TSX Dividend Stocks Transcontinental And 2 Others For Reliable Income

As we step into 2026, the Canadian market is navigating a landscape of economic surprises and shifting employment trends, making it crucial for investors to reassess their strategies. In this context, dividend stocks like Transcontinental offer a reliable income stream, providing stability amid uncertain market conditions and complementing a diversified investment approach.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Wajax (TSX:WJX) | 5.01% | ★★★★★☆ |

| Transcontinental (TSX:TCL.A) | 3.97% | ★★★★★☆ |

| Toronto-Dominion Bank (TSX:TD) | 3.27% | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | 13.70% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 3.33% | ★★★★★☆ |

| Olympia Financial Group (TSX:OLY) | 6.43% | ★★★★★☆ |

| Great-West Lifeco (TSX:GWO) | 3.62% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.62% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 3.35% | ★★★★★☆ |

| Bank of Montreal (TSX:BMO) | 3.62% | ★★★★★☆ |

Click here to see the full list of 18 stocks from our Top TSX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

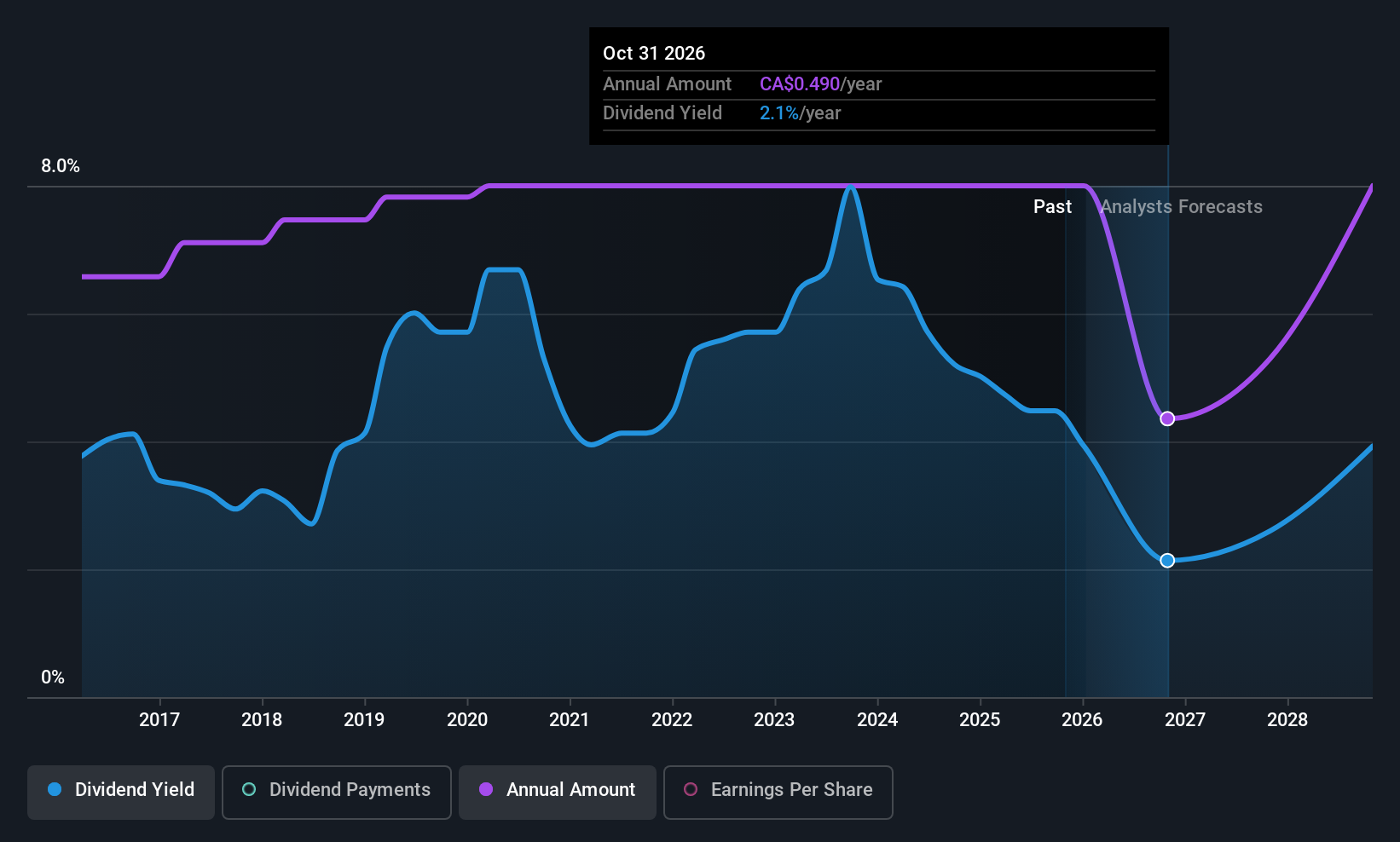

Transcontinental (TSX:TCL.A)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Transcontinental Inc. operates in the flexible packaging industry across Canada, the United States, Latin America, the United Kingdom, and internationally with a market cap of CA$1.90 billion.

Operations: Transcontinental Inc.'s revenue is primarily derived from its Packaging segment, which accounts for CA$1.60 billion, and its Retail Services and Printing segment, contributing CA$1.06 billion.

Dividend Yield: 4%

Transcontinental Inc. provides a stable dividend with a recent quarterly payout of C$0.225 per share, supported by a low cash payout ratio of 29.5%, ensuring coverage by free cash flows. The company's earnings grew significantly over the past year, enhancing its ability to sustain dividends despite revenues dipping slightly to C$2.74 billion in 2025. Recent strategic moves include extending key partnerships and seeking acquisitions, which may bolster long-term growth and shareholder returns amidst current market challenges.

- Navigate through the intricacies of Transcontinental with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Transcontinental is priced higher than what may be justified by its financials.

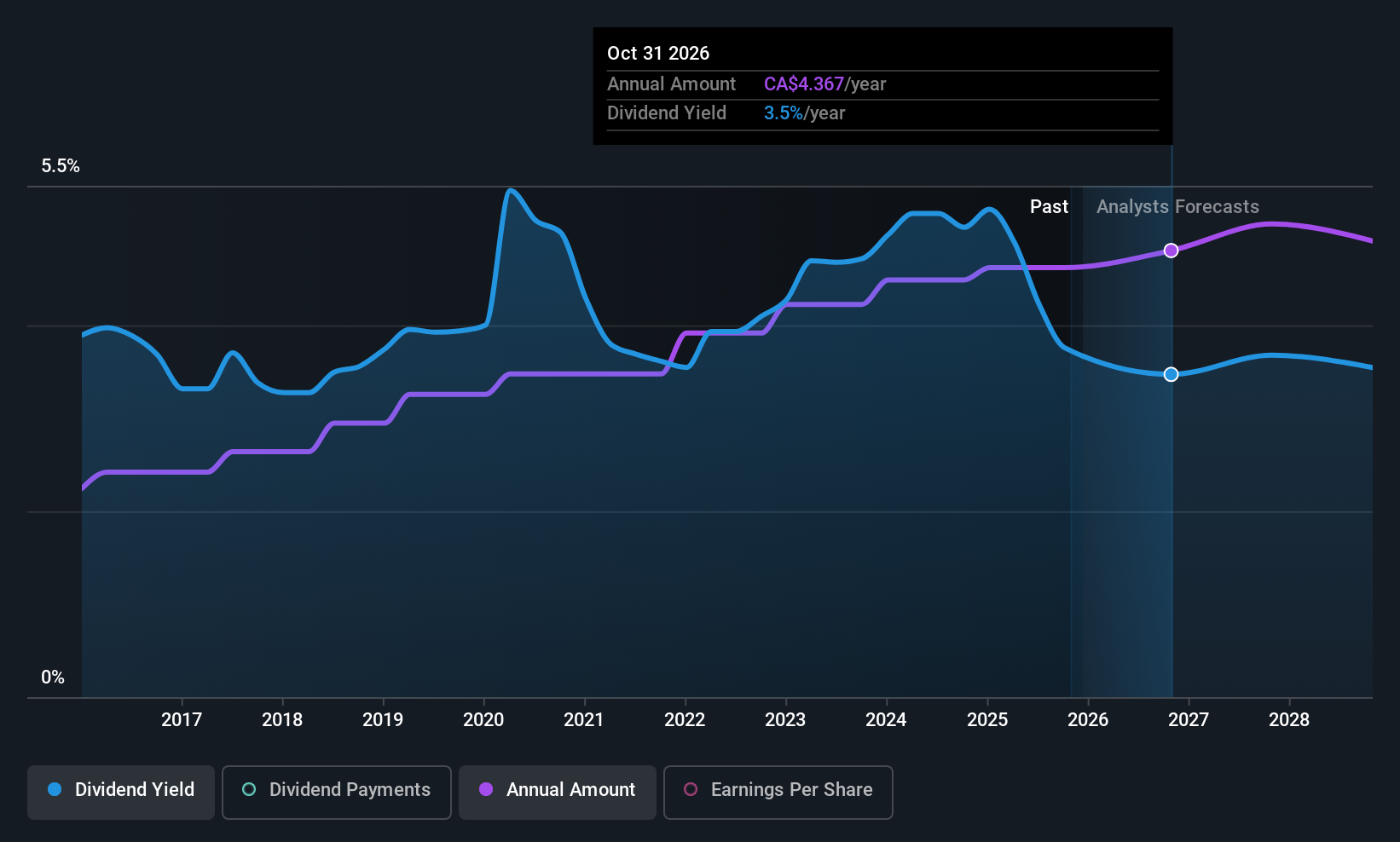

Toronto-Dominion Bank (TSX:TD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Toronto-Dominion Bank, along with its subsidiaries, offers a range of financial products and services across Canada, the United States, and internationally, with a market cap of CA$223.47 billion.

Operations: Toronto-Dominion Bank's revenue segments include Canadian Personal and Commercial Banking at CA$18.54 billion, Wealth Management and Insurance at CA$14.56 billion, U.S. Retail at CA$10.79 billion, Wholesale Banking at CA$8.10 billion, and Corporate at CA$11.27 billion.

Dividend Yield: 3.3%

Toronto-Dominion Bank offers a reliable dividend, recently shifting to a semi-annual review cycle with a C$1.08 quarterly payout per common share. Its dividends are well-covered by earnings, maintaining a low payout ratio of 36.3%. Despite trading below estimated fair value and offering competitive relative valuation, its yield of 3.27% is modest compared to top Canadian payers. Recent regional consolidations aim to enhance operational efficiency and client service, potentially supporting future dividend stability amidst forecasted earnings decline.

- Click here to discover the nuances of Toronto-Dominion Bank with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Toronto-Dominion Bank's current price could be quite moderate.

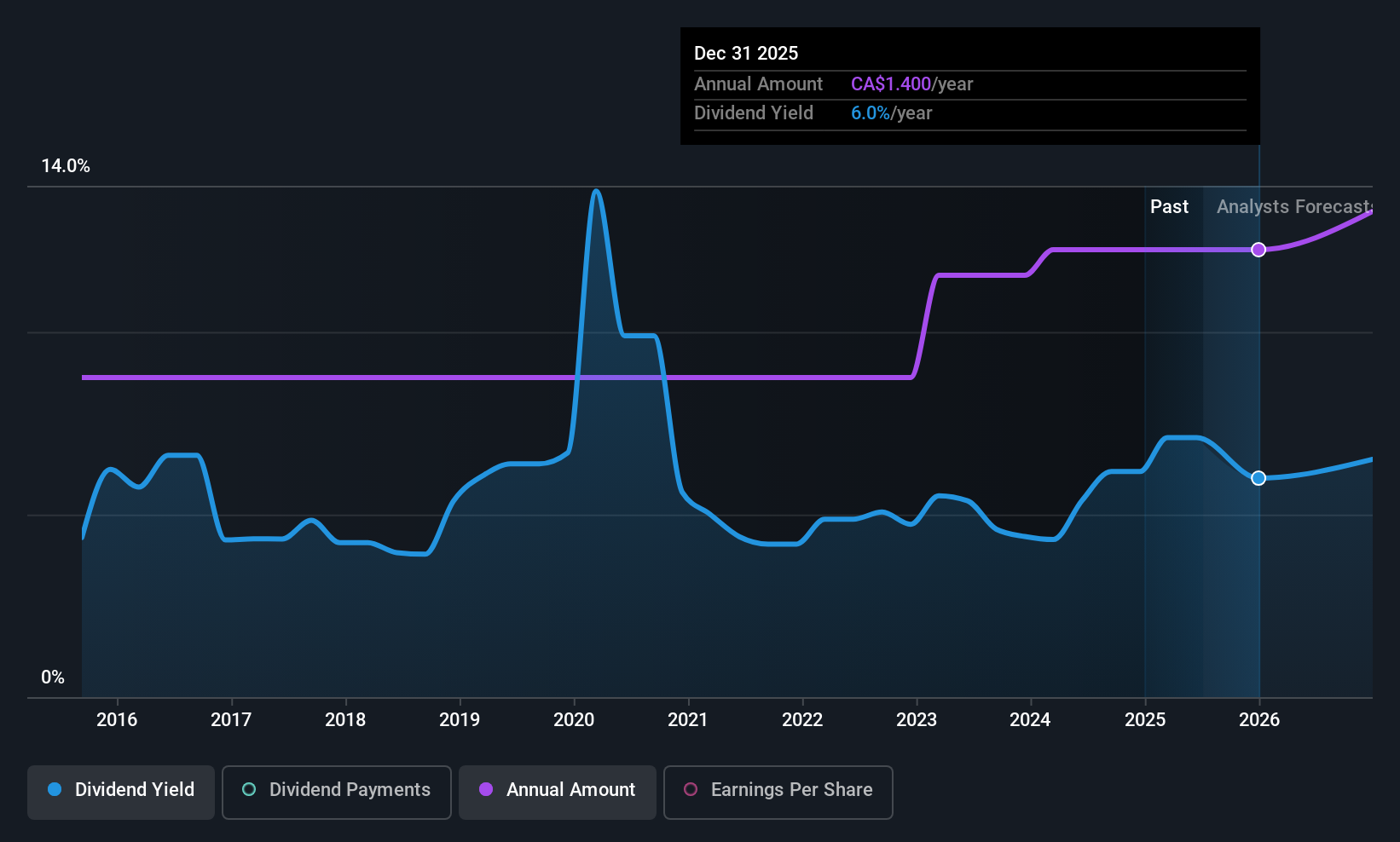

Wajax (TSX:WJX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Wajax Corporation offers industrial products and services in Canada, with a market cap of CA$609.34 million.

Operations: Wajax Corporation's revenue from the Wholesale - Machinery & Industrial Equipment segment is CA$2.15 billion.

Dividend Yield: 5%

Wajax Corporation offers a stable dividend, currently paying C$0.35 per share with a yield of 5.01%, which is reliable but lower than the top Canadian payers. The dividends are well-covered by earnings, with a payout ratio of 65.7%, and cash flows, maintaining a low cash payout ratio of 16.9%. Recent earnings showed improved net income and EPS growth, while extended credit facilities suggest financial flexibility despite high debt levels amidst ongoing CEO succession planning.

- Delve into the full analysis dividend report here for a deeper understanding of Wajax.

- The analysis detailed in our Wajax valuation report hints at an inflated share price compared to its estimated value.

Turning Ideas Into Actions

- Navigate through the entire inventory of 18 Top TSX Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal