A Look At NextEra Energy (NEE) Valuation After Reaffirmed Growth Targets And US$4b Equity Offering

NextEra Energy (NEE) has reaffirmed its long-term earnings and dividend growth targets while setting up a US$4b at-the-market equity offering, a combination that directly affects capital structure and future shareholder returns.

See our latest analysis for NextEra Energy.

NextEra Energy’s recent reaffirmation of growth targets, investor meetings and the US$4b at the market equity program come as the shares trade at US$81.32, with a 1 year total shareholder return of 19.06% and more muted 3 and 5 year total shareholder returns of 4.96% and 15.87%. This suggests momentum has been rebuilding after earlier weakness.

If this kind of steady reset appeals to you, it could be a useful moment to see how other utilities and power producers compare by scanning fast growing stocks with high insider ownership.

With earnings and dividend targets reaffirmed, a US$4b equity program on deck and the share price trading below the average analyst target, you have to ask: is NextEra still undervalued or is future growth already priced in?

Most Popular Narrative: 11% Undervalued

With NextEra Energy last closing at US$81.32 against a narrative fair value of about US$91.14, the current setup focuses squarely on long term earnings power and cash flows.

Recently enacted federal legislation (OBBB) and safe harbor provisions provide multi year tax and regulatory visibility through at least 2029 for wind, solar, and storage projects. Combined with a large existing project backlog and strong balance sheet, this allows NextEra to secure project returns, support dividend growth, and maintain healthy net margins despite broader policy uncertainty.

Curious what kind of revenue growth, margin profile and future P/E this narrative leans on to justify that higher fair value? The key assumptions might surprise you. The full set of forecasts connects clean power demand, earnings expansion and valuation in a way the current share price does not fully explain.

Result: Fair Value of $91.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that narrative could crack if renewable tax incentives fade faster than expected, or if higher financing costs keep squeezing returns on new clean energy projects.

Find out about the key risks to this NextEra Energy narrative.

Another Way to Look at Valuation

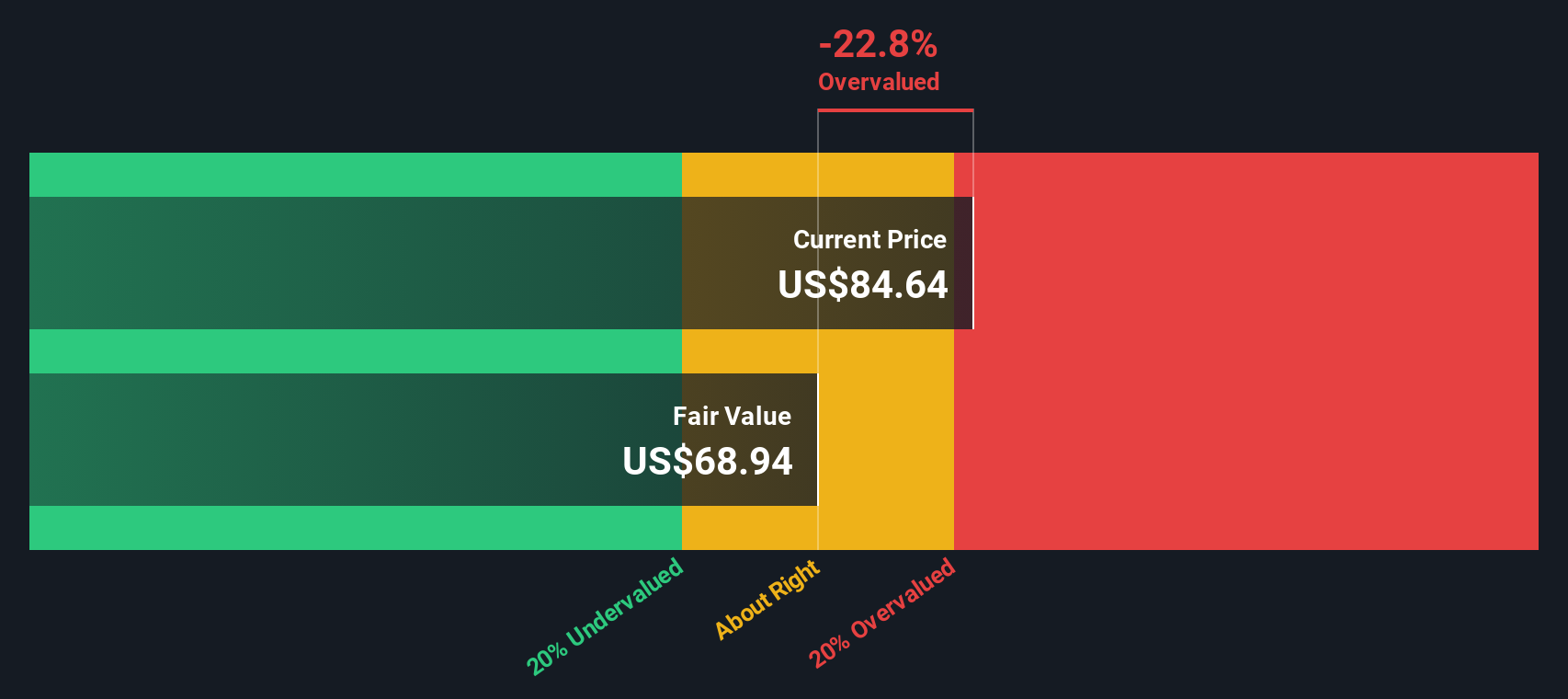

Our DCF model presents a different perspective compared to the US$91.14 narrative fair value. On this basis, NextEra Energy at US$81.32 appears overvalued relative to an estimated fair value of US$72.65, which assigns greater importance to funding costs, project risk, and long-dated cash flows. Which perspective do you think better reflects the business?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NextEra Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NextEra Energy Narrative

If you look at these numbers and reach different conclusions, or simply prefer testing your own assumptions, you can build a custom view in minutes with Do it your way.

A great starting point for your NextEra Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock, you might miss better fits for your goals, so keep expanding your watchlist with focused ideas that match how you like to invest.

- Spot potential high growth stories early by scanning these 3552 penny stocks with strong financials that already show stronger financial footing than many expect from this corner of the market.

- Zero in on future facing themes by checking these 25 AI penny stocks where artificial intelligence sits at the core of each company’s business case, not just as a buzzword.

- Target value focused opportunities by reviewing these 878 undervalued stocks based on cash flows that currently trade at discounts based on their projected cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal