Strata Critical Medical, Inc.'s (NASDAQ:SRTA) 30% Price Boost Is Out Of Tune With Revenues

Strata Critical Medical, Inc. (NASDAQ:SRTA) shares have had a really impressive month, gaining 30% after a shaky period beforehand. Looking further back, the 20% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

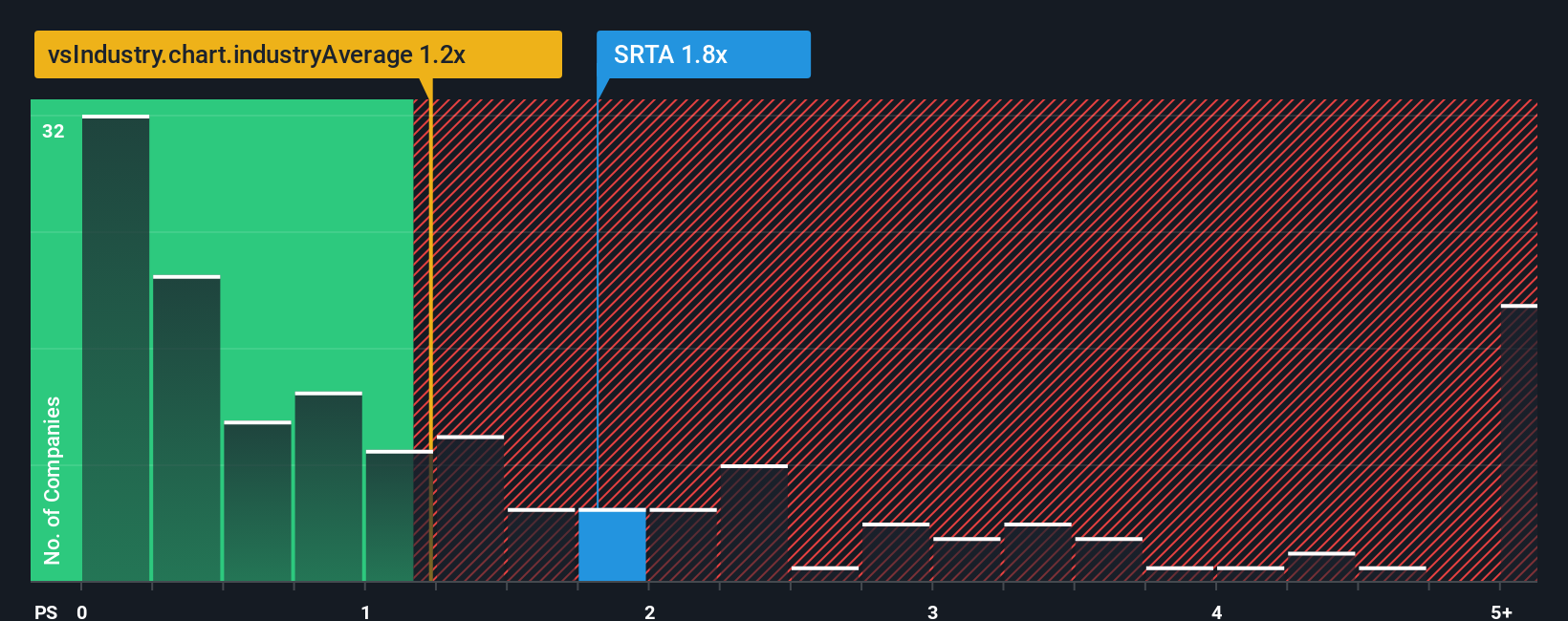

Since its price has surged higher, you could be forgiven for thinking Strata Critical Medical is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.8x, considering almost half the companies in the United States' Healthcare industry have P/S ratios below 1.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Strata Critical Medical

What Does Strata Critical Medical's Recent Performance Look Like?

Recent times have been advantageous for Strata Critical Medical as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Strata Critical Medical will help you uncover what's on the horizon.How Is Strata Critical Medical's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Strata Critical Medical's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 70% gain to the company's top line. Pleasingly, revenue has also lifted 103% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue growth is heading into negative territory, declining 5.7% over the next year. With the industry predicted to deliver 6.5% growth, that's a disappointing outcome.

With this information, we find it concerning that Strata Critical Medical is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

Strata Critical Medical shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Strata Critical Medical's analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. At these price levels, investors should remain cautious, particularly if things don't improve.

You should always think about risks. Case in point, we've spotted 1 warning sign for Strata Critical Medical you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal