Investors Give Zevia PBC (NYSE:ZVIA) Shares A 28% Hiding

Zevia PBC (NYSE:ZVIA) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 60% share price decline.

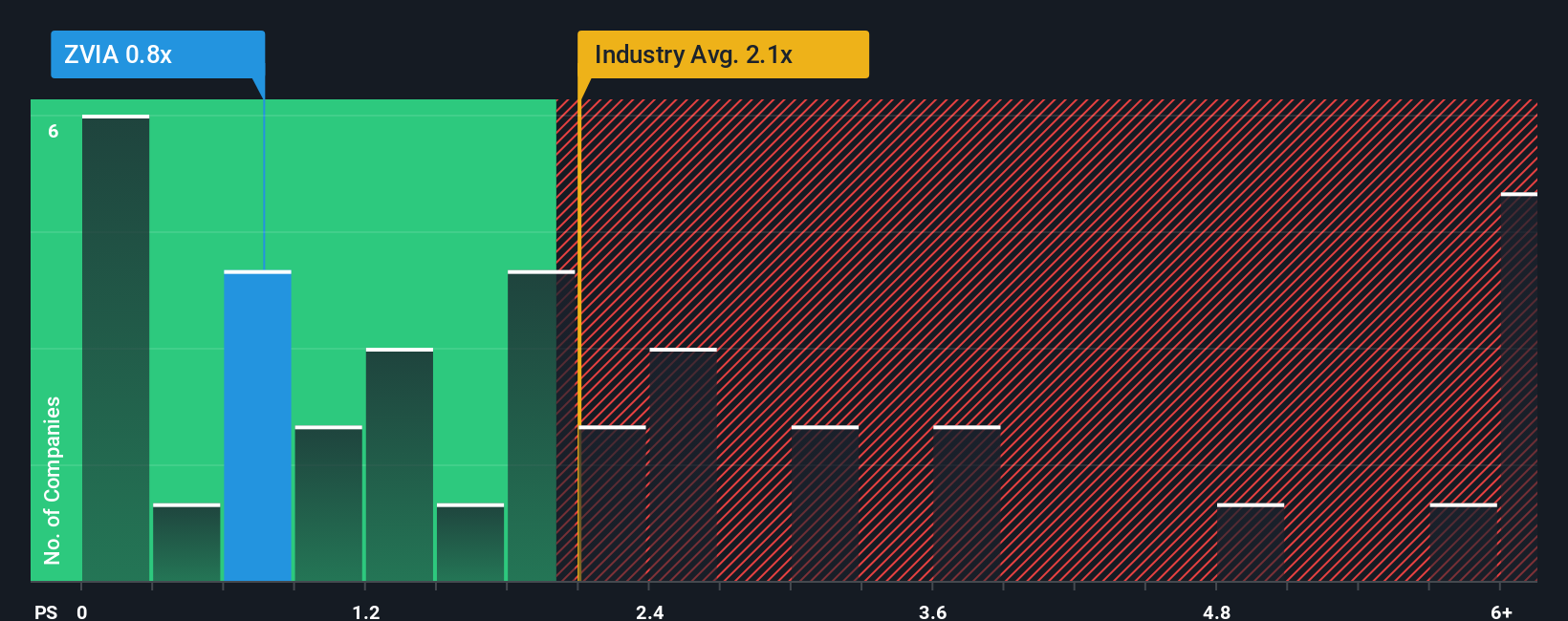

Following the heavy fall in price, considering around half the companies operating in the United States' Beverage industry have price-to-sales ratios (or "P/S") above 2.1x, you may consider Zevia PBC as an solid investment opportunity with its 0.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Zevia PBC

What Does Zevia PBC's P/S Mean For Shareholders?

Zevia PBC certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zevia PBC.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Zevia PBC's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.2% last year. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 5.3% during the coming year according to the five analysts following the company. With the industry predicted to deliver 5.1% growth , the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Zevia PBC's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From Zevia PBC's P/S?

The southerly movements of Zevia PBC's shares means its P/S is now sitting at a pretty low level. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It looks to us like the P/S figures for Zevia PBC remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Zevia PBC, and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal