A Look At MP Materials (MP) Valuation After Department Of Defense Magnet Offtake Agreement

MP Materials (MP) is back in focus after investors reacted to fresh optimism around its Department of Defense magnet offtake agreement and broader efforts to reduce U.S. reliance on Chinese rare earth supplies.

See our latest analysis for MP Materials.

The latest Department of Defense deal and geopolitical focus on non Chinese supply sit against a mixed share price pattern, with a 6.64% 1 day share price return but a 16.96% 90 day share price decline. At the same time, the 1 year total shareholder return of 184.84% points to strong longer term momentum.

If you are watching how policy sensitive names like MP Materials trade, it can be useful to scan for other US focused materials and energy suppliers through fast growing stocks with high insider ownership.

With MP Materials posting strong 1 year and 3 year total returns yet still trading at a reported discount to analyst targets, the key question is whether the recent pullback leaves potential opportunity on the table or if the market is already fully reflecting expectations for future growth.

Most Popular Narrative Narrative: 26.1% Undervalued

With MP Materials last closing at $58.62 against a narrative fair value of about $79.29, the gap reflects a view that contracts and downstream expansion materially reshape the earnings profile.

The analysts have a consensus price target of $77.0 for MP Materials based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $85.0, and the most bearish reporting a price target of $65.0.

Want to understand why an unprofitable miner is being valued like a high growth compounder? The narrative leans on steep revenue expansion, sharply higher margins, and a future earnings multiple usually reserved for market favorites. Curious which exact profit and share count assumptions have to hold for that outcome to make sense? The full breakdown lays out every step.

Result: Fair Value of $79.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on MP delivering complex downstream projects on time while managing heavy dependence on a few large customers whose contract or policy shifts could quickly reprice expectations.

Find out about the key risks to this MP Materials narrative.

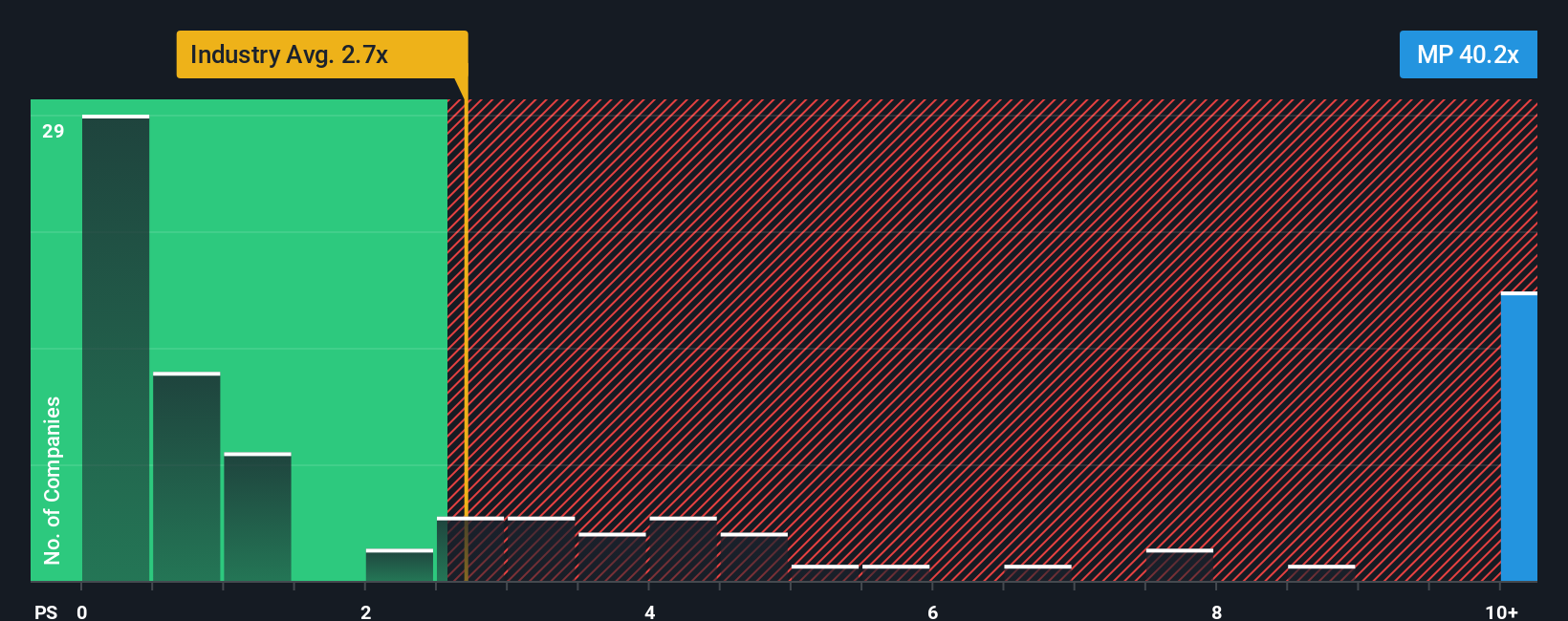

Another View: High Sales Multiple Flags Valuation Risk

While the narrative model sees MP Materials as about 26.1% undervalued, the simple sales-based view points in the opposite direction. MP trades on a P/S ratio of 44.6x versus an estimated fair ratio of 2.4x, the US Metals and Mining industry at 2.3x, and a peer average of 0.8x. That is a very large gap, which suggests the market already prices in a lot of success. The question is whether you are comfortable paying that kind of premium for a business that is still loss making today.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MP Materials Narrative

If you see the numbers differently, or just prefer to test your own assumptions against the market, you can create a custom MP thesis in a few minutes with Do it your way.

A great starting point for your MP Materials research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are weighing up MP Materials, it can be worth lining it up against a wider set of ideas filtered by return profile, quality, and sector focus.

- Spot potential value opportunities early by scanning these 880 undervalued stocks based on cash flows built around companies priced below what their cash flows might justify.

- Zero in on fast moving themes with these 25 AI penny stocks that group early stage AI names into one focused starting list.

- Strengthen your income watchlist using these 14 dividend stocks with yields > 3% that surfaces companies offering yields above 3% with supporting fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal