Will Rapid EPS Growth and Margin Gains Change Carvana's (CVNA) Narrative?

- In recent updates, Carvana reported that retail units sold have risen at an average annual rate of 31.4%, while earnings per share grew 38.5% annually over the past three years, alongside a significant improvement in free cash flow margin. These trends point to greater operational efficiency and financial flexibility, raising questions about how much further the company can build on its online used-car model.

- We’ll now explore how this acceleration in earnings per share growth and margin expansion could influence Carvana’s existing investment narrative.

- We’ll now explore how Carvana’s rapid earnings per share growth and margin gains may reshape its longer-term investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

Carvana Investment Narrative Recap

For Carvana, the core belief is that its online model can scale profitably without being overwhelmed by the operational complexity of handling more used cars. The recent acceleration in retail units, earnings per share, and free cash flow supports that view, but it does not fundamentally change the near term focus on sustaining margin gains while managing the risk of operational bottlenecks in reconditioning and logistics.

The most relevant recent development here is Carvana’s inclusion in the S&P 500 and related indices, which has brought the company into a wider set of institutional portfolios. While index inclusion does not change the underlying business, it can amplify market attention on whether the current pace of earnings growth and margin expansion is sustainable, especially with ambitious growth targets still emphasizing scale and efficiency.

Yet behind this strong recent performance, investors should be aware of the risk that operational capacity fails to keep pace with unit growth, potentially leading to...

Read the full narrative on Carvana (it's free!)

Carvana's narrative projects $33.2 billion revenue and $2.2 billion earnings by 2028.

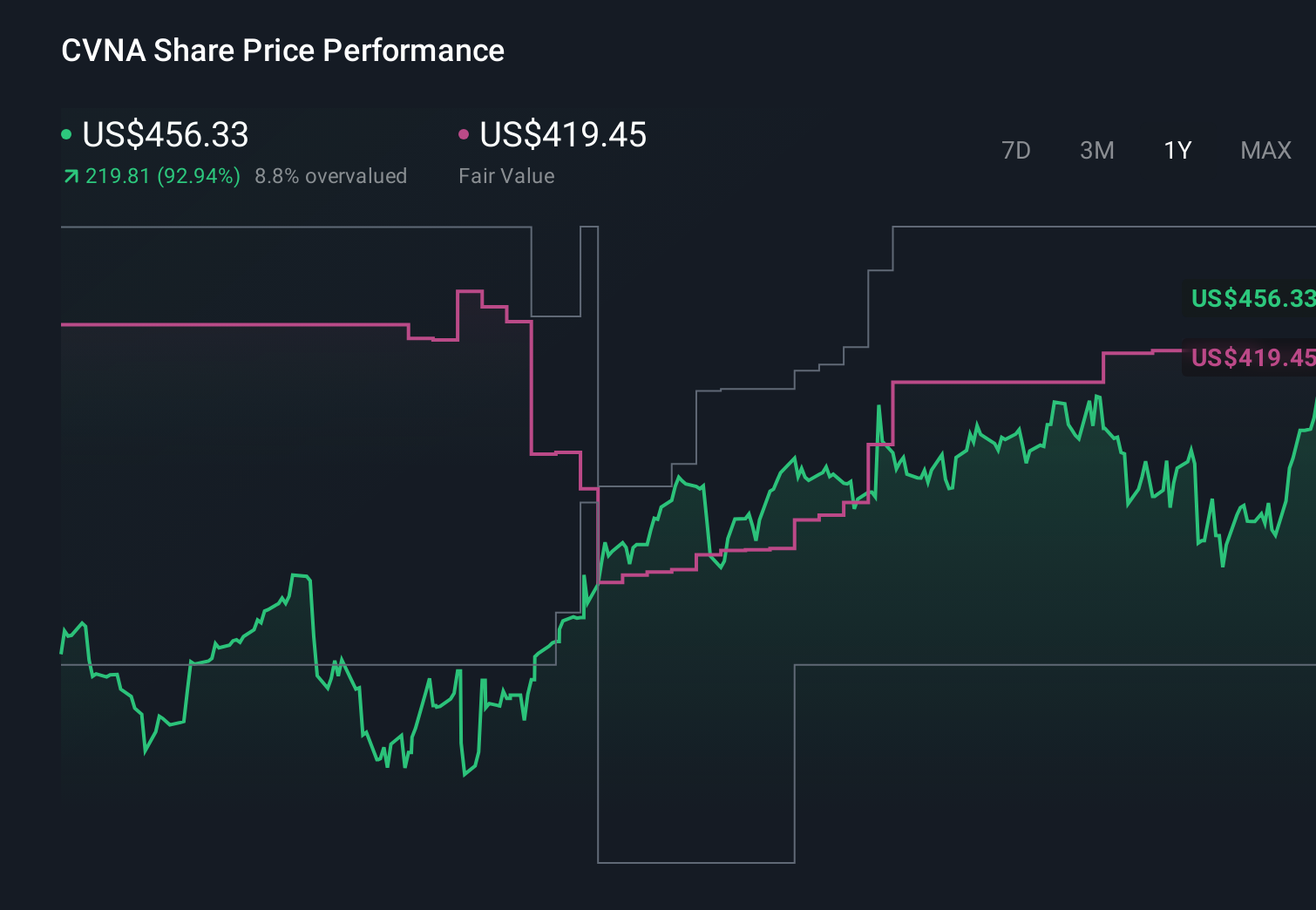

Uncover how Carvana's forecasts yield a $419.45 fair value, in line with its current price.

Exploring Other Perspectives

Seventeen fair value estimates from the Simply Wall St Community span roughly US$60 to US$550 per share, showing just how far apart individual views can be. Against that backdrop, the recent surge in earnings per share and margin expansion invites you to compare these differing expectations with the operational risks that could influence how the business performs over time.

Explore 17 other fair value estimates on Carvana - why the stock might be worth less than half the current price!

Build Your Own Carvana Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carvana research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Carvana research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carvana's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal