The Venezuelan incident did not shake up US stocks, but trading logic is accumulating 2026 risks

The Zhitong Finance App notes that if Wall Street bulls want to achieve double digit returns for the fourth year in a row in 2026, many conditions will need to be met. Trade tension between the US and neighboring countries continues to be high, and the economy is showing signs of fatigue. Interest rates are still high after three interest rate cuts, and the artificial intelligence boom is far from winning.

Geopolitics is another major variable. Although the US military action in Venezuela did not have an impact on domestic financial market sentiment, the surprise reminder to investors that in a world that has experienced generational geopolitical changes, any trading logic may be overwhelmed.

“We think people are ignoring macro risk — and this is even a macro risk we haven't anticipated before,” Christopher Harvey, head of equity and portfolio strategy at CIBC Capital Markets, said in an interview on Monday about the US intervention in Venezuela.

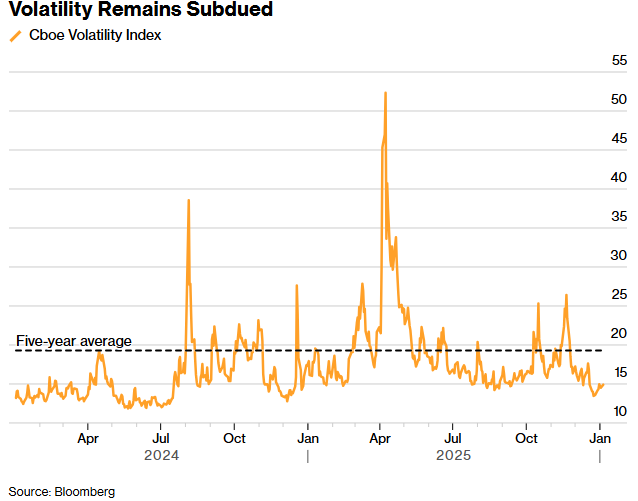

Up to now, the raid to arrest Venezuelan President Nicolas Maduro has had a lackluster response on Wall Street. The S&P 500 index rose 0.6% on Monday, and crude oil prices rose slightly. Some safe-haven assets have risen, particularly gold and US bonds. However, the Chicago Board Options Exchange Volatility Index (VIX) remained low and traded below 16.

Volatility remains moderate

According to Harvey, this kind of market reaction is basically reasonable, but it also confirms his view: after driving the stock market up about 80% in three years, investors have become numb to risk. The period was not without its twists and turns, especially the sharp drop over the past few days triggered by Trump's first announcement of the tariff plan in early April. Since then, however, the S&P 500 index has rebounded strongly by 39%, and every pullback is viewed as a buying opportunity.

“The market returns have been amazing since 'Liberation Day', and I think people have become very, very relieved,” Harvey said.

Sell-side strategists expect the stock market to rise for the fourth year in a row in 2026, with the 21 forecasters surveyed expecting an average increase of about 9%. No one predicted that the index would close down at the end of the year.

Of course, uncertainty is always a risk for investors. But as 2026 officially unfolds in global financial markets, the CIBC strategist notes that traders are increasingly tempted to ignore identifiable threats, which could cause pain.

Harvey pointed out that given continued inflation, investors may be too optimistic that the Federal Reserve will cut interest rates two more times this year. He also hinted that after soaring stock prices in recent years, US companies may lower expectations for further profit growth, thereby weakening the key pillar of the bull market.

Trump continues to wield the tariff stick as a weapon in negotiations with various parties, making the outcome difficult to predict. The trade agreements he reached with Mexico and Canada during his first term have yet to be adjusted, and related developments are intermittent. Geopolitical turmoil continues, as evidenced by the Russian-Ukrainian conflict, turmoil in Iran, and tension in Southeast Asia.

Just as the events of last weekend highlighted the risk that the unknown in 2026 could quickly retake the stage, Harvey warned of a “sharp outbreak of risk aversion” in the coming months. He advises clients to structure their portfolios by leaning towards high-quality assets to handle turbulence. Harvey's views are worth listening to. He was one of the few strategists last year who accurately predicted that the stock market would quickly and strongly rebound from April's tariff turmoil.

Other Wall Street sources pointed out that although the impact of the Venezuelan incident itself was limited, investors should remain vigilant.

“The events of the weekend were a sharp reminder that investors should continue to view policies — whether fiscal, monetary, or geopolitical — as a source of volatility rather than a suppressor,” said Frank Moncombe, head of macro trading at Buffalo River Commodities. At a time when we are testing historic highs and historically high valuations, the risk of cross-asset volatility contagion has clearly increased the vulnerability of the stock market.”

Schroder investment strategist Dan Suzuki believes that this complacency stems from near-causal bias because market adjustments have been brief in recent years, and investors have achieved double-digit stock returns for three consecutive years (and seven of the past nine years).

“Economic and profit growth has remained good, and recently received additional support from factors such as a government restart, anticipated large tax rebates, and accelerated business investment,” he said. The combination of these factors may make investors think more about how to seize upward space rather than prevent downside risks.”

For now, seasonal factors may be able to smooth out moderate short-term fluctuations.” The “January effect” theory suggests that the increase in US stocks in the first few weeks of each year is usually higher than in other months. Currently, this effect is being tested. In the first two trading days of 2026, the S&P 500 index has risen 0.8%.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal