictions for China's new energy batteries in 2026

The Zhitong Finance App learned that on January 6, GGII released the top ten predictions for China's new energy battery industry in 2026. In 2026, China's total lithium battery shipments will increase by nearly 30% year-on-year to more than 2.3 TWh. Among them, shipments of lithium batteries for energy storage will exceed 850 GWh, and the growth rate is expected to exceed 35%; shipments of power batteries (including lithium batteries for passenger cars and commercial vehicles) will exceed 1.3 TWh, a growth rate of more than 20%, and the absolute increase in the energy storage market is expected to surpass power batteries for the first time.

Looking back at 2025, the lithium battery industry experienced a strong recovery after a deep correction, forming a keyword matrix centered on “mismatch between supply and demand, reverse internal volume, energy storage explosion, technology iteration, a new round of expansion of the industrial chain, full production and sales, acceleration of overseas sales, volume value, etc.” The popularity of this round of industry growth has been profoundly reshaped compared to the development logic of the industry around 2020. It is expected that this trend will continue to be postponed until 2027.

In 2025, industry orders continued to gather at leading companies, leading companies were in frequent production capacity shortages, and the mismatch between supply and demand became the core contradiction of the industry. In this context, the “anti-internal volume” campaign promoted by policy and industry collaboration showed results. The expansion of industry production was no longer blind, but concentrated on leading enterprises with technological and scale advantages. This trend is expected to continue throughout 2026. Among them, key links such as the electrolyte industry chain (lithium hexafluorophosphate, additives, etc.), anode materials, wet diaphragms, phosphate industry chain, and batteries will remain tight, and the industry will officially enter a value return cycle from being driven by emotion to being dominated by reason.

Based on the tracking of the new energy battery industry over the past year, GGII expects China's new energy battery market to show the following trends in 2026:

Energy storage, offshore, and commercial vehicles become growth engines, lithium battery shipments pre-exceed 2.3 TWh

In 2026, China's total lithium battery shipments will increase by nearly 30% year-on-year to more than 2.3 TWh. Among them, shipments of lithium batteries for energy storage will exceed 850 GWh, and the growth rate is expected to exceed 35%; shipments of power batteries (including lithium batteries for passenger cars and commercial vehicles) will exceed 1.3 TWh, a growth rate of more than 20%, and the absolute increase in the energy storage market is expected to surpass power batteries for the first time.

The domestic independent energy storage market achieved more than expected growth and the introduction of capacity electricity price subsidy policies in many places, which led to an increase in IRR yield for energy storage power plants (generally reaching 6-12%); the increase in demand for large European storage, industrial and commercial energy storage, and the US is receiving demand from data centers (AIDC) storage, etc. are the keys to driving the growth of domestic energy storage demand.

The power sector is mainly driven by the growth of new energy vehicles (the growth rate is about 5-10%), the increase in bicycle charging capacity (compared to 2025, it is expected to continue to increase by 5 to 10%), and the growth of new energy commercial vehicles (the penetration rate of new energy commercial vehicles in China increased from 20.38% in 2024 to 25.7% in January-November 2025, with a monthly penetration rate of 33.9% in November, and the penetration rate is still increasing rapidly, driven by policies such as trade-in. The penetration rate of some market segments is expected to exceed 40% in 2026).

2024~2028 China lithium battery shipment volume and forecast (GWh)

Other fields include construction machinery, ships, field vehicles, robots, start-start-stop, low-altitude, etc.

Data source: Advanced Industrial Research (GGII), January 2026

In 2026, domestic sales of new energy heavy trucks will increase from 210,000 units in 2025 to more than 350,000 units. Their charge capacity is ten times that of plug-in hybrid passenger cars, and the mainstream charge capacity will reach 400 to 600 kWh, effectively boosting the demand for power batteries by more than 100 GWh. In other segmented scenarios, shipments of lithium batteries for construction machinery increased from about 14 GWh in 2024 to 24 GWh in 2025, and are expected to increase to 35 GWh in 2026, mainly benefiting from the elimination and replacement of old equipment and the advancement of major investment projects. Renewable energy replacement has become an industry consensus.

Overseas markets have become a new growth pole. It is estimated that in 2026, China's NEV exports are expected to be close to 4 million units, an increase of more than 50% over the previous year. In terms of vehicles going overseas, with overseas production capacity such as BYD's Hungarian plant, Chery's Spanish plant, and Great Wall Brazil plant successively launched, the overseas production scale of Chinese automobiles doubled to 900,000 units, corresponding to power battery demand exceeding 35 GWh; in terms of overseas batteries, the production capacity of Chinese lithium battery companies overseas bases is expected to exceed 100 GWh, and overseas battery production capacity is expected to be released at an accelerated pace, and annual shipments are expected to exceed 40 GWh.

Supply and demand in the industry continue to be tight, orders/production schedules of leading companies remain high

In 2026, the tight supply and demand pattern in the lithium battery industry continues, and companies such as TOP10 batteries and leading phosphate cathode materials, anodes, diaphragms, and electrolytes will basically maintain full production.

The supply side is regulated by an “anti-internal volume” policy, and the expansion of industry production capacity has returned to rationality. Although the industry's new tender orders increased by more than 30% year-on-year in 2026, most of this production capacity will gradually be put into operation in 2027-2028, making it difficult to completely fill the gap between supply and demand in the short term. The demand side is driven by multiple factors such as energy storage, commercial vehicles, and exports, forming rigid demand support. In the key materials sector, leading companies dominate the market with technology and scale advantages, and long-tail production capacity is being cleared at an accelerated pace. For example, leading lithium iron phosphate companies are running out of production capacity, and there is a gap between supply and demand for high-end negative products, further exacerbating the tight balance in the industry.

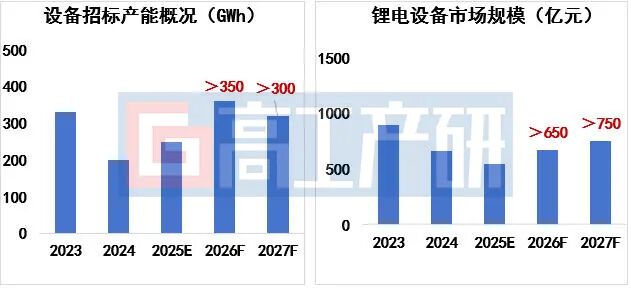

In 2026, the new production capacity of lithium batteries will exceed 700 GWh, driving the equipment market demand to exceed 65 billion yuan

Since 2025, China's lithium battery industry chain has ushered in a “third round” expansion cycle. Judging from the equipment bidding situation and battery factory plans, it is estimated that in 2026, China's new effective lithium battery production capacity is expected to exceed 700 GWh, mainly concentrated in Ningde Era (03750), BYD (01211), China Innovation Airlines (03931), Haichen, Everweft Lithium (300014.SZ), Ruipu Lanjun (00666), Chu Neng New Energy, and some solid state and sodium battery ion companies. Meanwhile, in 2026, leading companies will increase the release of overseas production capacity. The expansion of production capacity will directly drive the lithium battery equipment market to grow by more than 65 billion yuan, and there is strong demand for equipment such as coating, lamination, and chemical composition.

Data source: Advanced Industrial Research (GGII), January 2026

The industrial chain will rise in volume and price, and the price of core products will rise by more than 10%

Driven by tight industry supply and price increases in upstream materials, the lithium battery industry chain will usher in a sharp rise in volume and price in 2026.

The price of battery-grade lithium carbonate is expected to stabilize above 120,000 yuan/ton throughout the year, and the phased high may break through 150,000 yuan/ton. China's lithium battery demand for lithium salt is growing by more than 25%, and supply-side production expansion is slowing and inventory continues, making it difficult to fully meet high growth demand and provide support for rising prices. The price of copper foil will exceed 120,000 yuan/ton. The rise in copper prices will drive the cost of lithium copper foil to increase, while the supply and demand for high-end copper foil is shifting to a tight shift. It is expected that copper foil processing fees may rise by more than 1,000 yuan/ton in 2026, further supporting the price. Driven by tight supply and demand for upstream materials such as lithium hexafluorophosphate and VC/FEC, the price of electrolytes increased by more than 70% in 2025. New production capacity for upstream additives was limited in the first half of 2026, compounded by the increase in the cost of lithium carbonate, and the price of mid-tier electrolytes continued to increase by 10% to 20%. The rise in raw material prices has led to a recovery in the price of energy storage cells, which is expected to increase by more than 5%.

Newly imported small and medium-sized enterprises have become the only way out, leading companies compete for production capacity resources

In 2026, the number of small and medium-sized enterprises processing in the lithium battery industry chain will increase dramatically. The fields of batteries, phosphates, anode materials, etc. are particularly obvious, and leading manufacturers will compete to “grab factories”.

The core contradiction is the imbalance between insufficient production capacity of leading companies and restrictions on expanding production. On the one hand, leading companies have sufficient orders, but the cost of building new bases is high and the cycle is long, making it difficult to quickly release production capacity in the short term; on the other hand, mergers and acquisitions require large investments, are not cost-effective, and technology integration is difficult. However, in recent years, new small and medium-sized enterprises have been affected by industry differentiation. Due to lack of orders, production lines are largely idle, and they have a production capacity base for contract processing. This mismatch between supply and demand pushes leading enterprises to form generational processing cooperation with small and medium-sized enterprises, which not only solves the short-term production capacity gap of leading enterprises, but also brings living space for small and medium-sized enterprises, forming a phased industrial collaboration pattern.

The shipment volume of solid-state batteries exceeds the 15 GWh level, and it will take time for all solid-state batches to be launched

Semi-solid-state battery shipments will exceed 15 GWh in 2026, core drive:

1) Accelerated implementation of pilot lines and early mass production lines in 2026, such as GAC Group's all-solid-state battery production line and Qingtao Energy Energy Storage Demonstration Project, etc., laying the foundation for production capacity breakthroughs;

2) Supported by improved performance, continuous breakthroughs in the development of core materials and processes for solid-state batteries. Product stability and energy density have improved. The energy density of mass-produced products reached 400 Wh/kg in 2025, achieving a significant breakthrough from <350 Wh/kg before 2024.

There is still uncertainty about the market growth rate. On the one hand, the consistency of oxide and polymer routes is difficult to control, which directly affects product yield and delivery stability; on the other hand, the current application range of solid-state batteries is limited to markets below 50 Ah, such as small devices such as drones, and is still difficult to apply in high-capacity scenarios such as power. All-solid-state lithium batteries will enter the intensive road test stage, but it will be difficult to achieve mass launch with vehicles during the year. They are mainly affected by technical bottlenecks, immature special materials, equipment systems, and high costs.

With demand surging and profits returning, industrial chain IPOs are being restarted intensively

2026 will usher in a wave of centralized IPOs for companies in the lithium battery industry chain, and leading segments such as materials, equipment, energy storage integration, and solid-state batteries will benefit first.

Among material companies, the supply and demand gap for high-end products such as high-pressure quick-charging iron-lithium cathodes, silicon-based anodes, and ultra-thin wet diaphragms is widening, and the IPO process for leading companies with technical advantages and the ability to bind to large customers will be accelerated, and fund-raising will be used for high-end production capacity and overseas layout.

Along with the elimination of industry inventories and the rise in price centers, resource-based enterprises with lithium ore resources and outstanding cost control capabilities have greatly increased their will and feasibility to restart IPOs.

Equipment companies have benefited from a recovery in demand for battery factory expansion, and equipment prices have stabilized. They focus on companies such as semi-solid state and all-solid-state battery equipment, and AI quality inspection equipment, and have become the core targets of IPO applications due to their high bargaining power.

Energy storage integration and supporting enterprises rely on the explosion of energy storage markets at home and abroad to achieve a profit model transformation from “low price order grabbing” to “technology+service premium”. Enterprises with integrated capabilities and experience in implementing overseas projects will increase significantly in the IPO success rate.

The solid-state battery industry, on the other hand, has ushered in a key node for large-scale mass production of semi-solid batteries. Companies that have the capacity to mass-produce semi-solid cells and have passed the verification of downstream users will also hit their IPOs in 2026.

Shipments of sodium batteries increased by more than 100% year on year, breaking through the 10 GWH NFPP route dominates

In 2026, China's sodium-ion battery shipments will exceed 10 GWh, doubling the year-on-year increase. Mainly driven by the following factors:

1) In 2026, the price of lithium battery main materials will increase collectively, and the cost of sodium battery cells is expected to drop to less than 0.4 yuan/Wh, which will have a more cost-effective advantage and will increase applications in fields where energy density is not sensitive, such as energy storage;

2) Make up for the shortcomings of lithium batteries in terms of single performance, such as cyclic attenuation at low temperatures. In order to break the barriers of new energy vehicles in the northern market, sodium electricity is expected to become the main increase in the northern power market due to its excellent performance in a wide temperature range;

3) Leading companies have accelerated their deployment. Ningde Times announced that they will use sodium batteries on a large scale in the four major fields of power exchange, passenger cars, commercial vehicles, and energy storage in 2026; Haichen Energy Storage and Everweft Lithium Energy both announced application plans for sodium electricity in the AIDC scenario and are starting to build related production capacity.

On the technical side, the market share of NFPP sodium-ion batteries is expected to exceed 80%. Since NFPP sodium-ion batteries have comprehensive advantages in cycle stability, cost control, process maturity, etc., they are more suitable for mainstream application scenarios such as low-speed vehicles and energy storage, and leading battery companies have a deep layout on the NFPP route.

Whether sodium batteries can break through the 100 GWh scale in 2030 depends on whether a breakthrough is achieved in anode-free technology in 2026. If so, it is expected to be achieved as scheduled. Otherwise, improvements in energy density and cost competitiveness will be limited and delayed.

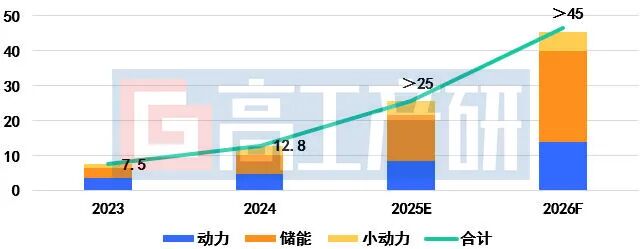

Shipments of large cylindrical batteries grew by more than 50%, and shipments broke 45 GWh

In 2026, China's large cylindrical battery shipments are expected to grow by more than 50% year-on-year, with energy storage as an important driving area. Reasons for high growth:

1) Replacement demand for household storage products: In 2025, the household storage market experienced a structural shortage of 100Ah square batteries. Large cylindrical batteries have become a solution to household storage “core shortage” due to their performance adaptability. At the same time, large cylindrical batteries have the advantages of low cost and high safety, and have become a key driving force for integrators to transfer orders, and will continue their high growth trend in 2026.

2) Rapid release of production capacity guarantees supply: In 2025, domestic production capacity of 32 series or above will be released at an accelerated pace, and production capacity is expected to exceed 100 GWh in 2026. Leading companies and second- and third-tier manufacturers have formed a differentiated layout. Leading companies such as Ningde Era and Everweft Lithium Energy focus their production capacity on passenger cars, while companies such as Penghui, Chuangming, and Lihua focus on household storage and other tracks to deliver in batches to overseas customers such as Europe and Australia. The release of production capacity resonates with the growth in overseas demand, providing a guarantee for shipments exceeding 45 GWh.

2023-2026 Large Cylindrical Battery Shipment and Forecast (GWh)

Note: Large cylindrical batteries refer to cylindrical products with a diameter of 30mm or more

Data source: Advanced Industrial Research (GGII), January 2026

Silicon-based composite anode: over 50% of applications in the 3C field, applications in the power field require process innovation

In 2026, CVD silicon-based composite anode materials are expected to account for more than 50% of applications in the 3C digital battery market, driving CVD silicon-carbon anode shipments to 5,000 tons, and the industry enters a period of explosive growth. Mainly due to the continuous increase in battery energy density and lightness requirements for 3C digital products, the theoretical specific capacity of traditional graphite anodes is close to the limit. Silicon-carbon composite anodes can significantly increase battery energy density, meeting the development needs of 3C products that are lightweight and high energy.

Models equipped with CVD silicon-carbon anodes are expected to be launched in 2026, driving the energy density of power battery systems to exceed 250 Wh/kg, but process technology is still the core bottleneck limiting large-scale applications in the power battery field, and problems such as poor consistency in the CVD process have not been fully solved.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal