Why TechnipFMC (FTI) Is Up 6.9% After Landing bp’s Major Tiber iEPCI Contract

- In 2025, bp awarded TechnipFMC a large integrated Engineering, Procurement, Construction, and Installation (iEPCI™) contract for its greenfield Tiber development in the Gulf of America, valued between US$600 million and US$800 million and included in TechnipFMC’s fourth-quarter 2025 inbound orders.

- This direct award extends TechnipFMC’s work on bp’s first 20,000 psi Paleogene project, Kaskida, underlining the company’s role in complex high-pressure subsea developments.

- We’ll now examine how this major Tiber iEPCI™ award, building on the Kaskida project, may influence TechnipFMC’s investment narrative.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

TechnipFMC Investment Narrative Recap

To own TechnipFMC, you need to believe its integrated subsea model can keep winning complex offshore work while managing exposure to oil and gas investment cycles. The new bp Tiber iEPCI™ award meaningfully reinforces the short term catalyst of subsea order momentum, but it does not remove the key risk that prolonged oil price volatility could still disrupt project sanctioning and future backlog visibility.

The recent update on TechnipFMC’s buyback program, with about US$1.46 billion spent to retire roughly 14% of shares since inception, is highly relevant here. It shows how management has been allocating capital alongside growing inbound orders such as Tiber and Kaskida, which together shape how investors might think about earnings power and resilience if offshore spending conditions change.

But while these contract wins are encouraging, investors should still be aware of how prolonged oil price volatility could affect...

Read the full narrative on TechnipFMC (it's free!)

TechnipFMC's narrative projects $11.3 billion revenue and $1.2 billion earnings by 2028. This requires 5.8% yearly revenue growth and a roughly $0.3 billion earnings increase from $937.5 million today.

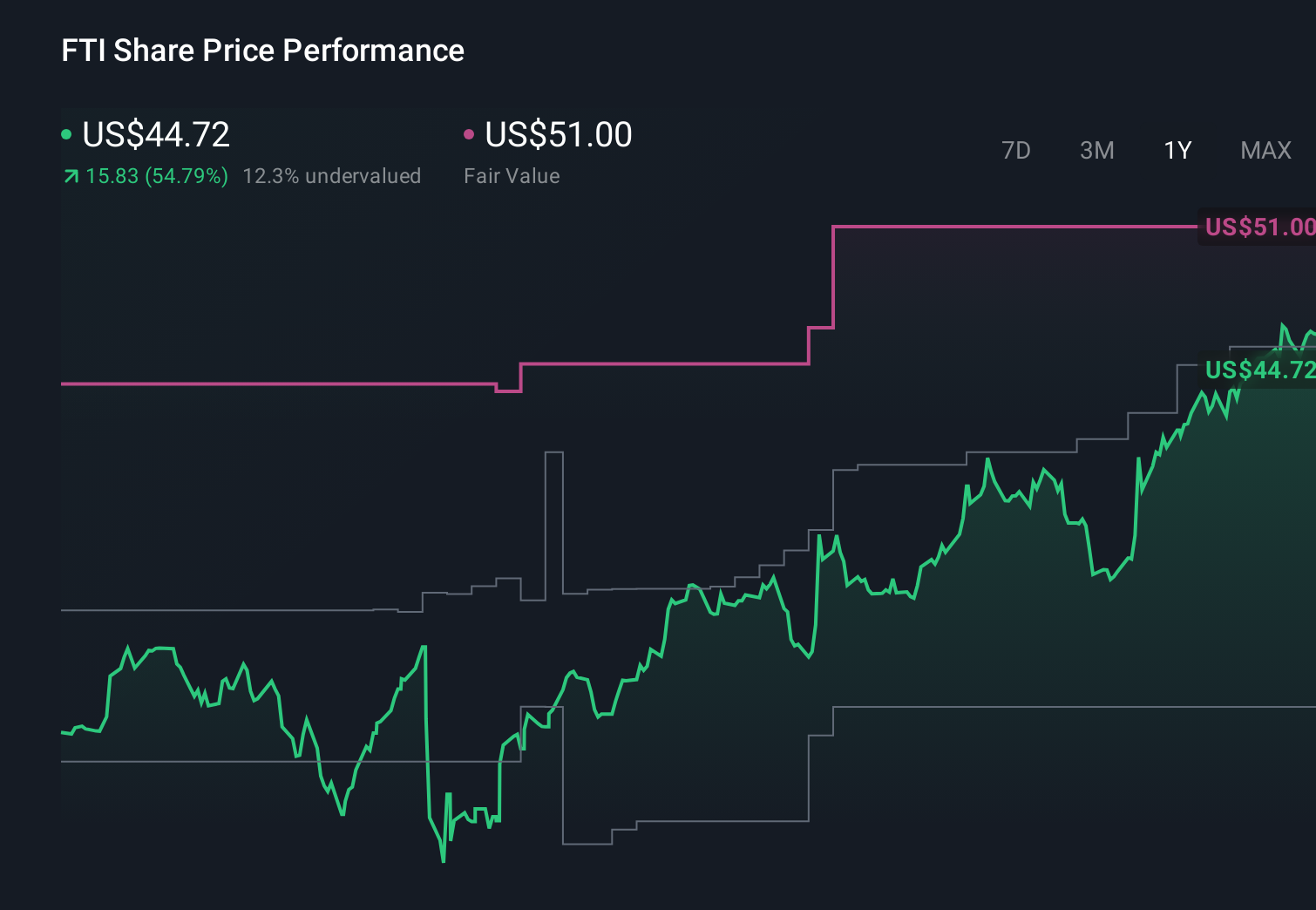

Uncover how TechnipFMC's forecasts yield a $47.10 fair value, in line with its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span roughly US$28.62 to US$76.19 per share, showing very different expectations. Against that backdrop, the reliance on continued offshore project sanctioning around contracts like bp’s Tiber development becomes a key point for you to test when thinking about TechnipFMC’s future performance.

Explore 4 other fair value estimates on TechnipFMC - why the stock might be worth as much as 58% more than the current price!

Build Your Own TechnipFMC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TechnipFMC research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free TechnipFMC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TechnipFMC's overall financial health at a glance.

No Opportunity In TechnipFMC?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal